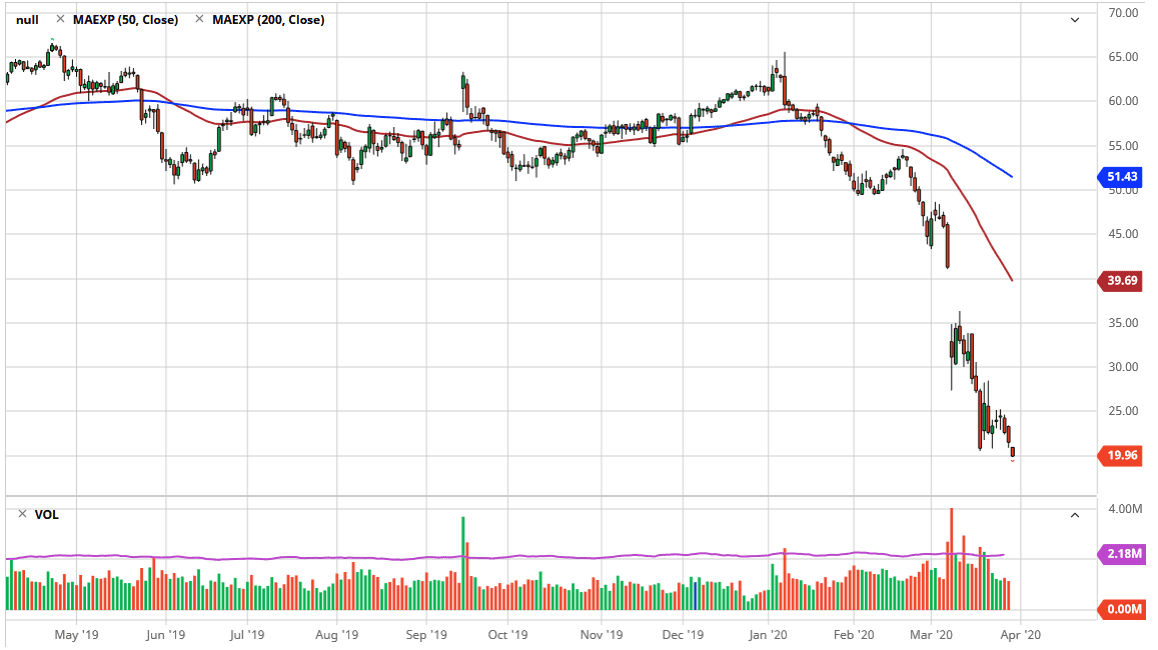

The West Texas Intermediate Crude Oil market has broken through a major support level in the form of the psychologically important $20.00 level. At this point, the market is likely to see a lot of volatility in this area, especially considering that the $20 level was broken a bit. By doing this, it shows a lot of negativity, but at this point the market turned around to form a bit of a hammer late in the day as short covering came into play. Looking at this candle, it’s obvious to see that the market is measuring the idea of a complete lack of demand. Ultimately, it’s hard to imagine how oil is going to pick up to the upside due to the fact that there are so many people out there are going to be on the sidelines and not participating in the global economy.

Furthermore, we obviously have the Russia/Saudi Arabia price war going on right now, and as a result the market is flooded with crude oil on top of a lack of demand. At this point, there’s no real reason for crude oil to rally, and we would need to see significantly bullish news to help this market out. To the upside, I see several resistance barriers that are going to be difficult to overtake.

To the upside, the market will find plenty of resistance near the $25 level, furthermore at the $27.50 level, and then of course the $30.00 level. Ultimately, the massive gap that kicked off this most recent break down is a juicy target, but we need to see some type of massive shift in sentiment to make that happen. In fact, I have a hard time believing that will happen before the price war is either over, or perhaps the coronavirus gets to be somewhat under control.

At this point, fading rallies continues to work the most from what I can see, and of course the market will continue to have plenty of headwinds and therefore it’s just too difficult to get bullish for a longer-term move. That being said, the news flow is important to pay attention to, as things could change very quickly. Ultimately, the market is likely to be very noisy, and therefore you will need to keep your position size somewhat small but in this type of environment it’s obvious that failure will be more often the case than success for this market.