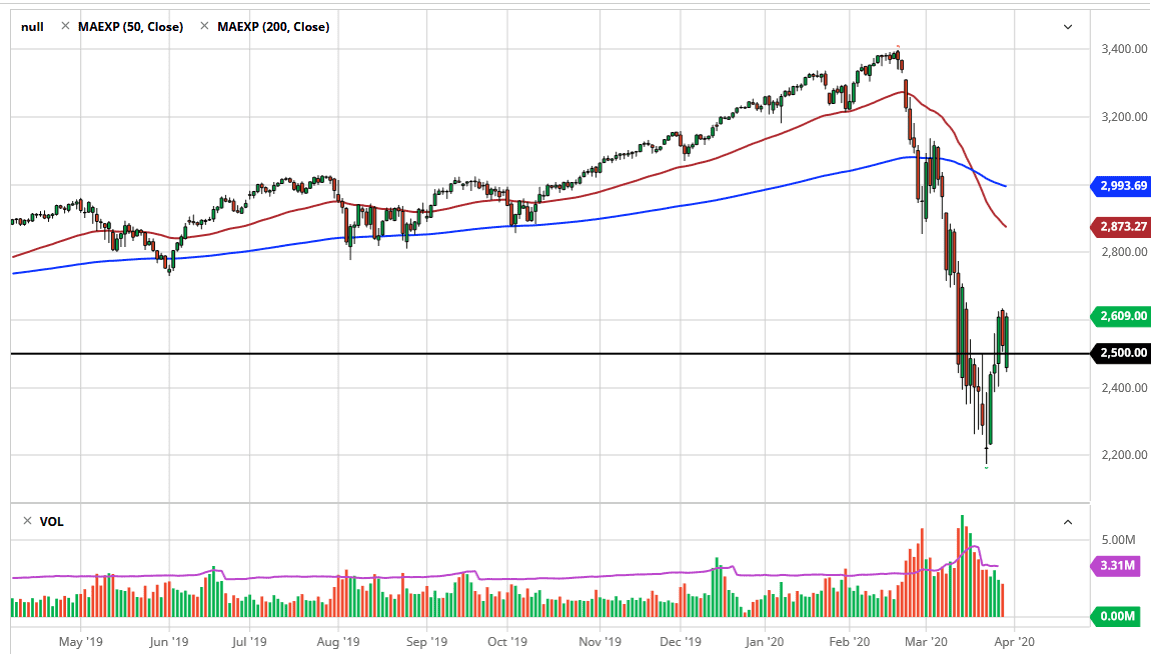

The S&P 500 initially gapped lower on Monday but then shot straight up in the air to show signs of strength. By clearing the 2600 level and closing at the top of the range, this is a very bullish sign. I think at this point if we can clear the Friday highs, which we aren’t too far from right now, this pair could very easily go looking towards the 2750 level. After that you would have the psychologically important 2800 level.

The 50 day EMA is currently at 2873, and therefore could come into play relatively soon, and I do think that’s an area that will probably attract a lot of selling pressure. The downside features the 2400 level, and if we were to break down below there, I think that opens up a move down to the 2200 level. I like the idea of fading rallies going forward, but there are arguments to be made for short-term buying opportunities on a break above Friday’s high. That would be a quick “smash and grab” type of trade, not something I would be looking to hang onto forever.

One thing is for sure, the candlestick for the trading session on Monday was very strong, and that is something that should be paid attention to. Alternately, if we were to rollover in this area, I think that could be some type of quick selloff just waiting to happen due to the fact that there are so many things out there to destroy investor confidence right now. The size of the candlestick is impressive, and that something that you can’t ignore. I think short-term we have a bullish move just waiting to happen but longer-term we still will probably fall in retest the lows again as Wall Street typically does in the scenarios.

Although it’s been an impressive rally over the last week or so, the reality is that it is nowhere near recovering what was lost. I think that will probably continue to be the case, and therefore one would still have to have a certain amount of bearishness to their longer-term outlook, at least for the time being. There is massive stimulus out there and that does typically help equities eventually, but again I think it’s far too early in the game to think that a recovery is underway. One thing is for sure, your position sizing should be lower than usual.