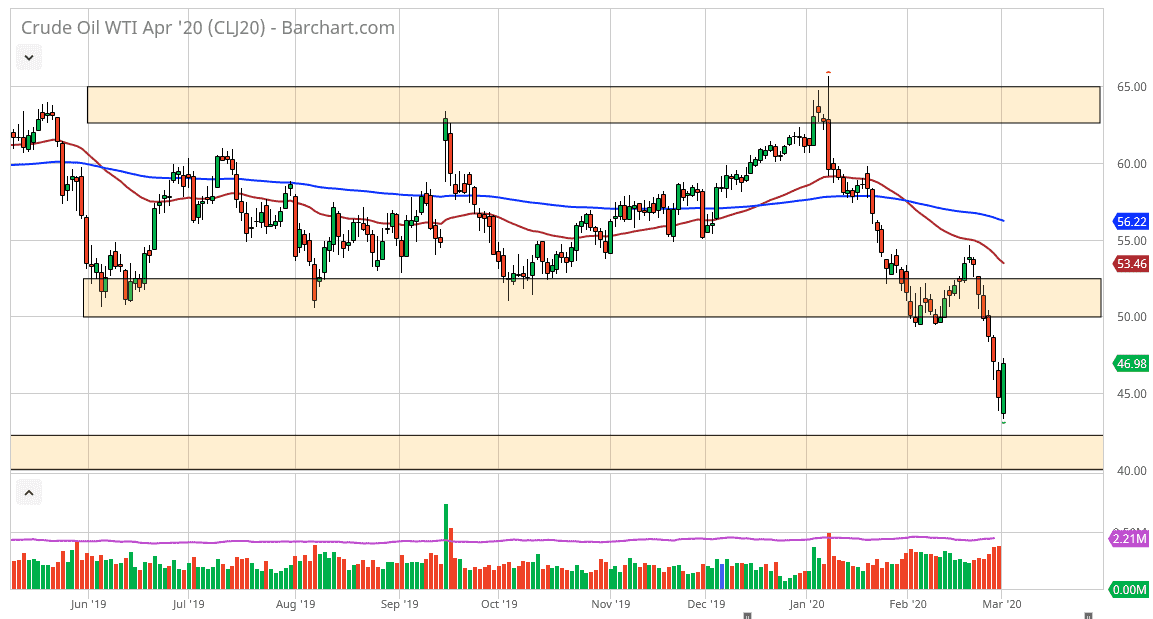

The West Texas Intermediate Crude Oil market ended up forming a massive bullish engulfing candlestick on Monday to show a real turnaround when it comes to crude oil. That being said, I think the upside is somewhat limited, reaching towards the $50 level at the best. Any type of exhaustion in that area would make quite a bit of sense for a selling opportunity, as market participants will more than likely look at the previous support as future resistance. That being said, if the market does break above there, there is plenty of resistance built into the 50 day EMA as well.

The crude oil markets are oversold to say the least, but I still think it’s only a matter of time before this market breaks down. Ultimately, this is a market that continues to see a lot of volatility but it’s a bit difficult to imagine a scenario where crude oil demand suddenly takes out. I think this is more or less just a sign that perhaps we had gotten a bit of head of ourselves. Furthermore, it’s a bit presumptuous to think that the economy is certainly going to turn around in order to drive up demand for crude oil. That being said, it’s also a bit presumptuous to think that the coronavirus is going to kill all demand for crude oil either.

During the session tomorrow, there will be a conference call between the heads of the G7 economies, suggesting that perhaps there is going to be some coordinated central bank action. Ultimately, if the Federal Reserve does in fact cut interest rates like people are starting to bank on, that should drive up the price of crude oil in the short term. However, it doesn’t matter that the US dollar gains or drops in value, the reality is that demand is the most important thing.

If we did break above the 50 day EMA, then it’s likely that the market would continue to go much higher. I don’t think that’s going to happen though, so it’s very likely that you will get a selling opportunity if you are patient enough. The catalyst isn’t necessarily known, but disappointing headlines coming out of that G7 call could be a catalyst. Furthermore, there will be inventory figures later this week that could also come into play as well. I have no interest in buying this market, rather I am interested in shorting it at higher levels.