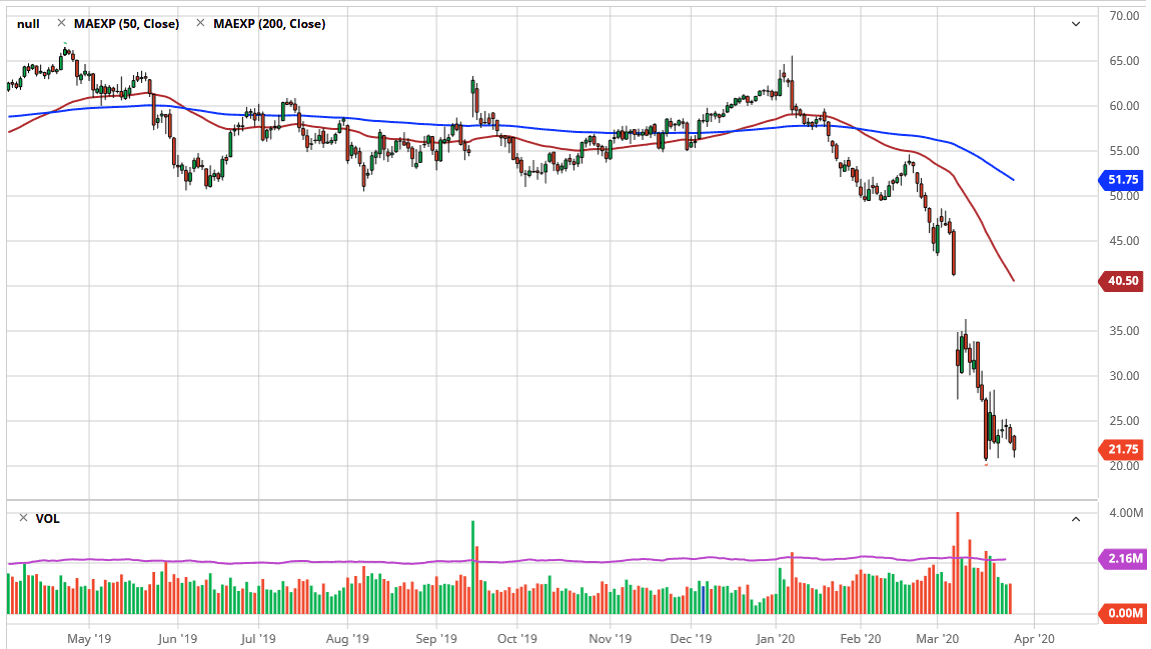

The West Texas Intermediate Crude Oil market fell during the trading session on Friday, but still sees plenty of buyers underneath that offer some type of support near the $20.00 level. That is an area that of course matters, because it is a large, round, psychologically significant figure, and an area that we have bounced from a couple of times already. The question now is whether or not we can hold that level for any length of time?

If the West Texas Intermediate Crude Oil contract drops below the $20 level, I think it will have long reaching implications. Not only will it open up the door to $15, but it also will have massive effects on various equities and stock markets in general. It will also probably cause massive problems with the Canadian dollar, Norwegian krone, and Mexican peso. In other words, no matter what you are trading right now, you should be paying attention to this market. That being said, there is a huge upside potential if we get the right confluence of factors showing up.

At this point, if we can get some type of truce between Saudi Arabia and Russia when it comes to the price war, it’s possible that crude oil could rally a bit. If nothing else, that will offer some type of psychological relief, which in and of itself can be enough at times. Don’t get me wrong, I don’t think that demand is suddenly going to pick up, especially with the coronavirus shutting down so many different economies. However, it is worth noting that the psychological boost could have the market looking for a reason to simply bounce and go to fill the gap above. I’m not holding my breath for this, but I do recognize that eventually that will be the task at hand.

If we do break down below the $20.00 level, that could unwind a lot. At this point in time, it should be noted that there are some pundits out there calling out for single-digit prices, but it should be noted that quite often there are extreme examples right before the market turns around. I don’t necessarily think that we get down to $9.00 per barrel, but I do think that we could see some lower pricing between now and the true bottom. If we can break above the $25.00 level, it’s likely that we will go looking towards the $27.50 level, followed by the $30 handle.