The spread of the fatal Corona virus - Covid 19 - in the United States, increasing numbers of infections and deaths, and three states declaring a state of emergency, all forced the US Federal Reserve to suddenly announce a US interest rate cut by half a point last week instead of waiting for the meeting scheduled for March 18, to keep the US economy from any consequences of the epidemic, as happened in China. This concern was a valid reason for the violent retreat of the USD/JPY to the 105.00 support, the lowest in six months at the end of last week’s trading. With the markets opening for trading this week, the record gains for the Yen increased, causing a bearish price gap to the 101.53 support, the lowest since November 2016, before settling around the 102.70 level at the time of writing.

Friday's data confirmed that the US job market is still strong before the Corona virus begins to sweep the country, as the US unemployment rate fell to 3.5% last month, hitting its lowest level in 50 years, down from 3.6% in January. 273 thousand new jobs were added in the non-agricultural sector, and average wages increased, as expected, to 0.3% from 0.2% previously. Despite the upbeat figures, most economists expect a slowdown in employment in the coming months. Businesses restrict travel of businessmen and factories face supply disruptions due to the closure of manufacturing industries in China and some Americans delaying holidays.

And if fears of the Coronavirus begin to reduce consumer and business confidence, a wider fall in spending and employment could weaken the US economy. A survey known as the Big Book found that half of the 12 provinces of the US Federal Reserve were reporting effects of coronavirus. The Federal Reserve in Philadelphia has reported fewer tourist groups from China and said that many of the city's Asian restaurants and stores have reported lower sales due to baseless concerns about the virus.

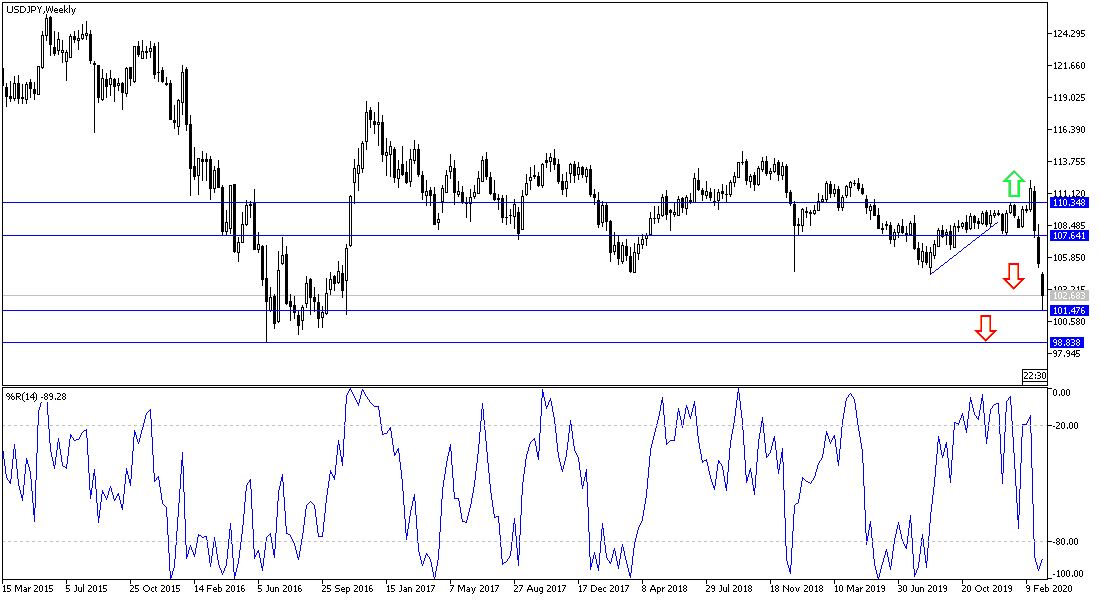

According to the technical analysis of the pair: On the daily chart below, it appears clear that the USD/JPY reached a strong oversold areas according to the performance of technical indicators, and that forex traders may take advantage of the recent decline in thinking about buying and collecting gains from the bounce. Support levels at 102.50, 101.80 and 100.90 are best suited for this. Corona developments in the United States will determine the fate of the pair, which is still in the range of a violent descending channel since it gave up the 110.00 psychological resistance.

As for the economic calendar data: The focus today will be on Japanese data, with the announcement of GDP and current account data. There are no significant US economic releases today.