The Federal Reserve has proven yet again that it works for Wall Street, and not the overall Main Street economy by giving Wall Street the 50 bps cut that had already been priced in. Ironically, the initial move in the Dow Jones Industrial Average and other US indices was of course for stock market adjustments to start buying, but after a while the selling started, and it ended up being a horrific day on Wall Street for most risk assets. This of course translated into this market as we have completely wiped out the gains from the previous session, showing just how fragile the market is.

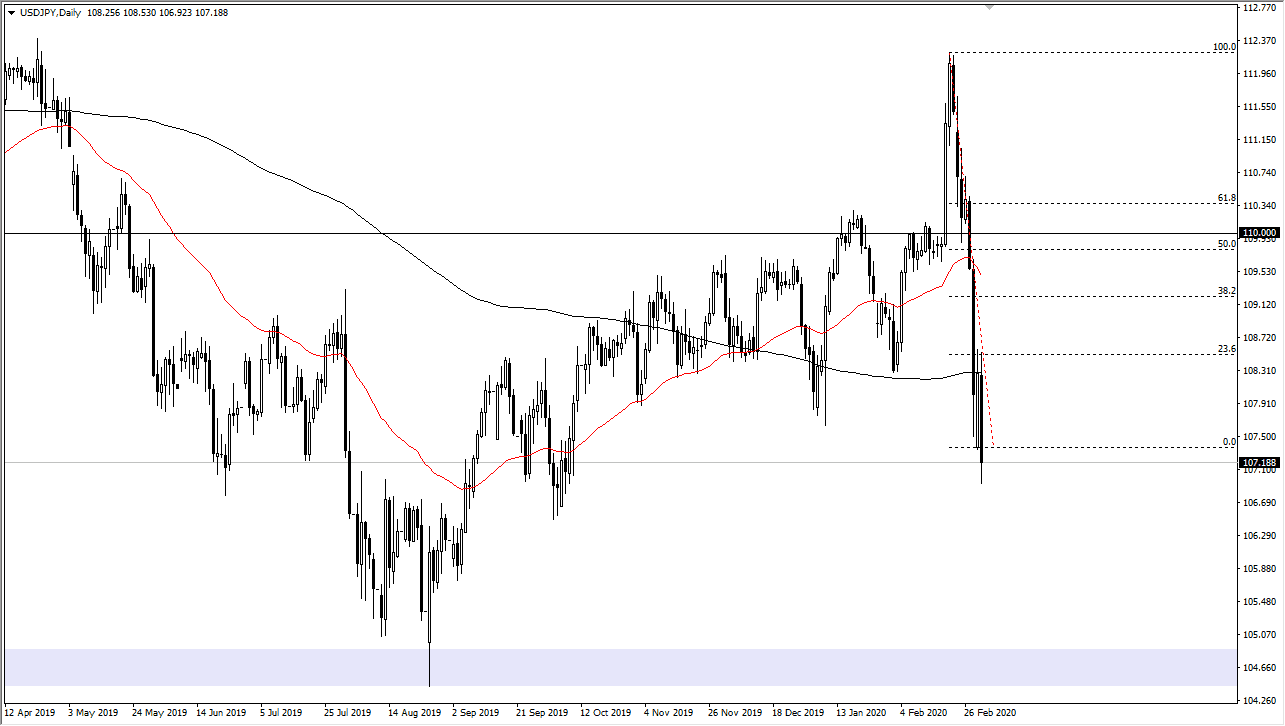

The market is testing the ¥107 level, and that of course is a very negative sign. At this point it’s likely that we will see the US dollar plunged even further, after the Federal Reserve has made it obvious that the US dollar has rate cuts coming down the road, it makes sense that we will continue to see this market rollover. Furthermore, as long as there is more of a “risk off” attitude around the world it makes sense that the Japanese yen would of course pick up a bit of momentum. If we can break below the ¥107 level, then it’s very likely that the acceleration will be notable. I have no interest in trying to buy this pair, because we have a wiped out what had been in an impressive rally during the previous session. The 200 day EMA has held as resistance and it now looks like we are ready to go much further.

Short-term rallies are to be sold, as the market has no business rallying for a longer-term move, and therefore I think we are going to go towards the bottom of the overall consolidation area, which reaches all the way down to the ¥105 level, as the market on a longer-term standpoint has vacillated between that level and the ¥115 level. The ¥110 level of course was fair value, but that seems like a distant memory at this point. I have no interest in buying anytime soon, we would need to see a major shift in attitude, which at this point seems to be very unlikely to happen for a longer-term move. I anticipate that perhaps we are just now starting to see how ugly things could get.