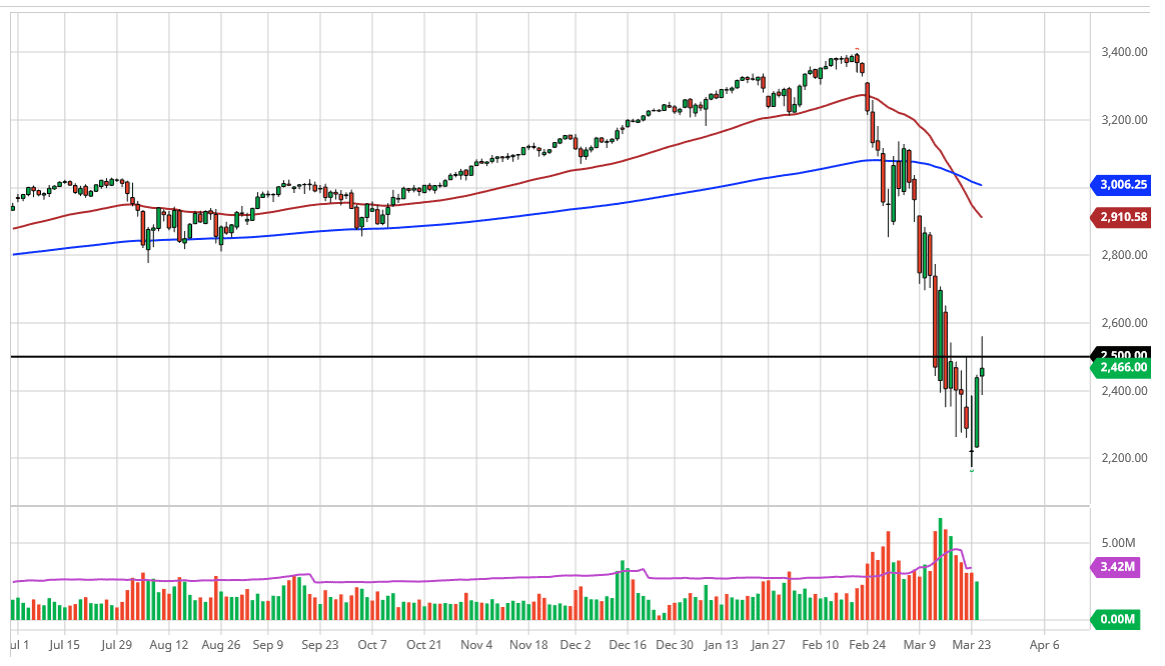

The S&P 500 went back and forth during the trading session on Thursday, initially shooting straight up in the air after a short-term pullback, but you can see we gave up quite a bit of the gains, to show just how the 2500 level is going to offer massive resistance. The shooting star is a very negative sign, and I do think that we are probably going to have a little bit of a pullback sooner rather than later.

A pullback could open up the door down to the lows again, something that the market will need to test if it’s going to build a solid “base” for a turnaround and a positive trend. That being said, this means that the next couple of days could be negative. After the massive rally that we have seen, that would make quite a bit of sense as a lot of times you will get these this is bear market rallies before the markets finally stable down completely and then find a reason to go higher over the longer term.

The United States Congress is getting ready to unleash a massive stimulus package on the US economy, and then typically does help stock markets over time, but this is a little bit different than the financial crisis that was just over a decade ago, because this is more or less a stopgap measure for the economy itself. Eventually, it will work its way through the economy and consumption will pick up, but we need to get through the buyers scenario first. The real take away is that given enough time we will see the infection rate of the coronavirus in the United States start to stabilize and then drop, and when that does it’s very likely that stocks will then enter a bullish phase again.

That being said, I believe that at this point if the market does break above the top of the shooting star from the trading session on Wednesday, that would be an extraordinarily bullish sign, perhaps sending this market towards the 2750 level, an area that has been important more than once. At this point, that is an area that buyers will probably jump in, or at the very least there will be a lot of short covering. That in and of itself could send this market much higher. I think though, it’s much more of a likelihood that we will see a pullback before some type of stabilization underneath.