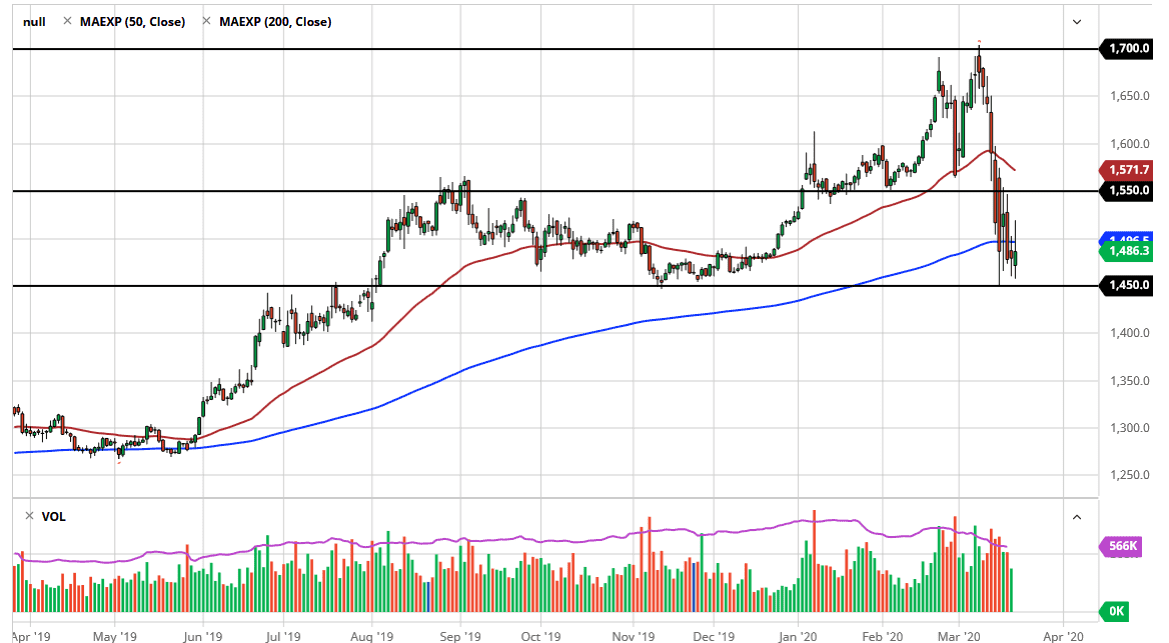

Gold markets have had a tough trading session on Friday, but at one point were rather bullish. We broke above the 200 day EMA but found sellers jumping in to push the market back down. That being said though, the market is at least stabilizing and that is crucial. Because of this, I believe that eventually we will find it a buying pressure to send this market higher, but the question now is whether or not $1450 will hold? If it does, then we have a really good shot at perhaps starting the uptrend back up. The $1450 level has been crucial more than once so it should not be a huge surprise to see that level offer buying pressure again.

The 200 day EMA of course offers a certain amount of psychological resistance, but if we can break above there then the market is likely to go looking towards the $1550 level. That is an area that was previous support, and it should be significant resistance. Breaking above the top of that level could send this market towards the $1600 level above, breaking above the 50 day EMA. I do believe that gold will eventually catch a serious bid, but right now it’s all about the US dollar. Having said that, when the dust settles people will start to focus on the central banks around the world and into much liquidity to the markets, and that of course can work for the value of gold because it is a noun possibility that central banks around the world are more than likely going to let economies not only recover, but run a bit hotter than usual if and when that day comes.

If we do break down below the $1450 level, I believe at that point it’s likely that we go down to the $1400 level, possibly even the $1350 level, as it is the 200 week EMA, an indicator that a lot of longer-term traders pay quite a bit of attention to. All things being equal though, I believe that the market is going to offer plenty of opportunities for those who are more longer-term inclined. Short-term trading will certainly be volatile, but that probably goes without saying as the headlines continue to cause a lot of issues. While the attempt to rally during the trading session on Friday was somewhat encouraging, the fact that we get back so much of the gains isn’t necessarily as promising as it once look.