Despite the USD/JPY attempts of a lower correction for two trading sessions in a row, the pair is still moving inside its upward channel, and the correction is temporary because all factors still support the continuation of its gains. The pair retreated towards the 110.45 level at the time of writing, and recent gains extended to the 111.71 resistance. The American economy got strong support from adopting the rescue plan, which is estimated at $2 trillion, to face the devastating effects of the deadly Corona epidemic, where American companies and families suffered from the recent closings to prevent the spread of the disease. Late on Wednesday, the Senate approved a comprehensive package aimed at mitigating the impact of the coronavirus outbreak on Americans, and sending the measure to the House of Representatives for a vote on Friday. The bill is $2 trillion and will provide $1,200 direct payments to adults with a total of $75,000 annually, and provides $350 billion in loans to small businesses, and establish a $500 billion fund to lend to industries, cities, and states.

Other details of the economic rescue package, written by Trump administration officials and Democratic and Republican Senate leaders, include $50 billion in financing and loans to airlines, and more than $100 billion to care for hospitals and veterans. For his part, Treasury Secretary Stephen Mnuchin said he expected the Americans to receive their direct payments within three weeks.

With economic activity declining significantly in most parts of the country, Trump seeks to "open" the country on Easter, which falls on April 12. The president said he will evaluate the coronavirus containment strategy for management early next week after the 15-day period ends. The aim of this initiative was to encourage social exclusion. Speaking at the White House, Trump urged the House of Representatives to pass the bill and said, "I will sign it immediately."

The latest figures from the Ministry of Health in New York showed that the number of cases increased by 20% in one day and on Wednesday the cases reached 30,811. In the United States, the total number reached 55,243 cases and at least 802 deaths.

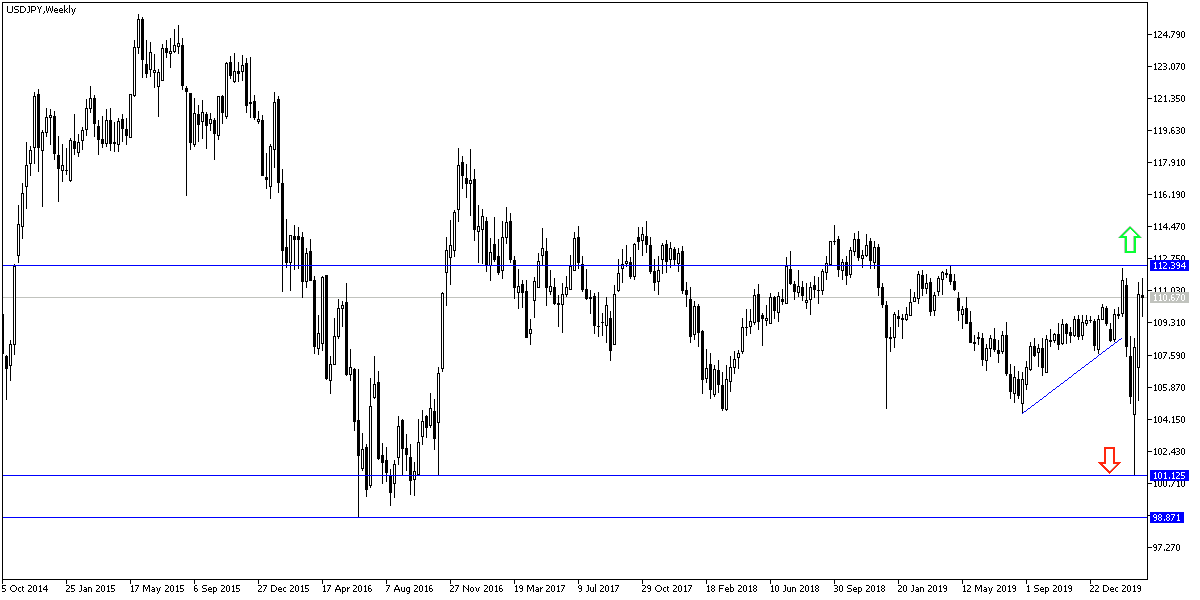

According to technical analysis of the pair: the general trend of the USD/JPY pair is still bullish as long as it remains stable above the 110.00 resistance and confidence may be shaken in this direction today if a record number of US jobless claims is announced as expected due to the Corona outbreak and the loss of thousands of jobs due to closings. The pair is expected to drop to support levels 109.90 and 108.80 before rebounding strongly higher again. Therefore, I still prefer to buy the pair from every lower level.

As for the economic calendar data: All focus will be on the US data, with the announcement of the annual GDP growth rate and weekly jobless claims.