With the beginning of this week’s trading, the recent US dollar record gains have stopped, and it seems that investors are awaiting the approval of the US Congress for the historic rescue plan, which is estimated at 2 trillion dollars to support the US economy and the world in the face of the catastrophic economic shock from the Corona epidemic. The USD/JPY fell back to the 110.08 support level in early trading today, and its recent gains extended to the 111.50 resistance after the successive gains of the USD amid the strong demand after many measures taken by the US central bank to stimulate the American economy, the measures including cutting US interest rates to the threshold of 0%. Yesterday, the Federal Reserve said in its announcement that it would establish three new lending facilities that would save up to $300 billion by buying corporate bonds, a broader range of local bonds and debt-related securities such as auto loans and real estate. The bank will also buy an unlimited amount of treasury bonds and mortgage-backed securities in an attempt to reduce borrowing rates and ensure these markets operate smoothly.

The recent US Central Bank approach is an acknowledgment that its previous plans to keep the flow of credit running smoothly, which included dollar limits, will not be sufficient in the face of a virus outbreak, which has brought the US economy to near-shutdown. Last week, the bank announced that it would buy $500 billion in treasury bonds and $200 billion in mortgage-backed securities, and then quickly exceeded half of those sums by the end of the week. Yesterday, the New York Federal Reserve said it would buy $75 billion in treasury bonds and $50 billion in mortgage-backed securities every day this week.

As the coronavirus infection continues to increase, US President Donald Trump said he wants to reopen the country to work within weeks, not months, and Trump told reporters at a news conference, reiterating in a tweet on midnight Sunday: "Treatment cannot be worse than the problem." and "We have to open our country because that causes problems, in my opinion, it could be much bigger problems." In recent days, tensions have escalated between those who argue that the United States needs to go back and operate to prevent a deep economic depression, and medical experts warning that unless more extreme measures are taken, the human cost will be catastrophic.

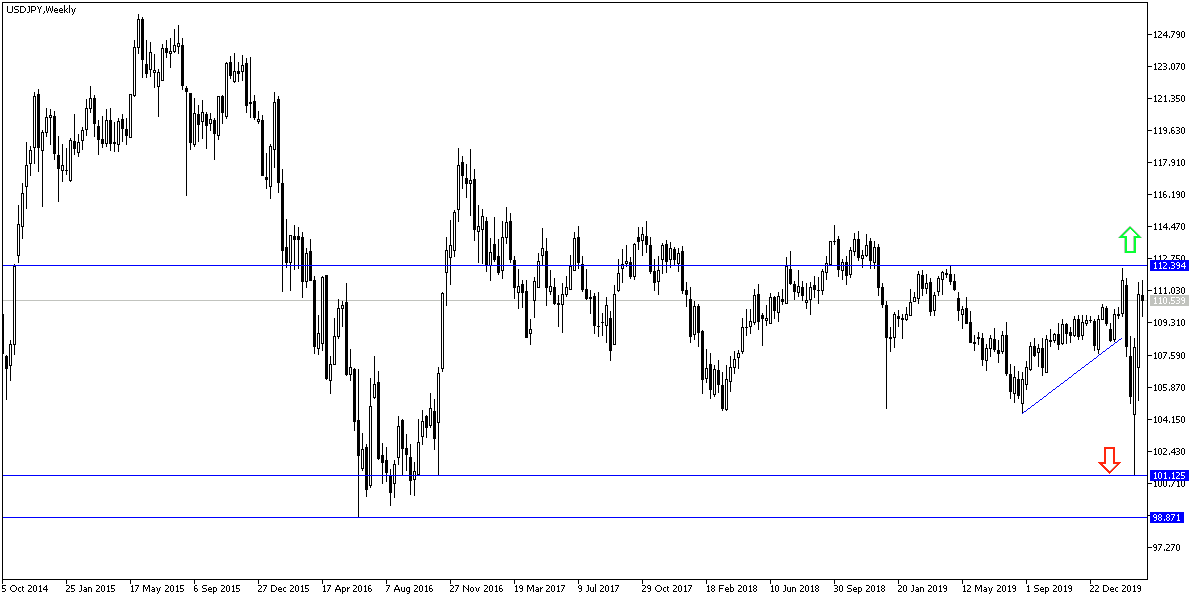

According to the technical analysis of the pair: USD/JPY general trend remains bullish as long as the pair remains stable around and above the 110.00 psychological resistance. I still prefer to buy the pair from every bearish level. The closest support levels are now at 110.10, 109.45 and 108.80, respectively. The developments of the Corona epidemic and its impact on the US and global economy will have a strong effect on the pair’s performance in the coming days. We must be cautious of take profits selling in case the dollar gains are stopped in the event that the US plans to deal with the economic shock towards the epidemic are exhausted.

As for the economic calendar data: The focus will be on the US data, with the release of the industrial and services PMI, and new US home sales data.