The US dollar has dropped initially during trading on Tuesday and what would have been a little bit of a “relief rally” for risk assets in a very noisy and choppy environment. The South African Rand of course represent a lot of different things in the same chart, not the least of which of course is emerging markets in Africa. Think of it this way: money will flow from major centers such as New York to more exotic locations when there is an opportunity to make a certain amount of return. After all, the returns in emerging markets are almost always stronger than in the more developed world, all things being equal. However, the exact opposite can happen as well, if there is fear typically money will flow back to places like New York, London, or Frankfurt.

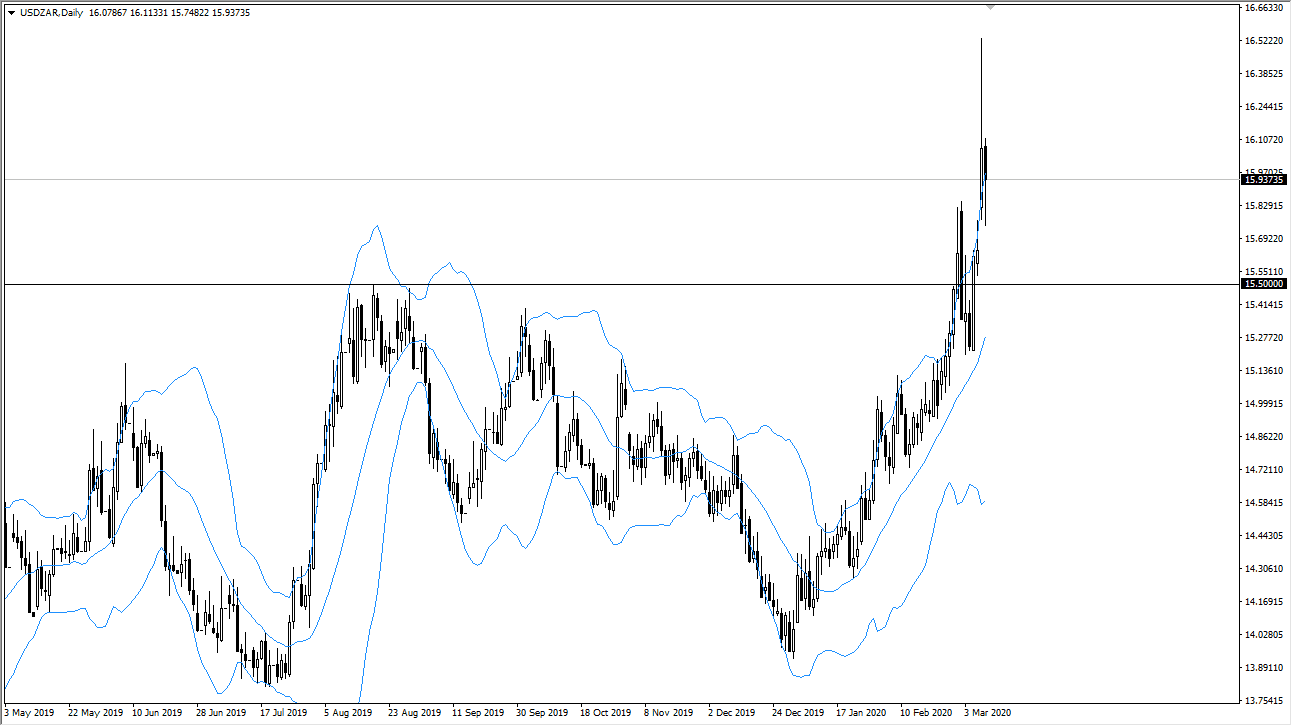

The pair initially dropped down to the 15.70 Rand level on Tuesday as word got out that the United States was going to do fiscal policy tweaking in order to calm the markets. We have yet to see that, and as a result it looks as if the US dollar has turned around to show signs of life again. For what it’s worth, the Bollinger Band indicator has been broken to the upside on the most volatile move on Tuesday. We dipped back into the indicator and then rallied again. We are “walking the band” at this point, which is a sign of extreme strength and perhaps an almost overbought condition. It would not be surprising at all to see this market pullback, but I believe that the gap underneath is probably going to cause a bit of support near the 15.70 Rand level, and most certainly at the 15.50 Rand level which has been important in the past as well.

Simply put, if this market continues to rally it will probably have a lot to do with more of a “risk off” type of situation, but if the theater jump back into the market, this will more than likely shoot straight up in the air. That’s what we have seen over the last couple of weeks, and therefore one would think that it would be more or less a continuation of this. If the market turned around a break down below the 15.25 Rand level, then it is a very good sign for risk appetite in general and could send this pair back down to the 14 Rand level.