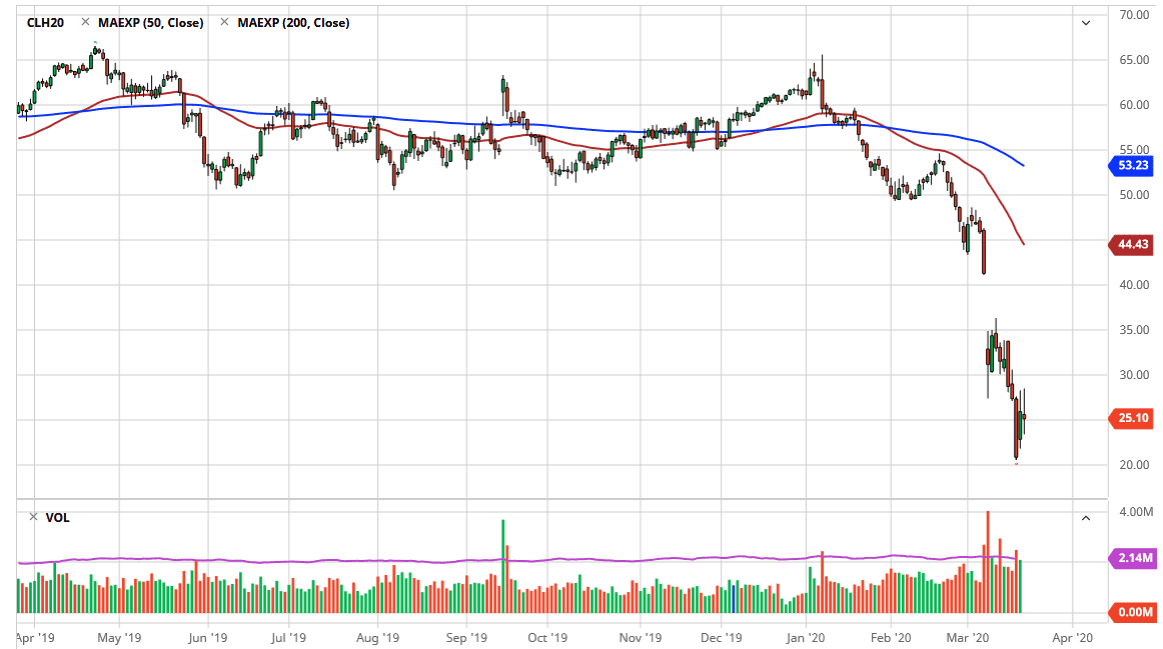

The West Texas Intermediate Crude Oil market initially tried to rally during the day on Friday, reaching towards the $27.50 level before giving back gains towards the $25 level later in the session. By forming the candlestick that it has, it shows that we are going to struggle going forward which makes quite a bit of sense considering that we have a multitude of bad issues going on at the same time.

While there is a price war going on between Saudi Arabia and Russia, the market is going to be flooded with supply. Add to that the fact that economies are standing still due to the coronavirus outbreak, then you have a perfect formula for lower prices as you can see clearly shown on the chart. While I do see a gap above that needs to be filled, I think we are pretty far from seeing that happening. In the meantime, the candlestick, albeit weak for the Friday session, suggest that there is at least some pushback in this area.

Don’t get me wrong, I think that the market stabilizing doesn’t necessarily mean that it’s going to reverse, just that the brutal selling is probably all but gone. I anticipate that the market will probably drift lower overall, perhaps trying to retest the $20 level underneath it has offered significant support. At this juncture, it makes quite a bit of sense that the level gets tested again, and we could even see oil drifted below there. That being said, the easiest way to trade this market in my opinion right now is to simply sell rallies as people have done during the Friday session. I recognize that the $30 level above is a large, round, psychologically significant figure, so therefore I would anticipate that there is probably going to be some built-in resistance there. If we can break above that level, then it’s likely would go to the $34 level next based upon shorter-term charts. We could eventually fill the gap, but I think we are going to need to see Saudi Arabia and Russia quit the price war, which could give oil a chance to rally but I think it’s still will struggle regardless, due to the fact that the demand is falling off of a cliff. Until something fundamentally changes, it’s probably best to fade all rallies.