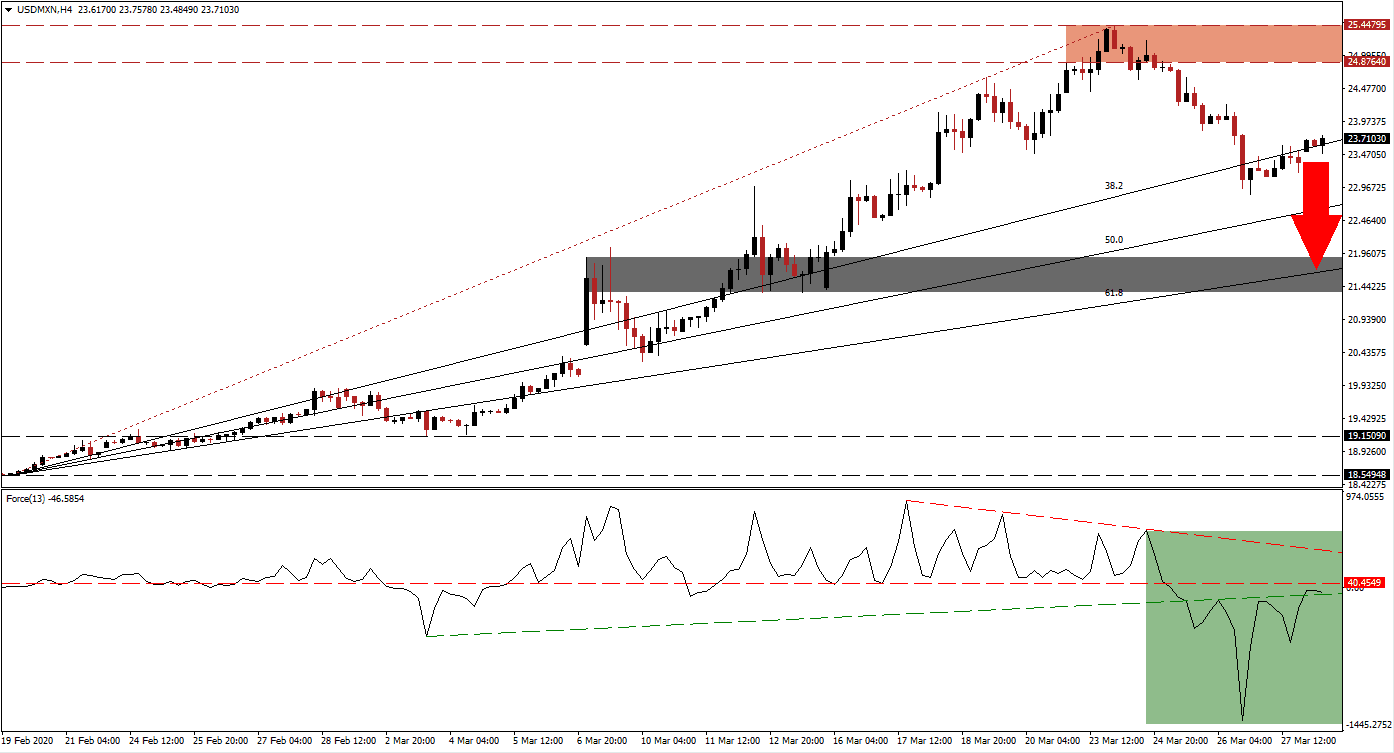

US Dollar weakness is anticipated to accelerate due to the massive oversupply of the currency by the Federal Reserve. Adding to downside pressures is the 10% spike in US debt after President Trump signed a $2 trillion economic stimulus and corporate bailout package last Friday. While the 6.50% interest rate has not resulted in a carry trade for the Mexican Peso yet, the prospects cannot be ignored once the global economy moves past the Covid-19 pandemic peak. The USD/MXN corrected from an all-time high and paused at its ascending 38.2 Fibonacci Retracement Fan Support Level. A renewed sell-off is pending amid a bullish momentum loss.

The Force Index, a next-generation technical indicator, plunged to a new monthly low before reversing the steep drop. It was able to reclaim its ascending support level, located just beneath its horizontal resistance level, as marked by the green rectangle. More downside pressure is delivered by its descending resistance level. Bears remain in control of the USD/MXN with this technical indicator below the 0 center-line. You can learn more about the Force Index here.

Following the breakdown in the USD/MXN below its resistance zone located between 24.87640 and 25.44795, as marked by the red rectangle, selling pressure has intensified. The US Dollar advanced amid a liquidity crunch, but Forex traders are adjusting their positions. After the US central bank slashed interest rates to a lower band of 0.00% and pledged an unlimited open-ended quantitative easing program, the US Dollar is positioned to devalue significantly. The debt-to-GDP ratio is on track to soar past 120%, highlighting structural weakness, which is not priced into the currency.

Price action is expected to initiate a new breakdown sequence into its ascending 61.8 Fibonacci Retracement Fan Support Level. It is currently passing through the short-term support zone located between 21.36325 and 21.89050, as identified by the grey rectangle. An extension of the breakdown sequence in the USD/MXN cannot be ruled out, depending on US economic data in the coming weeks. Dismal initial jobless claims reported last Thursday are likely only the beginning of depressive data to follow. You can learn more about a breakdown here.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 23.70000

Take Profit @ 21.80000

Stop Loss @ 24.25000

Downside Potential: 19,000 pips

Upside Risk: 5,500 pips

Risk/Reward Ratio: 3.46

A sustained breakout in the Force Index above its descending resistance level is favored to push the USD/MXN back into its resistance zone. Forex traders are recommended to view any price spike as a temporary event, and outstanding short-selling opportunity. The outlook for the US Dollar is increasingly bearish, adding a long-term fundamental catalyst for price action to correct farther to the downside.

USD/MXN Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 24.60000

Take Profit @ 25.40000

Stop Loss @ 24.25000

Upside Potential: 8,000 pips

Downside Risk: 3,500 pips

Risk/Reward Ratio: 2.29