After the US Federal Reserve executed a panic-inspired 50 basis points interest rate cut, markets are pricing an additional 75 basis point cut during the scheduled FOMC meeting this month. Adding to market pressures in the central bank is the oil price collapse and the ripple effect it will have across the global economy. Covid-19 scared the US central bank into a panic-cut, but oil prices carry more significant value to the economy. Therefore, a more massive cut is anticipated, allowing the USD/TRY to complete a breakdown below its short-term resistance zone.

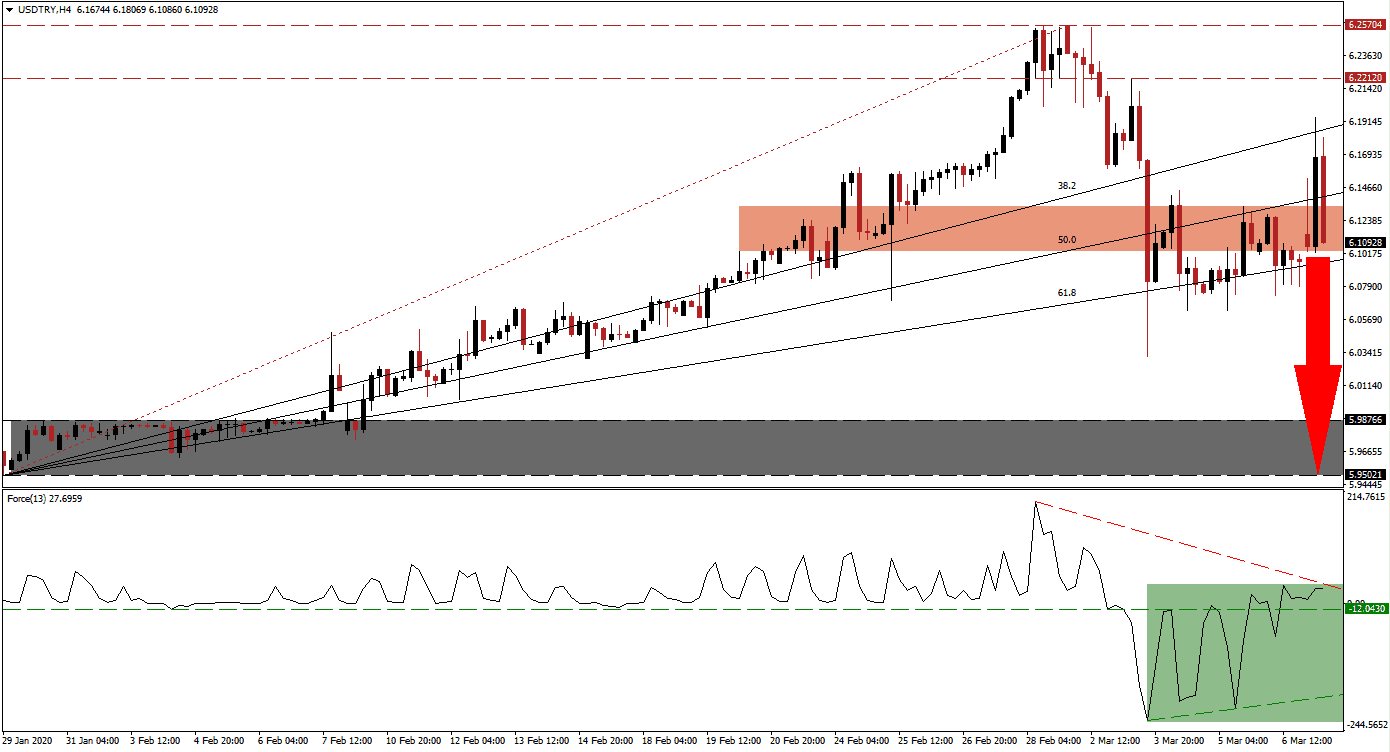

The Force Index, a next-generation technical indicator, indicates a steady recovery following the plunge to a new 2020 low in response to the US interest rate cut. An ascending support level provided the necessary platform for the Force Index to push through its horizontal resistance level, converting it into support. This technical indicator is now faced with its descending resistance level in positive territory, as marked by the green rectangle, from where a breakdown is expected to lead the USD/TRY to the downside.

A volatility spike resulted in price action gyrating inside of its Fibonacci Retracement Fan sequence before settling into its short-term resistance zone located between 6.10282 and 6.13371, as marked by the red rectangle. The 38.2 and 50.0 Fibonacci Retracement Fan Resistance Levels have eclipsed this zone, placing the 61.8 Fibonacci Retracement Fan Support Level in a position of last support. With receding bullish momentum, the USD/TRY is anticipated to crash through support and accelerate to the downside.

One key level to monitor is the intra-day low of 6.06971, from where this currency pair converted a breakdown below its short-term support zone, now acting as resistance, into a higher high. A breakdown in the USD/TRY below this level is anticipated to initiate the next wave of net sell orders, adding to downside momentum. It will additionally clear the path for price action to challenge its next support zone located between 5.95021 and 5.98766, as marked by the grey rectangle. You can learn more about a breakdown here.

USD/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.11000

Take Profit @ 5.95050

Stop Loss @ 6.15000

Downside Potential: 1,595 pips

Upside Risk: 400 pips

Risk/Reward Ratio: 3.99

In the event of a breakout in the Force Index above its descending resistance level, the USD/TRY is likely to attempt a reversal. While Turkey faces debt-related economic issues, the US Federal Reserve poses a more significant risk to this currency pair. A weaker US Dollar will help Turkey ease financing payments, providing a fundamental catalyst. Forex traders should view any price spike as a great selling opportunity. The upside potential remains limited to its long-term resistance zone located between 6.22120 and 6.25704.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.18000

Take Profit @ 6.23750

Stop Loss @ 6.15500

Upside Potential: 575 pips

Downside Risk: 250 pips

Risk/Reward Ratio: 2.30