Singapore emerged as one of the leading countries to combat the Covid-19 pandemic. It remained proactive, limiting its spread, and announced a stimulus to bridge economic disruptions. Its foreign reserves increased in February, boosting its balance sheet. While the fallout from virus-related problems persists, likely to cause challenges throughout the first half of 2020, the economy is better positioned to handle a global recession than many of its counterparts. The breakdown in the USD/SGD following a strong rally is now vulnerable to a more massive correction.

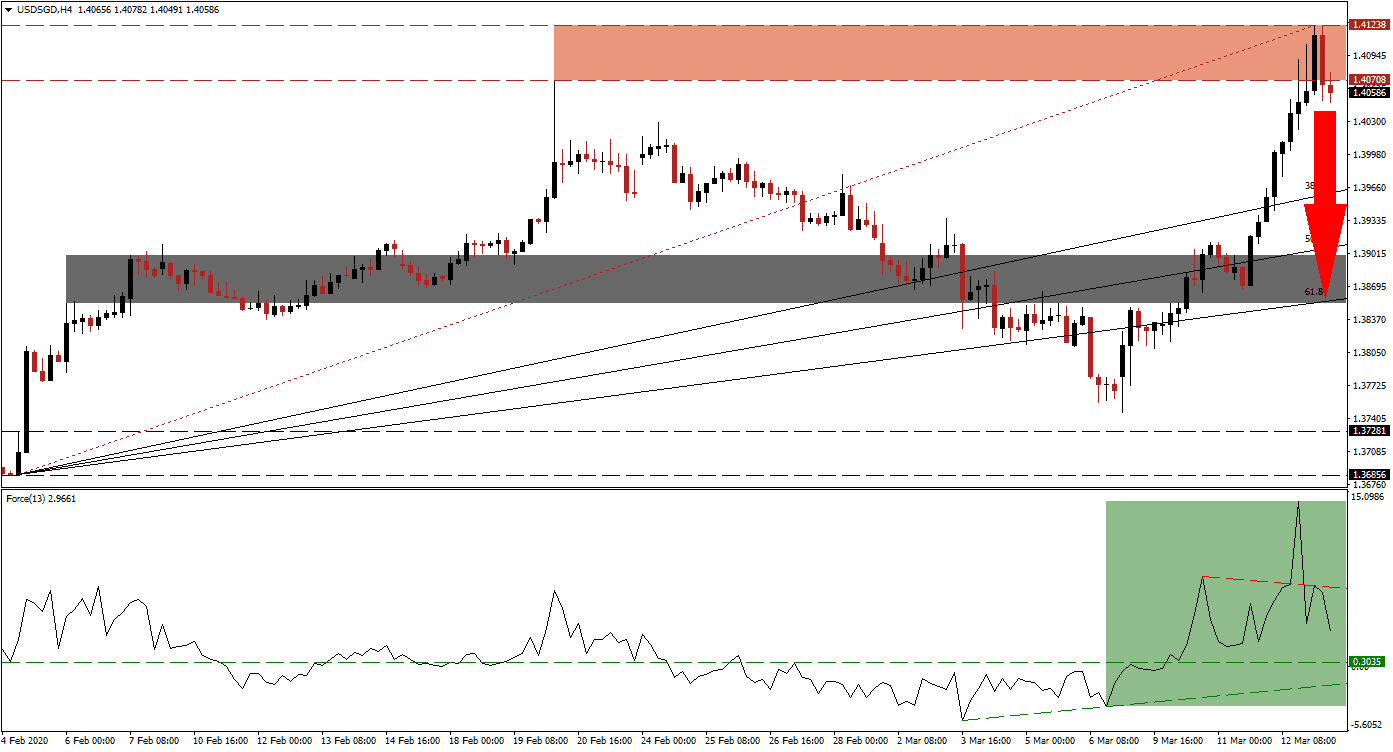

The Force Index, a next-generation technical indicator, displays the collapse in bullish momentum after spiking higher together with price action. It failed to record a brand-new 2020 peak and, therefore, did not confirm the new high in the USD/SGD. The Force Index now pushed below its descending resistance level, as marked by the green rectangle. An extension of the reversal below its horizontal support level and into its ascending support level is favored. It will place this technical indicator into negative territory, and grant bears control of this currency pair.

After the USD/SGD pushed below its resistance zone located between 1.40708 and 1.41238, as marked by the red rectangle, a profit-taking sell-off is anticipated. This zone dates back to August 2015 and developing fundamental conditions make a sustained advance highly unlikely. Forex traders rushed to the US Dollar amid liquidity concerns, and the US Federal Reserve announced $1 trillion in fresh capital, but the financial markets already dismissed it. With more stimuli awaited, the outlook for the US Dollar remains bearish.

One significant level to monitor is the intra-day high of 1.40295, the peak before this currency pair entered its previous sell-off. A breakdown is expected to spark the pending corrective phase and will close the gap between the USD/SGD and its ascending 38.2 Fibonacci Retracement Fan Support Level. Bearish pressures should allow price action a breakdown extension into its short-term support zone located between 1.38531 and 1.39000, as marked by the grey rectangle. You can learn more about a support zone here.

USD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.40550

Take Profit @ 1.38550

Stop Loss @ 1.41150

Downside Potential: 200 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.33

Should the Force Index reverse above its descending resistance level, the USD/SGD may attempt a breakout. The upside potential remains limited to its next resistance zone located between 1.42430 and 1.42920. Since Singapore is on a path to slow normalization, the US is in the early phases of the pandemic, providing a bearish fundamental catalyst to price action. Forex traders are recommended to sell any rallies from current levels in this currency pair.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.41650

Take Profit @ 1.42650

Stop Loss @ 1.41150

Upside Potential: 100 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.00