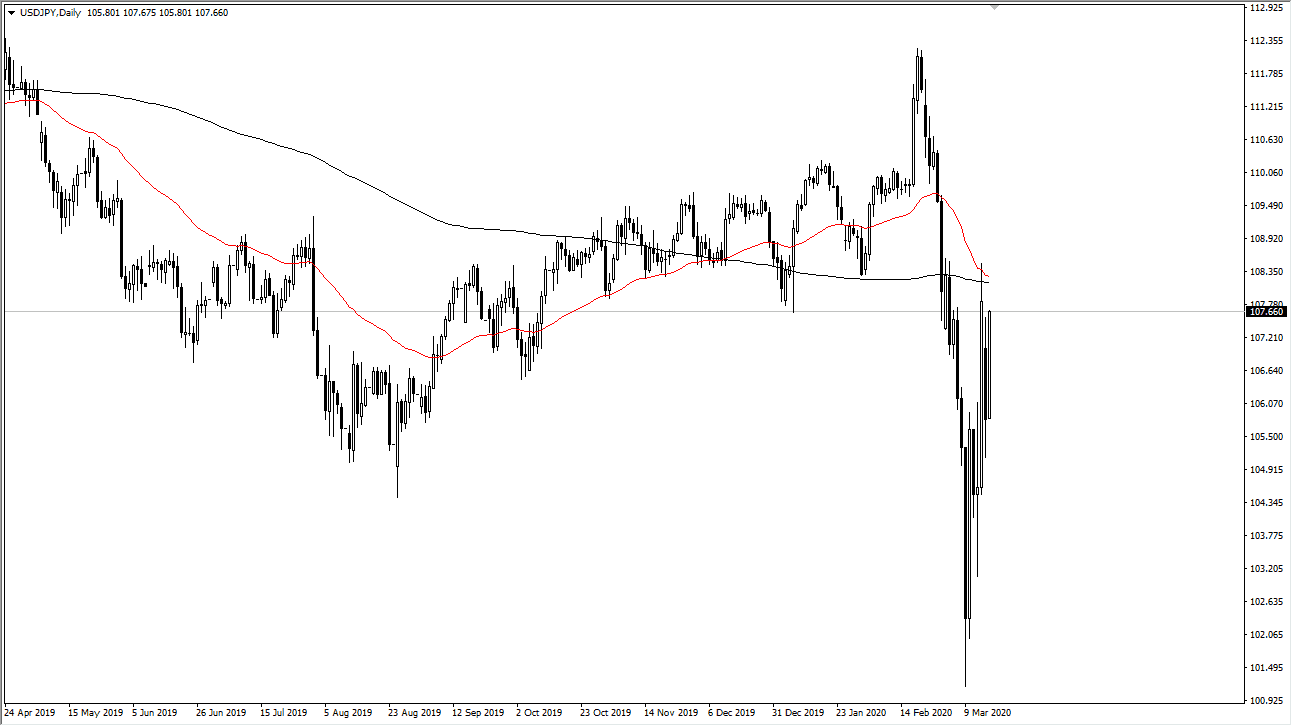

The US dollar rallied a bit during the trading session on Thursday, reaching towards the ¥108 level, an area that has been resistance previously. Furthermore, the 200 day EMA sits just above that level, and it will of course attract a lot of attention. We have seen the market pull back from here a couple of times, and now it’s obvious that the market is simply trying to figure out where to go next. Keep in mind that this pair is highly sensitive to risk appetite, and with the Federal Reserve and the US government looking to liquefy the markets, we may see a bit of more upward pressure given enough time. In the short term though, I think that it is a bit stretched just as it was a bit oversold previously.

Beyond all of that, the 50 day EMA sits just above the 200 day EMA as well, and that will attract attention in and of itself. The question now is whether or not the Japanese yen is going to be used as a safety currency in the short term? I don’t know if it will, but if we get some type of exogenous shocks out there, it is possible that traders will jump in and start buying the Japanese yen in the interest of safety. Regardless, I think this is going to be an extraordinarily volatile market and it is very difficult to hang onto positions for longer moves. I think that you are probably better off trading with small positions and aiming for big targets, and other words trading more of a longer-term attitude than anything else.

To the downside, I believe the 160 and level will probably be supportive, so don’t be surprised at all to see us bang around between these two areas. If we break above the highs of the Friday session, then the ¥110 level is your next target for resistance. Regardless, you need to be very cautious in this type of environment as the Japanese yen tends to be relatively wild anyway. The markets will continue to look at the stock market for hints as to where risk appetite might be. The S&P 500 had a really good day during the day on Tuesday, and this pair moved right along with it. Obviously, the exact opposite can happen as well. Looking at this chart, I think that the one thing you can probably count on is a bit more volatility.