Following the initial liquidity rush across the global financial system, which sparked the US Dollar to multi-year highs, fundamentals are slowly resurfacing. The US Federal Reserve flooded the system with capital, slashed interest rates to zero, and pledged an open-ended asset purchase program in a move to pseudo nationalize US financial markets. All factors are materially US Dollar negative and will persist for an extended period. After the USD/CAD completed a breakdown below its resistance zone, a more massive sell-off is favored to materialize.

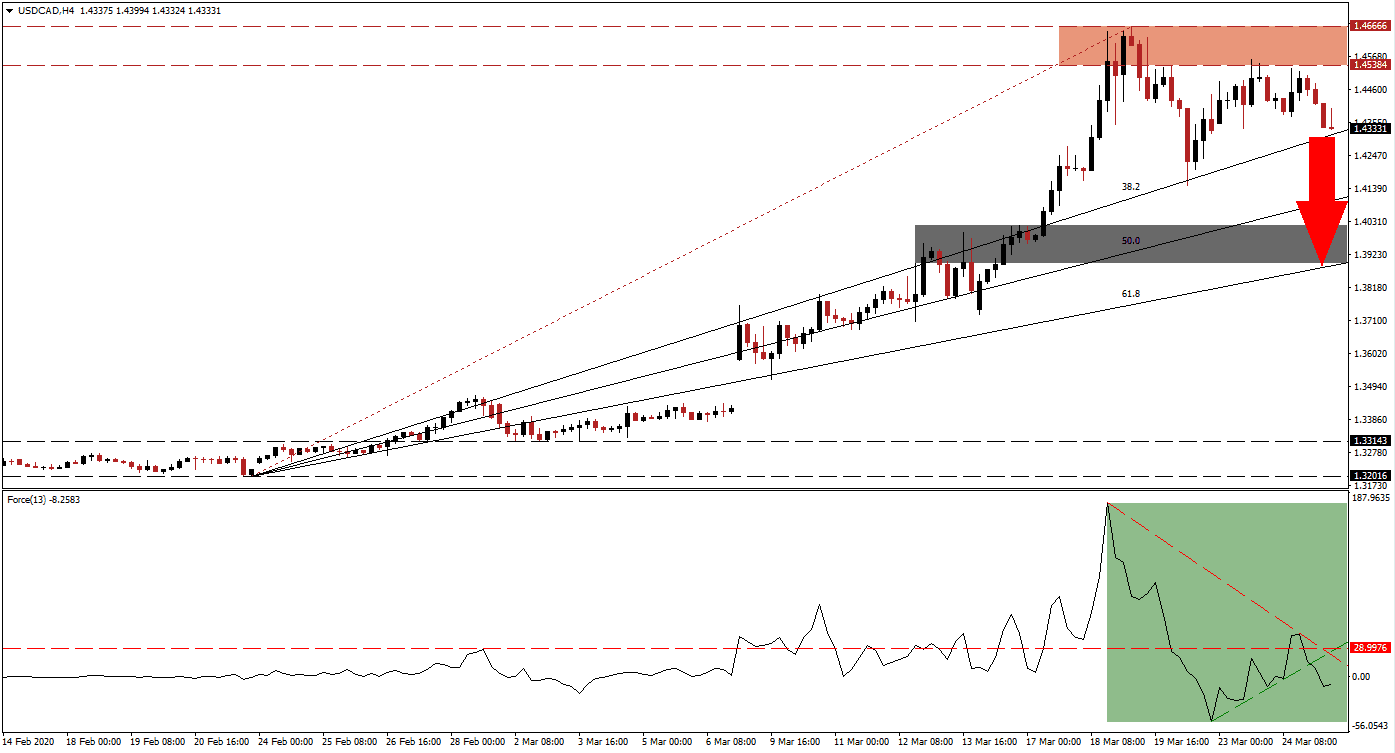

The Force Index, a next-generation technical indicator, confirms the spike in bearish pressures after the horizontal support level was converted into resistance. Aided by its descending resistance level, the Force Index collapsed below its ascending support level, as marked by the green rectangle. Bears have taken control of the USD/CAD once this technical indicator contracted into negative territory.

Price action is currently trapped below its resistance zone located between 1.45384 and 1.46666, as identified by the red rectangle, and above its ascending 38.2 Fibonacci Retracement Fan Support Level. The initial breakdown in this currency pair was reversed after reaching its 38.2 Fibonacci Retracement Fan Support Level. Conditions are ripe for a new breakdown sequence in the USD/CAD, due to the loss in bullish momentum. With market euphoria over economic stimuli and corporate bailouts anticipated to fade, attention to the costs and incurred debt will emerge as a driving force across the Forex market.

One critical level to monitor is the intra-day low of 1.41487, the base of the lead-breakdown in this currency pair. A sustained pushed below it will initiate the next wave of net sell orders, providing downside volume for a renewed breakdown. The USD/CAD is on track to reverse into its short-term support zone located between 1.38964 and 1.40181, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level. You can learn more about a breakdown here.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.43350

Take Profit @ 1.39000

Stop Loss @ 1.44600

Downside Potential: 435 pips

Upside Risk: 125 pips

Risk/Reward Ratio: 3.48

Should the Force Index recover above its descending resistance level, the USD/CAD is likely to advance into its resistance zone. While the Canadian economy is facing issues on multiple fronts, even before Covid-19, the magnitude of oversupply in the US Dollar remains a dominant bearish fundamental facto for this currency pair. Forex traders are advised to consider any price spike as a selling opportunity, as a sustained breakout is unlikely.

USD/CAD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.45350

Take Profit @ 1.46500

Stop Loss @ 1.44800

Upside Potential: 115 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 2.09