The US dollar has gone back and forth during the trading session on Thursday, as the market simply do not know what to do. The market has been going back and forth during the trading session as traders are trying to figure out what happens next. Clearly, the Federal Reserve is more than likely going to cut interest rates between now and the next meeting, or at the very least during the next meeting which is next week. 50 basis points is already priced in, and at this point I think it’s very likely that the Federal Reserve “goes big” rather soon. The markets have been an absolute mess and it’s difficult to imagine a scenario where things get easier from here, especially considering that we will be heading into a long weekend that is certainly going to have plenty of headlines to throw things around.

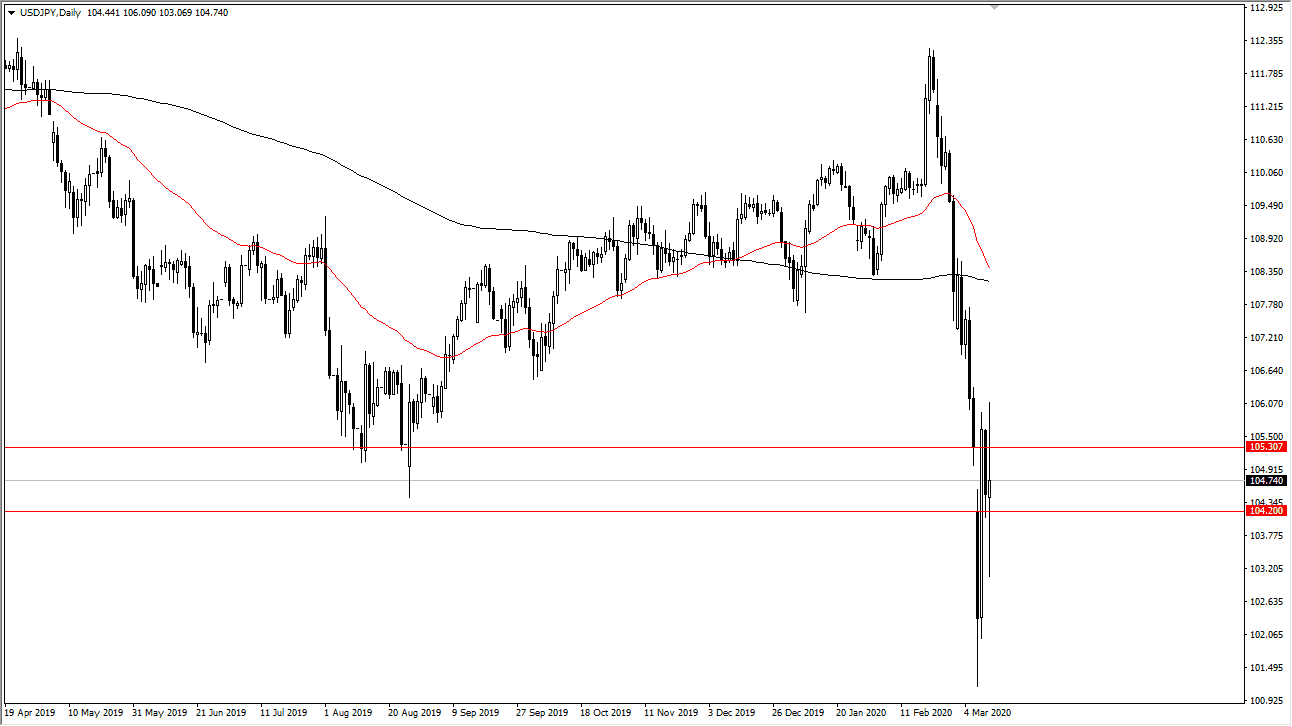

Looking at this chart, I think the extraordinarily volatile session for Thursday could give us a hint as to where we go next though, using the low and the high as an opportunity to trade the candle as a “binary situation.” In other words, if the market breaks above the top of the range for the session, it should be very bullish, and it could send this market towards the ¥107.50 level. On the other hand, if the market were to break down below the bottom of the candlestick, then it’s likely we go looking towards the lows again. Keep in mind that the Japanese yen is considered to be a major “safety currency”, even more so than the US dollar. Clearly at this point there is going to be a lot of confusion and drama, so keep your position size small but I think that we are getting close to the end of the overall panic. I anticipate that sometime over the weekend the Federal Reserve will announce something that should help stabilize the markets, as that seems to be their modus operandi over the last several years. At this point, I think that the market continues to see choppiness so therefore you will probably have to wait for some type of obvious signal. If we can get a bullish break out to the upside this could be the beginning of the end. If not, that means we carry more pain into next week.