Amid increasing volatility in the global financial markets and with the return of pressure on the US dollar after the approval of the huge and long-awaited US stimulus plan, which is estimated at 2 trillion dollars, to face the catastrophic effects of the deadly Corona pandemic and its negative impact on the future of the global economy, the USD/JPY returned to decline strongly, reaching the 107.75 support after gains in the beginning of trading last week pushed it to the 111.71 resistance, and then settled around the 107.70 level at the time of writing. Investors have abandoned the US dollar, but I expect that this will not last long. During only two trading sessions, the pair has declined nearly 3.5% in the past two days, in a performance in which the pair has lost approximately 390 points.

On the economic side. The recent fluctuations of the USD/JPY are driven by the spread of the deadly coronavirus, Covid-19, which has killed more than 25,000 people worldwide. Global economies have suffered from government closures as many companies have stopped operating and millions of people have been laid off. This situation may continue to affect the performance of the pair in the coming weeks. However, the latest round of US economic data results appear to have played a role in putting the dollar under stronger pressure. We did not see any positive data except with the announcement of the US Manufacturing PMI which exceeded expectations for March with a reading of 49.2 compared to expectations of 42.8. In contrast, the PMI came below expectations of 42 as it recorded a reading of 31.9 and the composite PMI decreased to 40.5 from 49.6.

The biggest surprise and the most impactful on the US dollar was the announcement of the rise in the weekly jobless claims, which rose to 3.283 million claims, higher than the expected figure of one and a half million, and the last final result was the highest in the history of the United States.

From Japan, the Manufacturing PMI for March declined to 44.8 while expectations were for a reading of 47.6 On the other hand, the consumer price index in Tokyo for March came at a reading of 0.4%, with expectations were for an inflation of 0.5%.

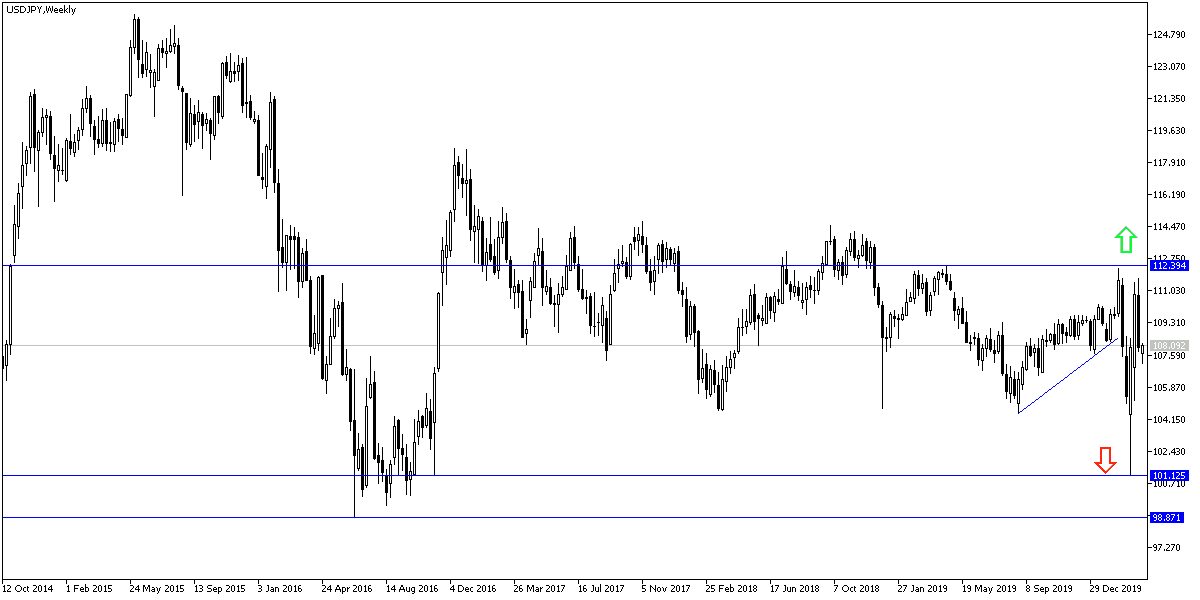

According to the technical analysis of the pair: The USD/JPY could benefit from the recent collapse, and wait for the support levels 106.75, 105.80 and 104.90, respectively, to return to buying again. On the long-term, on the daily chart, it appears that the pair has made a sharp rebound recently, which has supported the recent selling to take profits. Long term bulls will target the next high at 112.283 or higher at 114.117. On the other hand, the bears will look to the continuation of the recent correction to push the pair to 105.76 and 103.55 levels, respectively.

As for the economic calendar data today: There are no significant Japanese economic releases today. From the US, pending home sales data will be released.