There is no doubt that the strong investors’ demand for the USD, due to the highest liquidity globally, contributed to USD gains against most other major currencies. That pushed the price of USD/JPY to rebound up towards the 108.65 level during Wednesday's trading, its highest in nearly a month, before settling around 108.90 at the time of writing. Recent decisions by the US Federal Reserve to cut US interest to zero and introduce more quantitative easing plans, as well as stimulus measures by the US government, have contributed to strengthening the dollar as a stronger safe haven than the Japanese yen, which is a historical safe haven for investors in times of uncertainty, as is now the case with the Corona outbreak, which has infected more than 200,000 people and caused the deaths of nearly 9,000 people, and is now close to spread to the entire globe.

On the economic side. The pace of building new homes fell again in February, but not as much as the previous month. The declines came after a December boom that drove home construction to a 13-year high. Construction companies began building 1.60 million homes at an annual rate which is a seasonally adjustable result, down 1.5% from 1.62 million units in January, and analysts had expected a more significant drop. Even the economic impact of the Corona virus outbreak was not evident in US housing market figures.

Building permits, which is a good sign of future activity, fell 5.5% in February to an annual rate of 1.46 million units. However, building permits for single-family homes increased by 1.7%. The report issued by the US Commerce Department showed that housing starts fell more in the northeast, where they decreased by 25.1%, followed by a decrease of 8.2% in the west. Home construction decreased modestly in the western and southern regions.

The National Association of Home Builders NAHB reported on Tuesday that its survey on builders' morale fell slightly in February, but remains high.

And because of Corona outbreak fears, US stocks slumped more than 5% on Wall Street during Wednesday's trading, and the Dow Jones gave up nearly all of its gains since President Donald Trump's inauguration in 2017. Even investment prices seen as safe during economic downturns fell with the Corona virus outbreak. Investors rushed to raise money in light of a record lack of liquidity in the markets.

American markets have been incredibly volatile for weeks as Wall Street and the White House recognized the potential of a recession in the US economy due to Corona outbreak. The global number of Corona cases crossed the 200,000 mark, creating more uncertainty about the extent of damage to the economy, the amount of profits lost by companies and the number of companies that may go bankrupt due to a cash crisis.

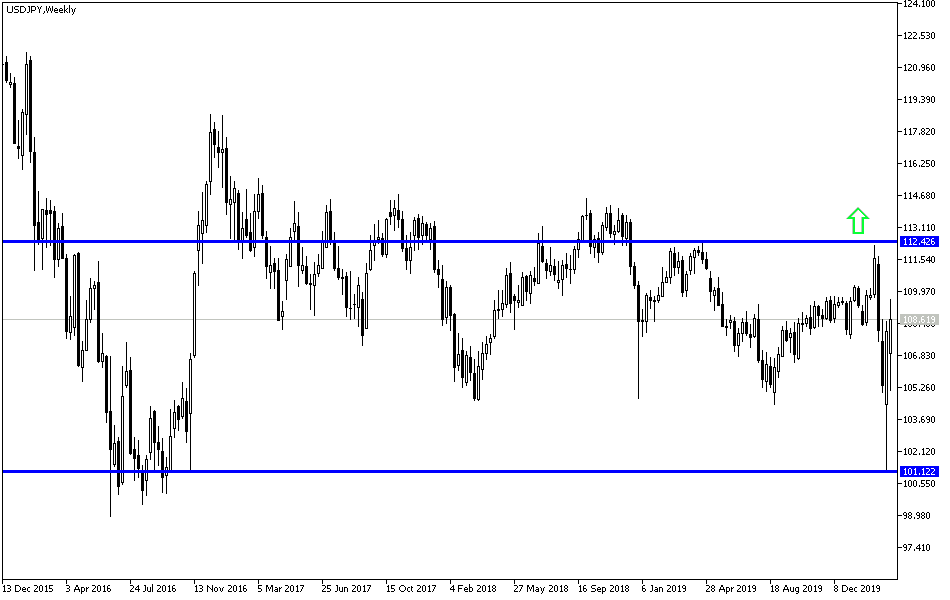

According to the technical analysis of the pair: On the daily chart, the USD/JPY is still moving inside an ascending channel, which may receive strong support in the event the pair moves towards the 110.00 psychological resistance. But taking into consideration investors abandoning more dollar purchases and availability of liquidity, we may see strong gains for the Japanese yen again. The closest support levels for the pair are currently 107.55, 106.80 and 105.90 respectively. I still prefer to sell the pair from every upper level.

As for the economic calendar data today: From Japan, the National Consumer Price Index and the activity of all industries will be announced. Then the most important US economic data, the industrial index of Philadelphia, the claims of the unemployed and the current account.