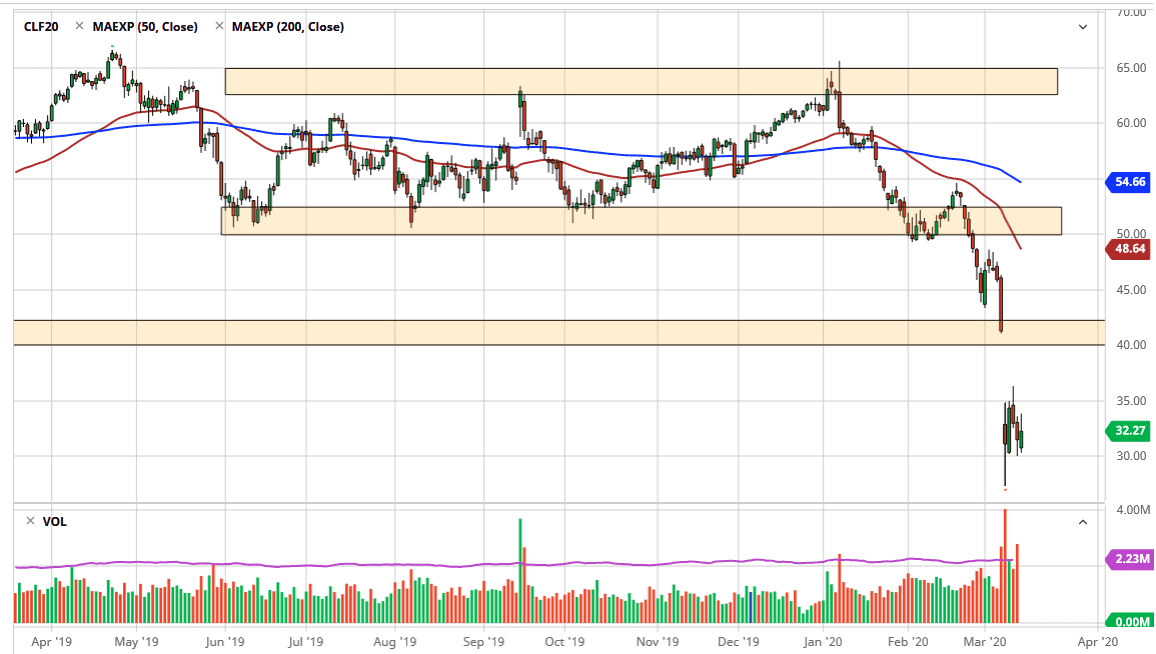

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday, reaching towards the $34 level. At this point, the $35 level above is a large, round, psychologically significant figure that you should be paying attention to, but we could break above there. If we do, the market could go all the way to the $42 level in order to fill the gap. At this point, the market is likely to see an attempt to fill that gap, but that move should be one that you should be looking to sell as demand for crude oil is going to collapse.

That being said, the $30 level underneath should offer support so if we were to break down below there, I think we will test the lows again. As we go into the weekend it is possible that maybe Russia and Saudi Arabia come together and that could offer a nice short-term pop in this market. That being said though, I’d be more than willing to start selling at the first signs of exhaustion after that pop. Keep in mind that the market will continue to see a lot of demand destruction as the coronavirus slows everything down. This doesn’t mean that it will be going to zero, but at this point it’s going to be a longer-term bottoming process, not a complete turnaround. Furthermore, there was also a lack of demand heading into the coronavirus care, and of course the price war that Saudi Arabia has kicked up. This has just been a bit of a “perfect storm” coming together.

If for some reason we were to break above the $42.50 level, then the market could go to the 50 day EMA which is closer to the $48.50 level. That seems to be very unlikely, because it would cause absolute chaos in the market to the other side. That being said, keep in mind that the markets are very skittish, and it’s difficult to imagine a scenario where we simply take off to the upside without some type of massive government action. Even then, it will probably be somewhat short lived to say the least. I think fading rallies will be the best way to go going forward, until we get a true fundamental change in the demand picture, not to mention the fact that we need the price war to end.