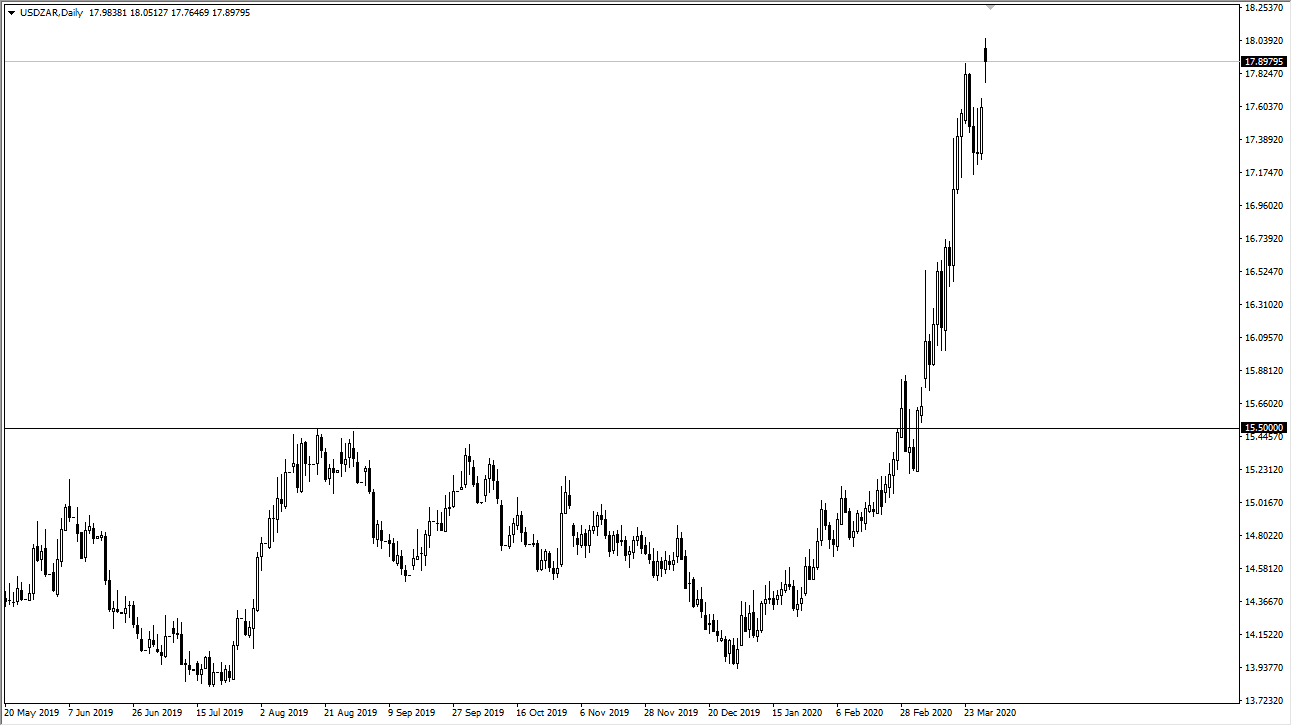

The US dollar gapped higher against the South African Rand to kick off the week, showing signs of weakness in the emerging market yet again. The South African Rand of course is a bit of a measuring stick for Africa, as it is the most developed economy that currency traders can invest in when it comes to that part of the world. Furthermore, the markets will look at the overall risk appetite of the world when pricing currency such as the South African Rand, Mexican peso, the Chinese Yuan, and many of the other smaller ones, which is why I pay so much attention to these currency pairs.

One of the biggest mistakes that traders on the retail level make is that they ignore these currency pairs, because they think that they are “too volatile” to trade. The reality is that they are no different than any other currency pair, just that you need to keep your position size a little smaller due to the fact that they tend to by their very nature offer a longer-term trading opportunities. However, as we gapped higher to kick off the week, pulled back and then rallied again, this should give you an idea as to help risk appetite is going. If the greenback continues to pick up against the South African Rand, it should show that people are wanting stability and comfort over taking a lot of risk. Even though this market is parabolic, it still could go much higher based upon what we are seen around the world.

At this point, it looks as if the South African Rand could make a run towards the 20 handle, over the longer term. We are currently tossing about the 18 handle, which of course is a large, round, psychologically significant figure, but I see a lot of support at the 17.25 level as well. At this point, I like the idea of picking up dips, unless of course something changes drastically that allows for a lot of risk-taking. I think at this point pullbacks will be short-term at best, as the world rushes to find some type of stability and safety. Pay attention to this pair, the USD/MXN pair, and the USD/CNH pair, as they can give you an idea as to what to do about other markets even if you don’t trade these. That being said, you can see how it’s been a very easy uptrend to follow in this market