The persistence of global concerns about the negative impact on global economic growth from the continued outbreak of the Corona epidemic, which the World Health Organization officially considered as a global epidemic, will continue to support more record gains for the Japanese yen as an ideal safe haven in such critical times. The price of the USD/JPY pair did not care much about Trump's suggestion of stimulus plans for the US economy, which has begun to be affected by investor fears due to the start of the epidemic in the American territories, which has caused 29 deaths so far. The pair returned lower to the 104.08 support after trying to correct upward to the 105.91 level in the previous session after Trump's hints, and is now stable around 103.70 at the time of writing.

The USD/JPY collapsed at the beginning of the week's trading to the 101.17 support, with the continued drop of the American stock markets and the value of the US dollar since the Federal Reserve Bank suddenly announced a US interest rate cut by half a point to boost confidence again in the hearts of investors. With the increasing pressure on the dollar and US stock markets, the bank may be forced to announce more interest rate cuts and introduce new stimulus plans so that the US market returns to its record strength before the outbreak of the Corona pandemic started from China.

US Treasury Secretary Stephen Mnuchin said on Wednesday that a strong economic stimulus would not be able to pass through Congress quickly and announced a smaller measure designed to help small businesses and workers facing the outbreak of the coronavirus. Manuchin added that the smaller measure is somewhat like disaster relief. The Treasury Secretary told lawmakers that the White House looked forward to using loan guarantees to help airlines, hotels and cruise line industries affected by the COVID-19 outbreak.

The US government quickly intensified its efforts to contain the outbreak and its financial repercussions, as the number of confirmed cases exceeded 1000 in the United States, and the World Health Organization announced that the COVID-19 virus is now a global epidemic. All events requiring crowds gathering in all states have been canceled in the hope of stopping the spread of infection. US stock indexes fell on Wednesday amid investor disappointment that the stimulus package will not be released soon. The Dow Jones Industrial Average closed -5.85%, dropping 1466 points, or 5.9%, to 23,553.22 points.

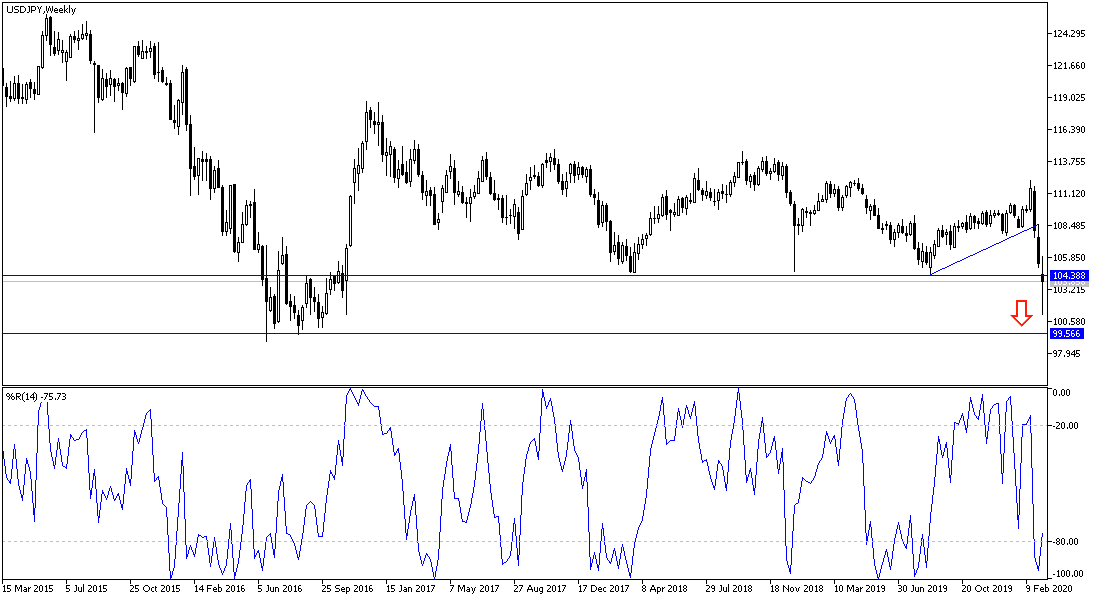

According to the technical analysis of the pair: On the weekly chart below, the pair is still inside a violent bearish channel, and with the announcement that the Corona Virus is now a global epidemic, the Japanese yen will have the opportunity to achieve more gains as it is the preferred safe haven for investors in times of uncertainty. Support levels at 103.20, 102.10 and 100.00 are still legitimate targets for the bears. There will be no reversal of the trend to go up without returning to the 110.00 psychological resistance, and I think this will take more time.

For today's economic calendar data: All focus will be on US data, producer price index and unemployed claims.