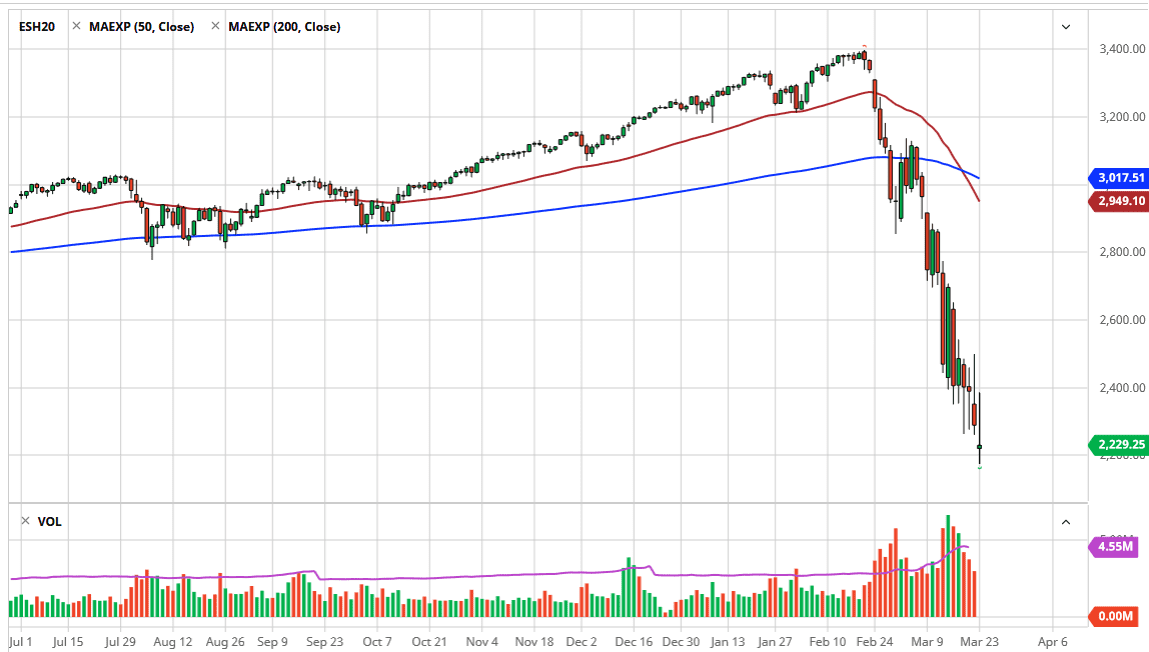

The S&P 500 gapped lower during the trading session to kick off the week on Monday, and then went limit down at one point. However, the market open backup and then shot to the upside as the Federal Reserve suggested that it was going to come out and start buying commercial bonds. This of course help stabilize one of the most concerning parts of the financial markets are now, but we have seen the market rolled right back over and end up forming a bit of an “inverted hammer.” That of course is a very negative sign, but it’s also very positive if we can break above the top of it, so keep that in mind.

The bullish scenario would be breaking above the 2500 level. If that happens, then it’s likely that the market goes looking towards the 2700 level. Alternately, if we break down below the lows of the trading session on Monday, that means that we get more of an unwinding we will almost certainly break down towards the 2000 handle.

If you watch the market during announcements, you can quite often get a feel for what people were thinking. The initial reaction to the S&P 500 hearing the Federal Reserve is going to step in and buy corporate bonds was very positive. The market shot straight up in the air but those gains were only held onto for a short amount of time. This tells you that there is a serious confidence problem right now. It’s almost as if there was a collective response with the question “What does the Federal Reserve know that we don’t?” This was very common during the 2008-2009 trading range, as the market kept being offered headlines that were central bankers trying to support the markets, but markets were skeptical in the sense that they wondered whether or not they would either be effective or if the situation was so bad that there were things out there that nobody knew. If that is the case, then it’s almost impossible to price risk, which is something that you see in the bond markets. Remember, when your trading these type of indices, there is a certain amount of analysis that goes into the bond market to figure out what the “risk-free rate of return” is. All things being equal, it looks as if we are going to continue to see negative pressure, but we will eventually get that sudden “rip your face off rally” that all bear market seem to produce.