For the third consecutive week, the USD/JPY pair continues its sharp losses, as the pair surged to the 101.17 support in the beginning of this week's trading, the lowest level since October 2016. The correction attempt stopped at the 102.45 level as bears continued to dominate the performance amid growing concerns about the exposure of the American economy to the disasters that the Chinese economy was exposed to, as the number of Corona cases and deaths in the United States increased at a faster rate, pushing three US states to declare a state of emergency.

Investor anxiety caused the US Dow Jones Industrial Average to decline by 7.8% during Monday's trading and US stock indexes followed in similar sharp losses. The Dow recorded its biggest drop since the financial crisis in 2008, as the free fall in oil prices and exacerbated fears of Corona virus outbreaks, led to sharp sale in markets. The sharp declines caused the first automatic pause in trading on Wall Street in two decades. The price of oil fell by about 25% after Saudi Arabia made it clear that it would increase production after Russia refused to cut production in response to a decline in global oil demand due to the Covid-19.

On the economic side. Japan's economic growth contracted at a bleak annual rate of -1.7 percent from October to December, worse than the initial estimate, adding to fears that the world's third largest economy will head into recession. The deflation was the first for Japan in more than a year, especially after an increase in sales tax imposed on the first of last October, which affected retail spending.

The data does not reflect the sharp decline in tourism and other commercial activities related to the outbreak of the virus that has spread from China to most parts of the world. Most economists expect another contraction in the current quarter, and perhaps the full year, for the third largest economy in the world. The "Economic Watchers" survey released by the Cabinet Office also showed a sharp drop in all types of commercial activity on Monday to levels that were last seen nine years ago after the devastating March 11, 2011 earthquake and tsunami that struck nuclear facilities in northeastern Japan.

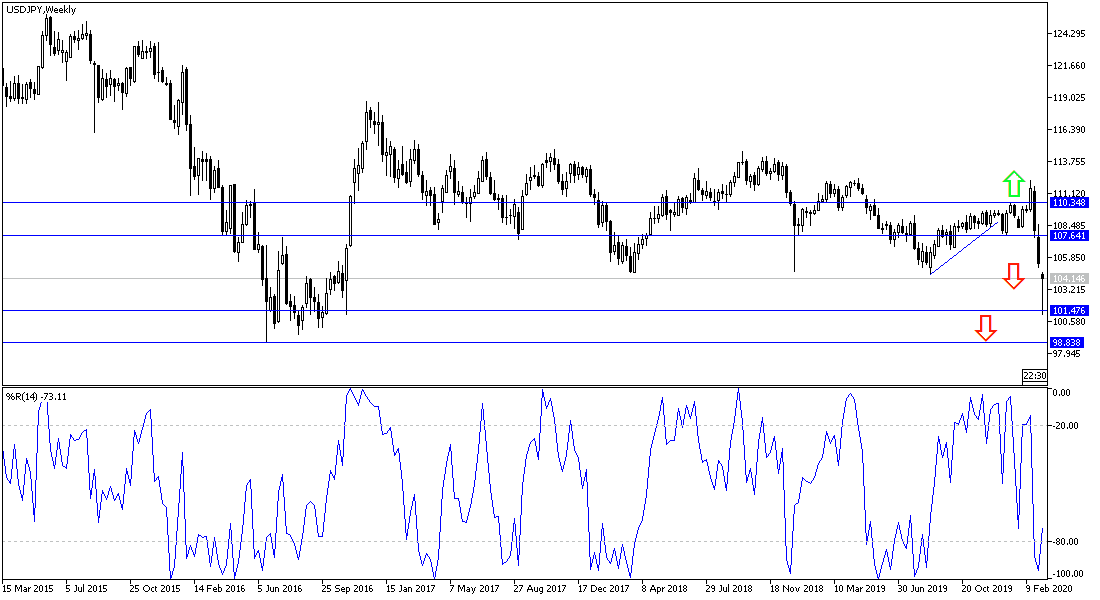

According to the technical analysis of the pair: The downtrend still strongly controls the long-term price performance of the USD/JPY pair after giving up more than 1,000 points since mid-February 2020 trading. Increasing global concern about the Coronavirus and its devastating impact on the US economy will increase pressure on the US dollar and pave the way for the pair to test new record support levels. Safe havens are ready for more advance despite technical indicators reaching strong oversold areas. The closest support levels for the pair are currently at 101.55, 100.00 and 98.90, respectively.

The pair is not expecting any important economic data today, whether from Japan or from the United States.