The West Texas Intermediate Crude Oil market continues to fall apart, as the Russians now have suggested that they are not going to cut output. OPEC had suggested that the OPEC members would cut 1 million barrels while the periphery would cut 500,000 barrels. As that is the case, it makes perfect sense that crude oil would fall apart. Quite frankly, there is a serious issue with demand and that is something that OPEC can’t fix.

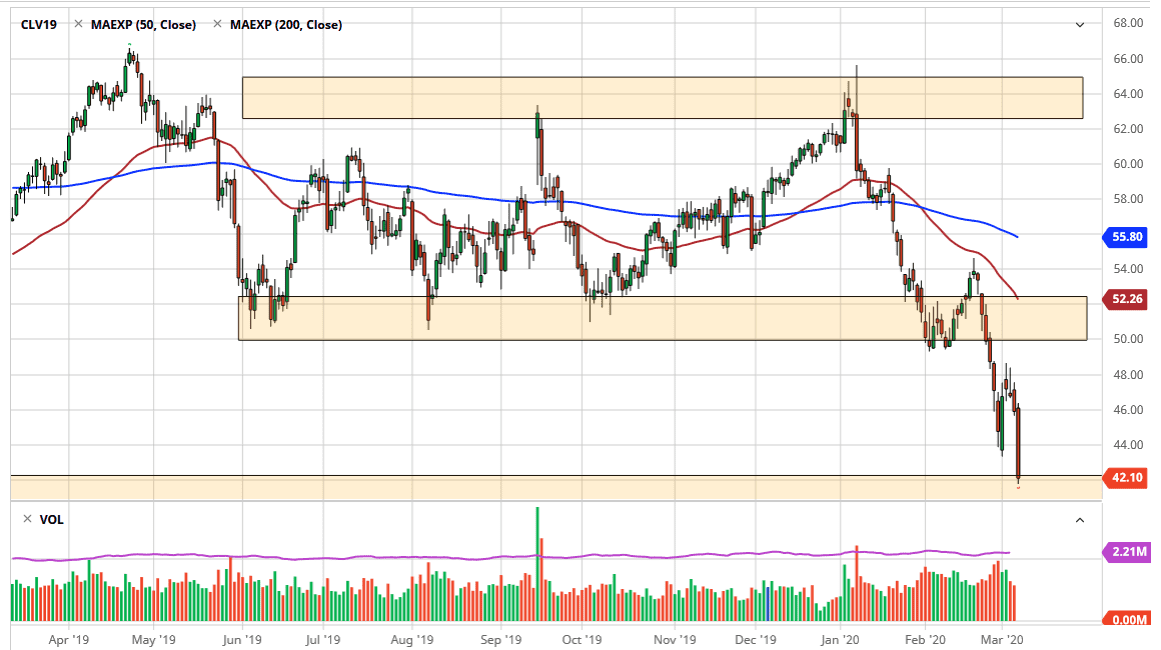

It looks as if there are a lot of concerns when it comes to global growth, and that means that the market will more than likely break down through the support level underneath. If we do break down below this $42 region, it’s likely that the market will go looking towards the $40 level. Any rally at this point will more than likely be sold off, especially near the $46 level. That’s an area that should be massive resistance, and I think that there will be plenty of sellers in that area. Quite frankly, it’s a market that can’t be bought because there isn’t going to be enough demand out there and failure to hang on to gains should be the story going forward. At this point, it’s likely that the downward pressure is only going to pick up over the longer term. The size of the candlestick for the trading session on Friday suggests that there is a lot of negativity out there yet again.

It’s not until we break well above the $50 level that I would be willing to start buying. I think until then, all rallies are to be looked at as selling opportunities. I believe that most of the market feels the same way, and with the oversupply of crude oil out there, not only in OPEC stands but around the world, it’s going to be difficult for crude to take off to the upside. The coronavirus reaching through economies and slowing down movement should suggest that demand will only fall from here, and thereby we need to find equilibrium at a lower level. Based upon the parish flag, the measured move is down to the $35 level. That doesn’t mean we get there tomorrow, but the way things have been acting recently, it’s not a huge surprise to see the crude oil markets do just that. Crude oil seems to be helpless at this juncture.