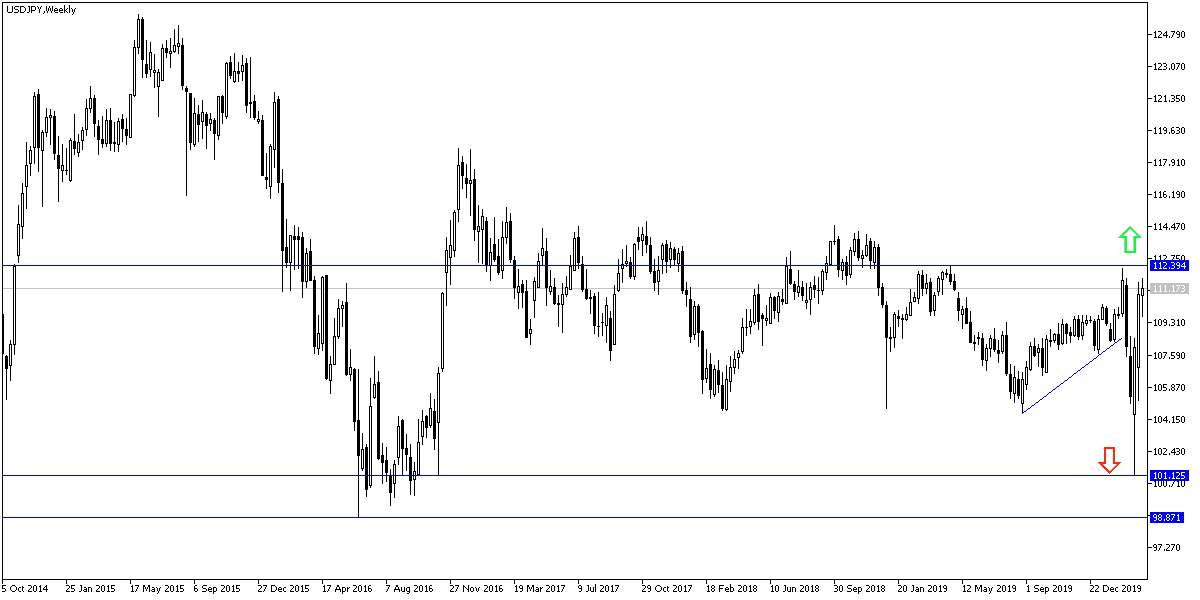

Despite the gains of other major currencies against the US dollar during yesterday's trading session, the price of the USD/JPY pair is still moving inside a bullish channel, and recent gains have hit the 111.71 resistance, the highest in a month, before settling around the 111.30 level in the beginning of today’s trading. There is no doubt that the US Federal Reserve has taken historic measures to deal with the economic shock caused by the outbreak of the Corona epidemic strongly within the United States of America, which increases the pressure on the global economy. The United States is now going through more than a week in an unprecedented 15-day effort to encourage all Americans to dramatically reduce their public activities. The guidelines are from the Centers for Disease Control and Prevention, but many government and local leaders have issued mandatory restrictions that are in line with, or even stricter, than those from the CDC.

On Monday, the United States experienced its biggest leap so far in the death toll from the coronavirus, with more than 650 US deaths from the COVID-19 epidemic. Trump's comments follow dire warnings from officials in the severely affected areas, mostly from New York State.

During Tuesday's trading session, the Dow Jones Industrial Average rose to its best level since 1933, as Congress and the White House approached an agreement that would pump nearly $2 trillion in aid to the US economy facing recession due to Corona. The Dow rose 2112.98 points, the largest point gain in history, to 20,704.91 points. Investors were appealing to the US Congress to pass the deal, especially as the Federal Reserve did almost everything it could to support financial markets, including the latest round of exceptional assistance launched on Monday with unlimited purchases to help companies and people defaulting due to the Corona epidemic.

On the economic side. New US home sales fell 4.4% in February, with expectations of even greater declines in the coming months as the coronary virus greatly affects home sales. The US Commerce Department said February sales fell to an annual rate of 765,000 homes, down from an average of 800,000 in January. The January figure was revised up from a preliminary estimate of 764,000 homes but economists warn that home sales, along with many other parts of the economy, are expected to be significantly affected in the coming months due to the closures approved to try to limit the spread of coronary virus (COVID- 19).

The official report showed that the average price of a US home sold in February was 345,900 dollars, 6.3% higher than the average price of 325,900 dollars in January. Economists expect large declines in the general economy, with a wave of layoffs due to the massive blow the economy has received from the deadly epidemic.

According to the technical analysis of the pair: On the daily chart, the USD/JPY is still moving inside a bullish channel with a stability above the 110.00 resistance and the continuation of market confidence may prepare the pair to move towards stronger resistance levels, the closest of which are currently 111.85, 112.40 and 113.60 respectively. Statistics due to global human and economic losses due to the Corona epidemic greatly affect the morale of investors and markets in general. Any stability of the pair below the 110.00 level may motivate the bears to move the pair and exit from its current channel, in order to take profits.

As for the economic calendar data today: The focus will be on US data: Durable goods orders and crude oil stocks numbers.