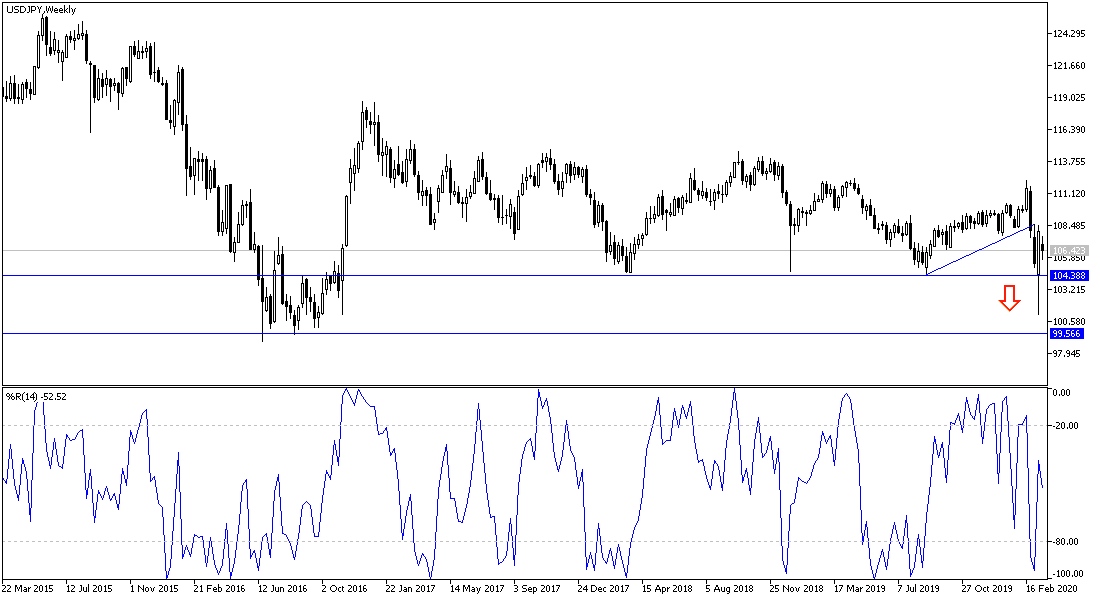

Strong interest from investors to buy the US dollar after the recent and successive measures by the US Federal Reserve, and the US government, to support liquidity in the markets after the historical losses suffered by the US stock markets supported stronger gains for the USD/JPY, pushing it towards the 108.50 resistance, gaining 400 points during last Friday's trading, starting from the 104.50 support. In the beginning of last week's trading, the price fell to the 101.17 support, the lowest level of since October 2016, and is stable around 106.25 at the time of writing. Prior to the opening of the financial markets for trading, including the Forex market, the US Central Bank surprised everyone by reducing the US interest rate to 0.25%, a record low and closer to 0% from the last rate of 1.25% after the sudden rate cut at the beginning of this month.

The US Federal Reserve also announced that it would buy more Treasury bonds to encourage lending in an attempt to offset the negative impact on the economy from the corona virus outbreak. The central bank said in its statement that the outbreak will affect economic activity in the near term and pose risks to economic expectations. They added that they would keep interest rates at almost zero until they feel confident that the economy has weathered recent events.

The Fed also said it would buy $500 billion in treasury bonds and $200 billion in mortgage-backed securities to counter market turmoil that has made it difficult for banks and major investors to sell treasury bonds. The Fed also announced that it had reduced interest rates on loans in dollars in a joint measure it had taken with five central banks abroad. This aims to ensure that foreign banks continue to access the dollars they lend to foreign companies.

All in all, the Fed’s actions amount to an admission that the US economy faces the most serious conditions since the recession ended more than a decade ago.

According to the technical analysis of the pair: Despite the recent USD/JPY gains, it is still subject to the return of the Japanese yen gains at the end of the day, and that the pair may not be able to reach the 110.00 psychological resistance and the stability above it, as the Corona pandemic still threatening the future of global economic growth with its effects may be more than the recession of the 2008-2009 global financial crisis. This would be an ideal situation for the Japanese yen to achieve record gains in the near future. Accordingly, it can be said that selling from every upside level is the best trading strategy at that point. The closest significant support levels for the bears to control performance would be 106.90, 105.75 and 104.00, respectively.

As for the economic calendar data today: The surprising US Federal Reserve decision will steal the spotlight from any economic data, and the results of today's Chinese data may not be as important as what happened. Investors' interaction with the decision and Trump's comments after it will determine the performance of the pair.