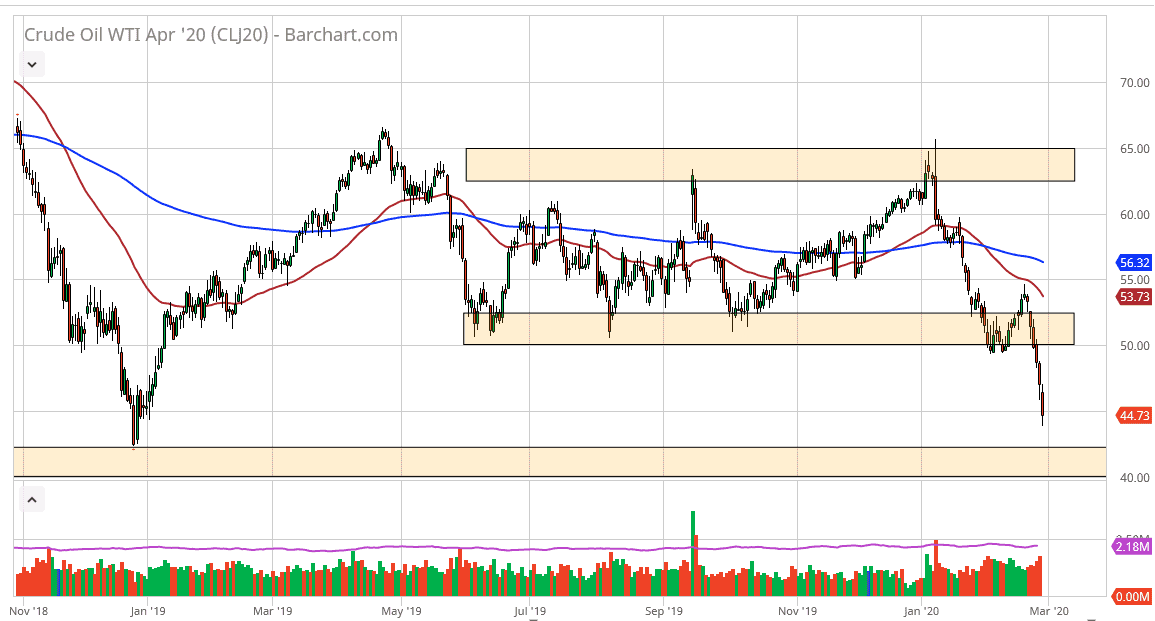

The West Texas Intermediate Crude Oil market broke down below the $45 level during the trading session on Friday, showing signs of weakness yet again. The fact that we have broken down the way we have suggest that we will probably go looking towards the $40 level underneath. This is a market that continues to see lots of the coronavirus fears and therefore people are starting to wonder whether or not there is going to be enough demand. Economies around the world are grinding to a halt, and that of course works against the total demand picture.

The inventory figure was not one to be overly hawkish during the week as well, so therefore it makes quite a bit of sense that the market is finishing the week at extreme lows but as we have fallen so hard, I would not be surprised at all to see a little bit of a bounce. That bounce very well could offer another selling opportunity above at the $50 level, assuming we can even get to that level. If we were to break above the $50 level, then it would be a very bullish sign but even then, there is a lot of noise above there. In other words, I just don’t have a scenario where I think that buying oil is feasible, at least not without OPEC coming in and slashing production by some type of radical figure. The coronavirus will continue to be an issue, and it will continue to slow down economies. This means we get less machinery and transportation that will need petroleum to move. Furthermore, the United States continues to pump out massive amounts of crude oil in a market that is already oversupplied.

Beyond that, you have to worry about the US dollar suddenly spiking higher, because it will work against the value of crude oil, as it is priced in that currency. In other words, it will take less of those US dollars to buy oil. At this point, I think that the best way to trade this market is to simply fade short-term spikes, at least until something fundamentally changes in the world. That’s unlikely to happen in the next few days, so I do believe you should have plenty of selling opportunities. For what it’s worth, we had formed a bearish flag previously, and it looks like we are trying to fill out that target.