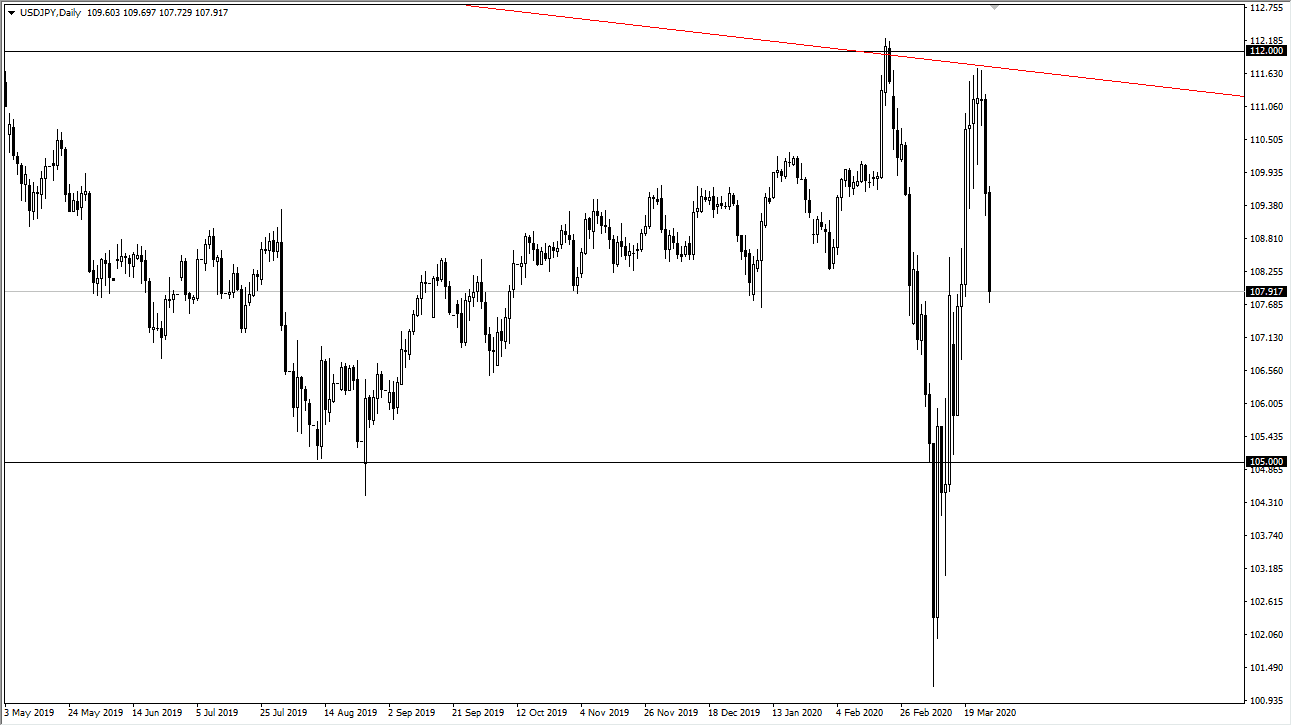

The US dollar has broken down rather significantly during the trading session on Friday, reaching down below the ¥108 level. This is an area that should show some type of support or resistance, but with the market closing on Friday, it’s hard to tell whether or not we were going to simply go lower or if the bell saved the pair so to speak.

That being said, the candlestick for the last couple of days both have been very negative, and it does look like we are ready to go lower. Ultimately, I like the idea of fading rallies at this point but having said that it’s likely that the ¥105 level underneath is support, with the ¥112 level above offering resistance. I think we will continue to slam back and forth as we continue to see a lot of noise out there due to the various coronavirus headlines. All things being equal, these candlesticks showed just how negative things have gotten as money rushes into the Japanese yen for safety.

Furthermore, we should pay attention to the downtrend line above that coincide with the ¥112 level so I think that could end up being the highs for the foreseeable future. The US dollar had been in short supply for a lot of debt out there, so it has skewed the normal behavior of this market. At this point, it certainly looks as if the normal correlations are going to come into play, with the Japanese yen being a safety currency that people will be looking towards. At this point, I believe that we are probably going to test lower levels, and at this point looking for short-term bounces to fade will probably be the best way to play this market going forward. I have no interest in buying it, at least not here. I might be interested closer to the ¥105 level, but I don’t see that opportunity quite yet. Given enough time it’s very likely that we see the market offer a certain amount of value that we can take advantage of, but we aren’t there yet. Furthermore, you need to pay attention to the overall risk appetite of the markets, and other words you need to pay attention to stock markets. If they rally, then there’s a good chance that this pair will as well. However, if they fall apart it’s likely that we see selling here.