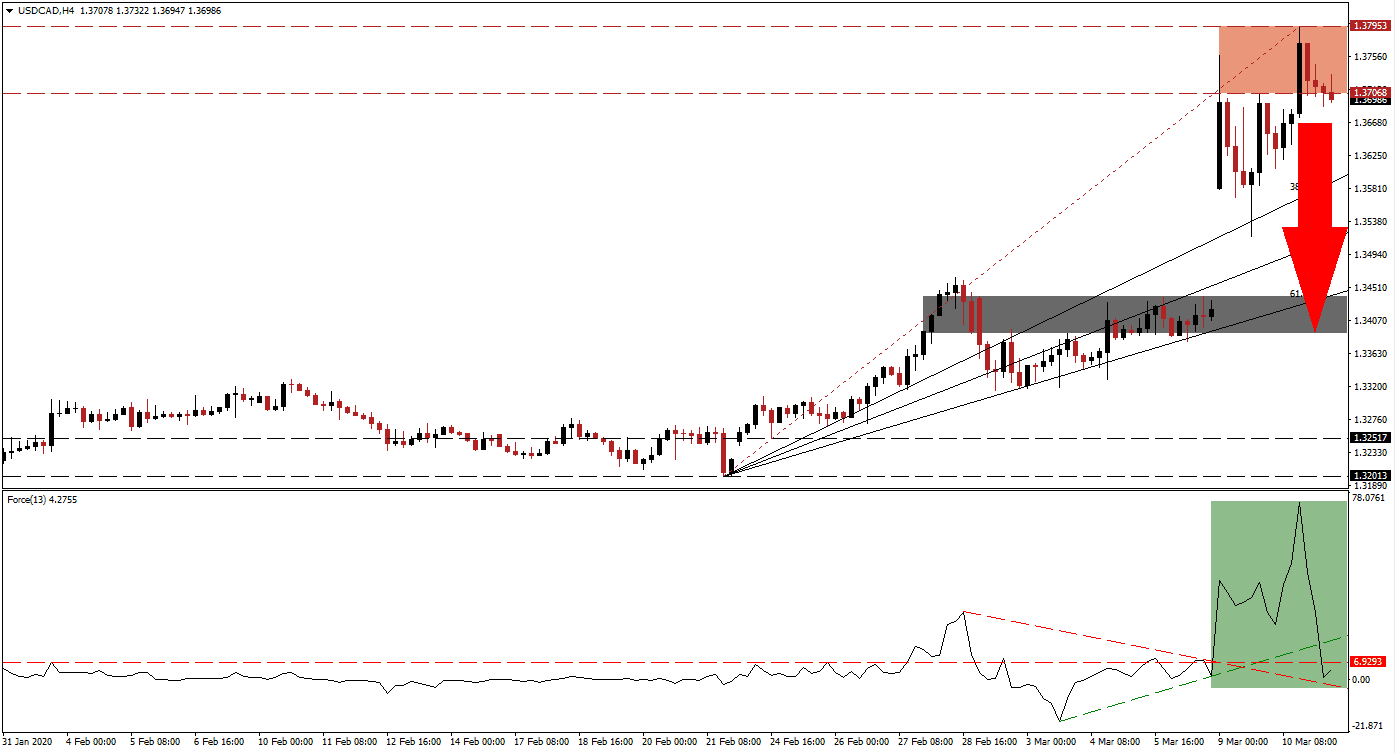

Canada’s exposure to the oil market has increased recession risks following the most massive oil price contraction since 1991. It forced the most violent sell-off in Canadian equities since 1987. The economy was already under pressure from ongoing railroad strikes before Covid-19 added disruptions. A 50 basis point interest rate cut by the Bank of Canada, mirroring the US Federal Reserve, increased panic across the economy. The resistance zone rejected the advance after the USD/CAD opened with a price gap to the upside.

The Force Index, a next-generation technical indicator, initially spiked to a new 2020 high before collapsing. It has now converted its horizontal support level into resistance, as marked by the green rectangle. The Force Index pushed below its ascending support level, which now acts as resistance. While the descending resistance level, currently providing temporary support, paused the contraction, this technical indicator is favored to resume its move to the downside. Bears are on the verge of taking control of the USD/CAD with a crossover below the 0 center-line. You can learn more about the Force Index here.

A profit-taking sell-off is now pending after price action pushed below its resistance zone located between 1.37068 and 1.37953, as marked by the red rectangle. It will close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Adding significant downside pressures to the USD/CAD is the anticipated 75 basis point interest rate cut by the US central bank this month. Oil prices will be boosted following further monetary easing by the US Federal Reserve. Expectations for abnormal oil production cuts out of the US added stability to the faltering price.

Price action will receive an additional downside catalyst once the USD/CAD completed a breakdown below the intra-day low of 1.35807, the top range of the price gap to the upside. It is anticipated to result in the addition of new net sell orders, closing the price gap. An extension of sell-off into its next short-term support zone is expected to follow. This zone is located between 1.33897 and 1.34382, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level crossed above this zone, but a breakdown cannot be ruled out. You can learn more about a support zone here.

USD/CAD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.37000

Take Profit @ 1.34000

Stop Loss @ 1.37750

Downside Potential: 300 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 4.00

In case of a move in the Force Index back above its ascending support level, the USD/CAD may attempt a breakout. Given developing fundamental conditions, the upside remains limited to its next resistance zone located between 1.39474 and 1.40159, dating back to January 2016. Forex traders are recommended to consider this an outstanding selling opportunity.

USD/CAD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.38250

Take Profit @ 1.40000

Stop Loss @ 1.37500

Upside Potential: 175 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 2.33