The US dollar has gotten hit rather hard against the Chinese Yuan, and just about any other currency you can think about their as the Federal Reserve has cut interest rates by 50 basis points in a surprise move at the very open of the month. That being the case, the next thing that traders will be paying attention to is the Fed Funds rate futures, which are banking on another 50 basis points in rate cuts going forward. Because of this, and the fact that markets are forward-looking, it’s very likely that the US dollar will find itself on the back foot.

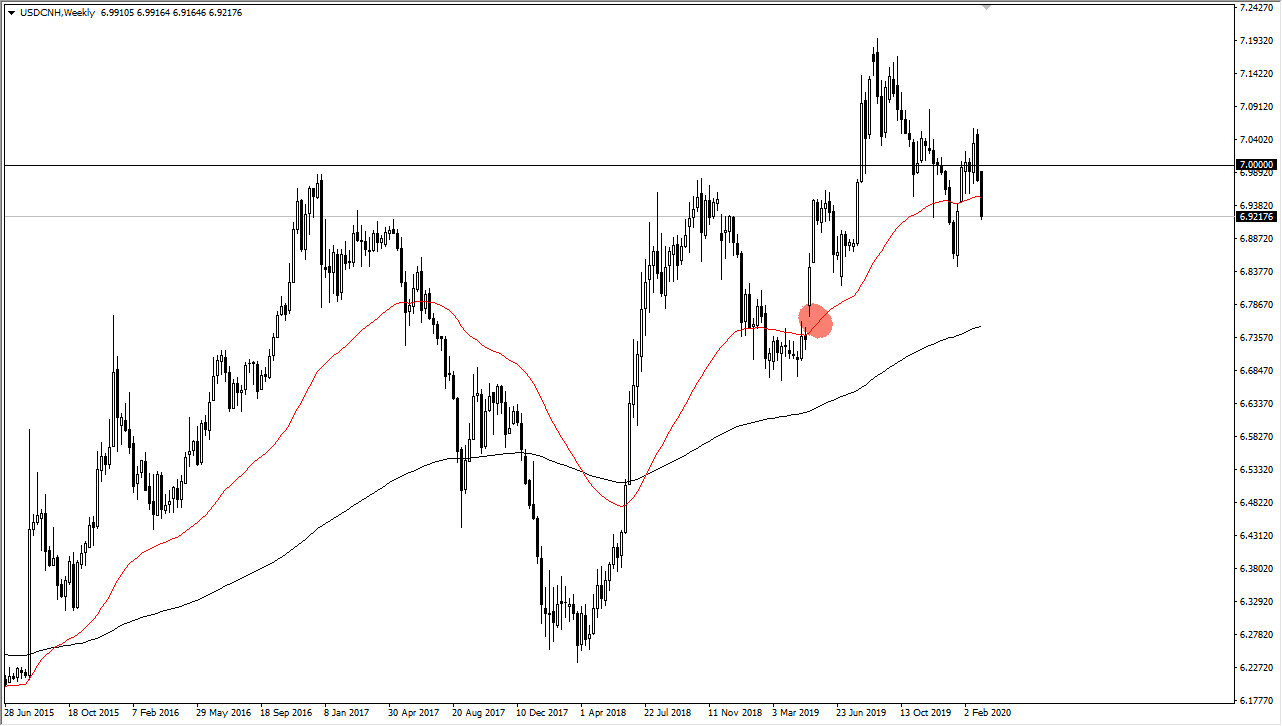

This pair is particularly useful for traders to pay attention to, even if they do not trade the pair itself. This is because it’s a great proxy for risk appetite, and it also shows you how the market feels about the idea of the Chinese recovery. We are starting to see more cases of coronavirus outside of China than inside, and that is a sign that perhaps the worst is done on the mainland. I believe this currency pair will tell that story, and the fact that the market has slice through the 50 week EMA suggests that now the gap has been filled and broken through of the most recent surge, we are now going to go looking towards the gap underneath near the 6.75 Yuan level.

That being said, even if you don’t trade this you can look at this as a proxy for where other currencies may go. For example, if the US dollar loses strength against the Chinese Yuan, then it typically means that the Australian dollar will rally right along with it. I anticipate that the 6.85 level could cause some headaches on the way down, but any rally at this point will probably be sold into. I believe that the 7.00 level is one to pay attention to and should cause resistance. If we find this market breaking back above that level rapidly, I believe it would be a sign of extreme stress in the markets, and you would probably see that coincide with a massive selloff in the stock markets.

Again, I cannot stress how important watching this currency pair can be when it comes to trading all other assets. Unfortunately, most retail traders completely ignore this currency pair at their own peril. I do believe that we may have attempted to make a longer-term top, but we still have some work to do.