Singapore delivered a massive second economic stimulus worth S$48 billion. It follows February’s S$6.4 billion response to Covid-19. While a second one was anticipated, the size was rumored to be S$15 billion. In total, the city-sate announced assistance roughly worth 11% of GDP. In an unprecedented move, S$17 billion of the funding will be derived from a drawdown of its national reserves. The USD/SGD is in the midst of a corrective phase, well-positioned to continue with a breakdown below its short-term support zone.

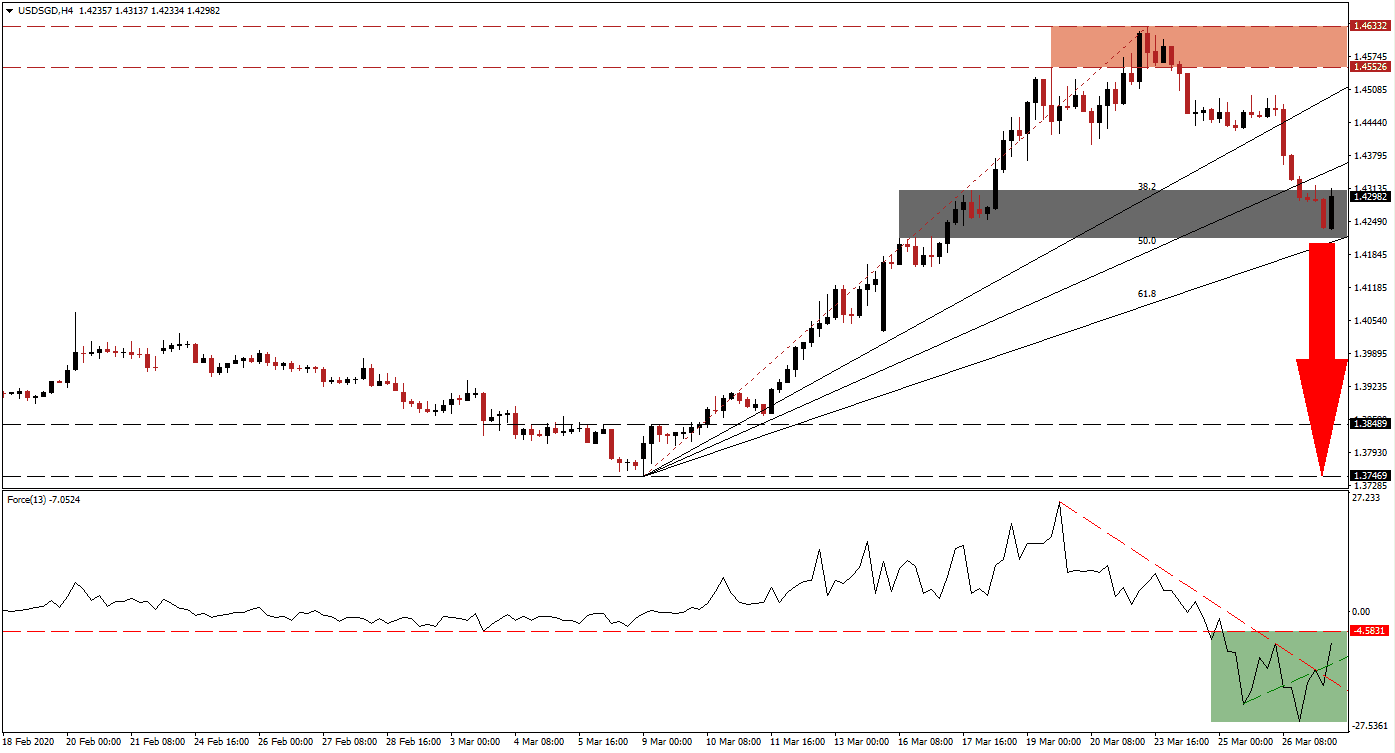

The Force Index, a next-generation technical indicator, collapsed from a new 2020 high and converted its horizontal support level into resistance. While bullish momentum is recovering off of a new low, a sustained push into positive territory is questionable, allowing bears to remain in control of the USD/SGD. The Force Index moved above its ascending support level and descending resistance level, as marked by the green rectangle, in an unsustainable short-term bounce, vulnerable to a quick reversal.

US Dollar weakness is expected to drive price action farther to the downside. Adding to selling pressure in this currency pair is the willingness of Singapore to deliver a unified approach to fighting the pandemic. The US is faced with a more complex situation and a struggle between state and federal government. After the initial breakdown in the USD/SGD below its resistance zone located between 1.45526 and 1.46332, as marked by the red rectangle, bearish sentiment expanded. You can learn more about a resistance zone here.

Adding a fundamental driver is Singapore’s ability to use national reserves for partial funding, whereas the US will issue more debt, pushing its debt-to-GDP ratio well above 100%. The USD/SGD collapsed below its ascending 50.0 Fibonacci Retracement Fan Support Level, converting it into resistance, and into its short-term support zone. This zone is located between 1.42160 and 1.43106, as identified by the grey rectangle. A breakdown extension into its long-term support zone between 1.37469 and 1.38489 is likely to emerge.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.43000

Take Profit @ 1.37500

Stop Loss @ 1.44500

Downside Potential: 550 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 3.67

Should the Force Index push higher, assisted by its ascending support level, the USD/SGD may challenge its resistance zone once again. Forex traders should consider this an outstanding selling opportunity, as a breakout remains unlikely due to dominant fundamental developments. Singapore is implementing measures to allow its economy to enter a recovery based on relative fiscal discipline, while the US is boosting debt, resulting in a bearish bias for price action.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.45000

Take Profit @ 1.46200

Stop Loss @ 1.44500

Upside Potential: 120 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.40