Investors returned to buy US dollars in light of the successive stimulus plans by the US Federal Reserve and the US government, but the rebound gains for the USD/JPY pair did not exceed the 107.86 level during this week's trading, before the pair settled around 106.90 at the time of writing, after the announcement of a strongly negative readings for US retail sales numbers. The global economy is still facing the unknown in light of the deadly Corona epidemic, which killed nearly 8,000 people, infected 190,000 people and caused the complete shutdown of many global economies led by China, Italy and now the United States with the start of its work on quarantine plans to prevent further outbreak.

In an effort to allay the fears of the American people and investors, Trump said at a White House news conference where reporters sat in separate seats to keep a safe distance: "One day we will stand here and say: We have won. Surely while you are sitting there, we will say it”. The president's announcement came a day after he acknowledged, for the first time, that the epidemic might push the US economy into recession, and suggested that the nation might have to deal with the virus until "July or August". On Tuesday, the president and his team warned Americans to prepare for a long change in their daily routine as it could take more than a month before the impact of his guidance was measured for the 15-day deadline he set on Monday.

Trump's tone on Tuesday was much less optimistic than his previous forecasts, when he insisted that it could end in a matter of weeks. His admission that an outbreak could push the US economy into recession is astonishing for Trump, who for two weeks has shown a heterogeneous optimistic tone about the pandemic that endangers his presidency.

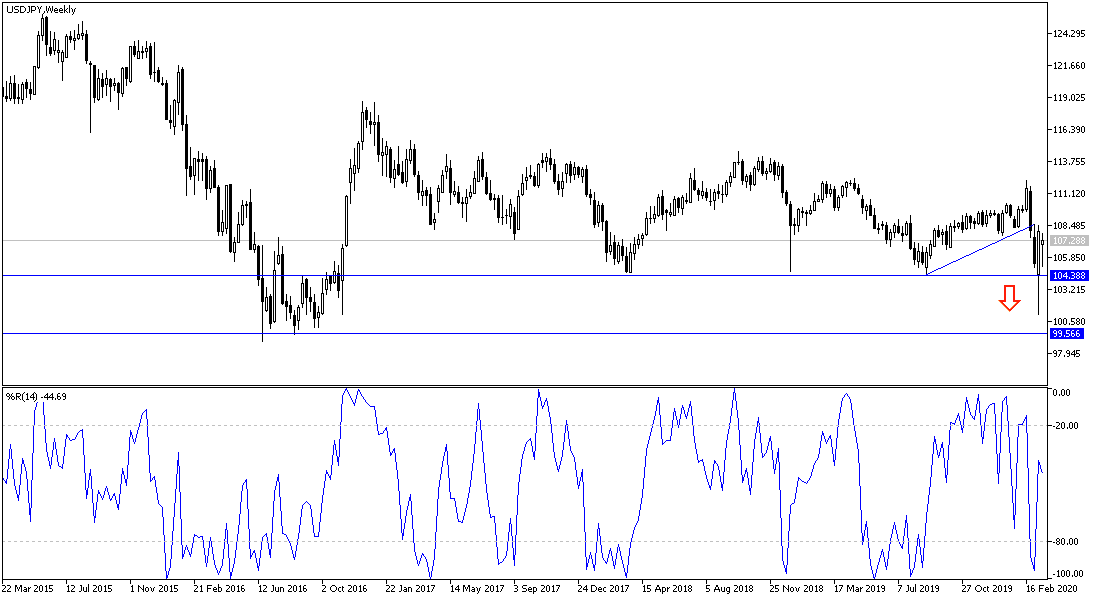

According to technical analysis of the pair: Despite the recent correction attempts, the USD/JPY pair has not yet lived up to confirming the reversal of the general trend to the upside unless the pair moves around and above the 110.00 psychological resistance. This pair specifically faces the struggle of safe havens, as the Japanese yen has historically been an ideal haven for investors in times of uncertainty due to the negative interest and lack of Japanese central intervention, no matter how strong the Japanese yen is, and recently the US dollar, with successive stimulus plans from the US central bank and US government, to stimulate the largest economy in the world in the face of a possible recession from the corona outbreak round the world. Bears are still dominating the performance and therefore we expect the pair to continue in the path of its descending channel, moving towards the support levels at 106.45, 105.80 and 104.70 respectively.

As for the economic calendar data: After announcing the Japanese trade balance, we will wait until the announcement of building permit numbers, housing starts and oil stocks data from the U.S.