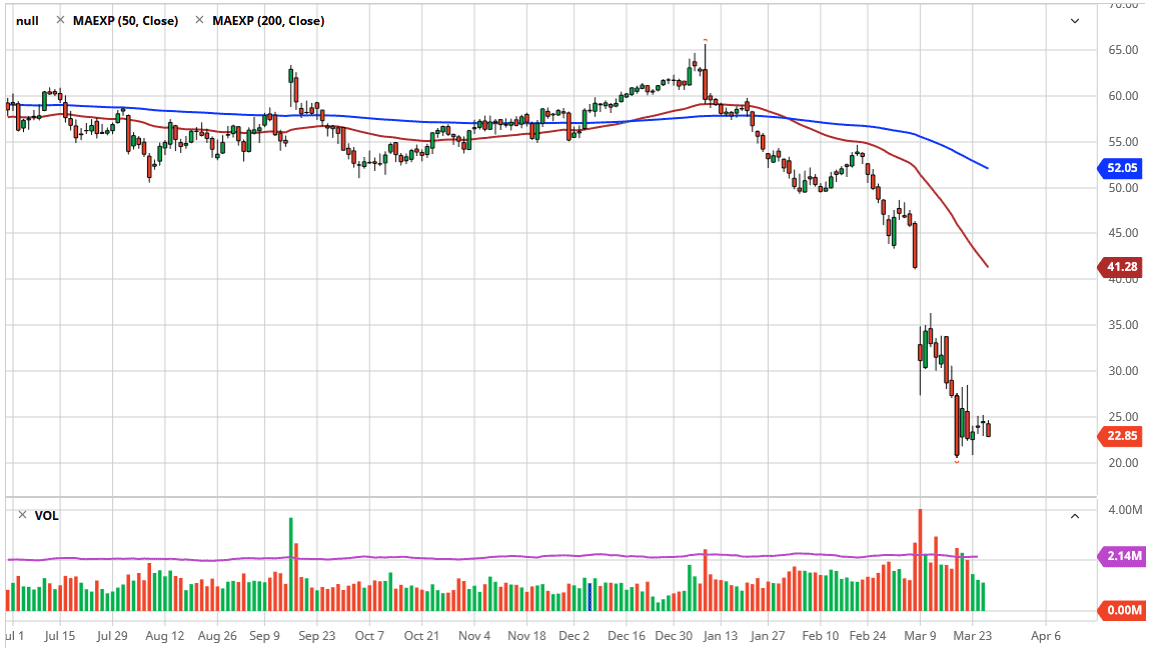

The West Texas Intermediate Crude market has pulled back just a bit during trading on Thursday, as we continue to see $25 offer significant resistance. By doing so, it looks as if the market is going to continue to try to see the market form a little bit of a base down here, because the market has accelerated to the downside so rapidly. At this point, it’s unfortunate but the price work continues, just as demand is falling through the floor. With the coronavirus raging still, demand for crude oil is going to continue to be tentative at best. Further exacerbating the issue is that the world will soon run out of storage space for crude oil.

Looking at the chart, beyond the obvious resistance at the $25 level, I also see the $27.50 level as an area that could cause significant resistance as well. We have seen the market try to break above there are a couple of times, only to fail again. At this point, I anticipate that rallies will continue to be sold into, because quite frankly there isn’t enough demand out there to overtake the massive amount of oversupply. That being said, if we do get the market picking up due to some type of geopolitical announcement like the price were being over, then we have to worry about the overall demand. Alternately, if the demand picks up, then we have to worry about the price war. It’s not until we get both of those things off of the table the crude oil will take off for a bigger move.

That being said, then we need to fade rallies as they occur, looking for signs of exhaustion. The gap above, extending all the way to the $42 level, could be reached if we get that price were taken out. It could also be reached if we get the economies around the world that are currently locked down opened back up. As far as breaking through that level, we need both of those things that happen, something that I’m not holding my breath for in the short term. To the downside, the $20.00 level will be considered to be the “floor” of the market, but if we were to break down below there is my next target would be the $18 level based upon longer-term charts. Overall, it is so much easier to sell this market then buy it. That should continue to be the case going forward.