Following a new 2020 high in the USD/ZAR, the 50 basis point interest rate cut by the US Federal Reserve ended the advance. Nigeria has overtaken South Africa as the continent's largest economy after the latter posted a 1.4% GDP contraction in the fourth quarter. It resulted in the second recession for the South African economy in two years, driven by ongoing power outages related to Eskom’s inability to maintain the grid. The ripple effect has impacted neighboring countries as well. Issues in South Africa are known, but the US is at the start of economic disruptions, creating a bearish bias in this currency pair. The rejection of the recovery by its resistance zone is favored to lead to a profit-taking sell-off.

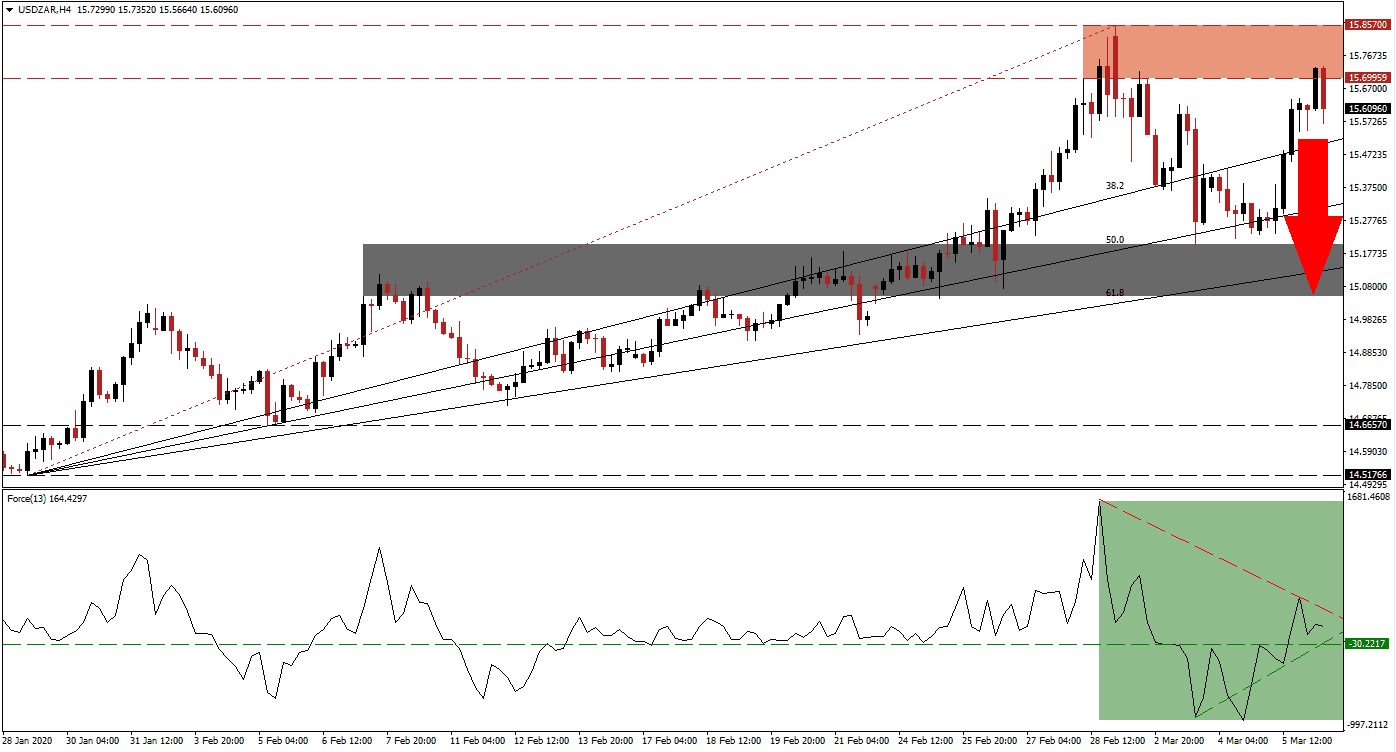

The Force Index, a next-generation technical indicator, points towards the collapse in bullish momentum after confirming the fresh 2020 high in price action with one of its own. A lower high was formed during the recovery in the USD/ZAR, allowing for the formation of a descending resistance level. The Force Index remains above its horizontal support level in positive territory, as marked by the green rectangle. This technical indicator is anticipated to contract below its ascending support level below the 0 center-line, ceding control of this currency pair to bears.

Price action attempted to recover following the panic-driven central bank inspired sell-off, but the resistance zone rejected an advance while a lower high was recorded. This zone is located between 15.69959 and 15.85700, as marked by the red rectangle. The USD/ZAR is now challenging its ascending 38.2 Fibonacci Retracement Fan Support Level. A push below it will result in a conversion to resistance, adding more downside pressure on this currency pair. You can learn more about the Fibonacci Retracement Fan here.

Covid-19 is expected to have an impact on South African tourism. Seven out of ten sectors in the South African economy recorded a contraction in the fourth quarter, but finance, mining, and personal services expanded. With critical sectors resilient, the economy is positioned to recover. A contraction in the USD/ZAR into its next short-term support zone located between 15.05102 and 15.20541, as marked by the grey rectangle, will keep the long-term uptrend intact. Risks for a breakdown ending the bullish chart pattern have increased, on the back of US economic weakness related to virus disruptions.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 15.60000

Take Profit @ 15.05200

Stop Loss @ 15.74000

Downside Potential: 5,480 pips

Upside Risk: 1,400 pips

Risk/Reward Ratio: 3.91

In the event of a breakout in the Force Index above its descending resistance level, the USD/ZAR is likely to follow suit. The upside potential is limited to its next resistance zone located between 16.24160 and 16.36060, dating back to January 2016. With the developing fundamental conditions, supported by emerging technical aspects, any push high will present Forex traders with an excellent selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 15.98000

Take Profit @ 16.36000

Stop Loss @ 15.82200

Upside Potential: 3,800 pips

Downside Risk: 1,580 pips

Risk/Reward Ratio: 2.41