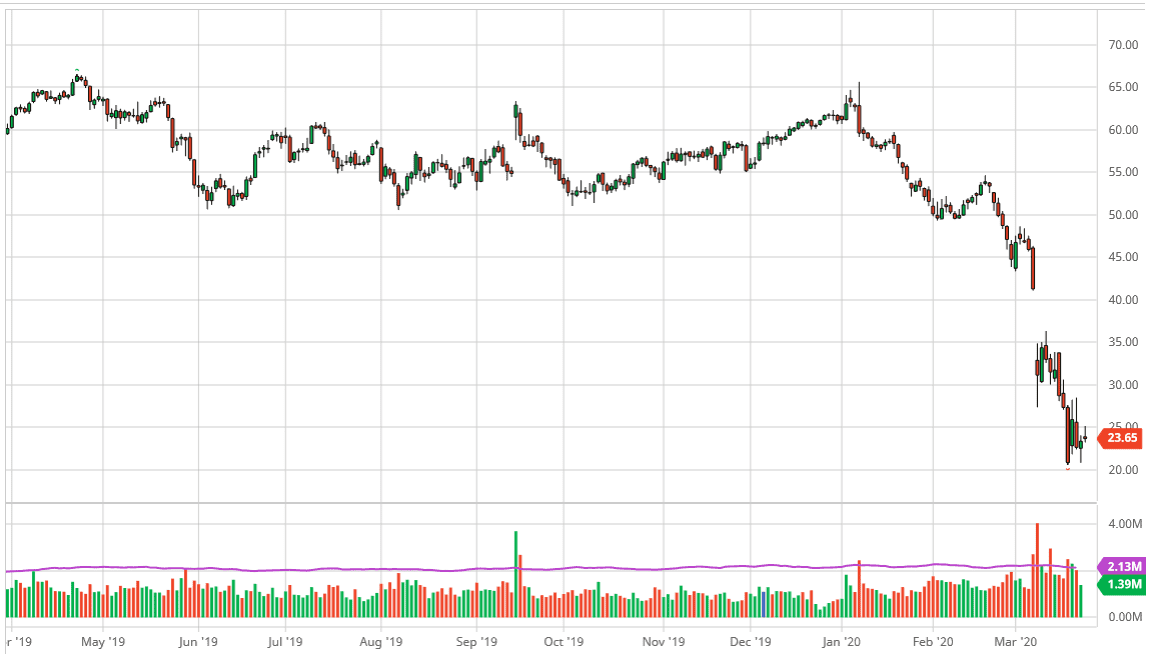

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Tuesday but found resistance near the $25 level to give back the gains. By doing so, it suggests that we are going to continue to see more of the same, as there is a serious concern about the lack of demand. At this point, the market continues to worry about lack of demand and of course the ongoing price war between Russia and Saudi Arabia does no favors either. This is about squeezing American shale producers and causing bankruptcies. That being said, the Federal Reserve is stepping into by corporate bonds, and one would have to think that it’s only a matter of time before the Trump administration steps in and does something about it. In other words, the drama around crude oil is far from over.

At this point, it looks as if there are multiple places where sellers may return, including the $25 level that has caused selling pressure during the day on Tuesday, the $27.50 level, and then the $30.00 level above. In other words, there are plenty of areas where the short term sellers will come in and push this market to the downside. Furthermore, the gap above will also cause a significant amount of resistance but quite frankly we would need to see a lot of momentum to turn around and fill this gap. At this point, I think that the entire situation will have to change for anything close to that happening, so therefore I give that about a 5% chance, barring some type of resolution between the Russians and the Saudi governments.

To the downside, I see the $20.00 level as being significant support, and as long as we can stay above there, we could be trying to form some type of short-term bottom, which would make quite a bit of sense considering that the market is oversold. That being said, it looks as if there is some type of hope that any good news will cause a significant amount of buying activity or at least short covering. However, the spear market rallies can be vicious but are quite often short-lived. Look to fade rallies as we did during the trading session on Tuesday, but a break down below the $20.00 level doesn’t seem likely in the short term, simply because of mere exhaustion in the sellers.