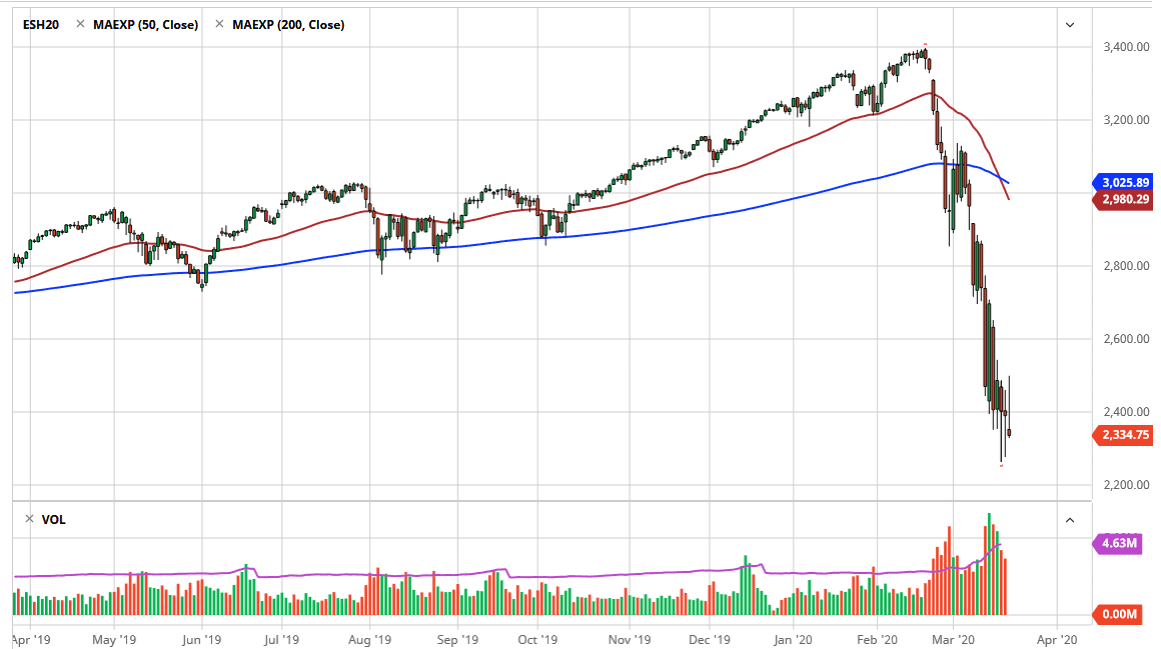

The S&P 500 has had a rough trading session on Friday but that shouldn’t be a huge surprise considering that the session was also the “quadruple witching Friday”, meaning that for separate major options markets all had expiration. This always causes a very volatile and choppy trading session, so I think at this point you can probably throw out the Friday candlestick. That being said, there have been a couple of attempts at breaking down below, but the 2350 level continues to attract a lot of attention, just as the 2300 level does. The question now is whether or not we can pick up the market from this place. If we do not, then it opens up the possibility of a move down to the 2100 level.

At that level should see plenty of support down to the 2000 handle, which is a large, round, psychologically significant figure. At this point, there should be a bit of value hunting as well. Keep in mind that expiration days tend to be very noisy and when you have four different markets it makes quite a bit of sense that you would see the markets all over the place. There will be a lot of noise, but again I think that the open on Monday is going to be crucial.

Looking at this chart, if we can take out the top of the candlestick from the Friday session that would be a very bullish sign. Ultimately, I believe that Monday will be a major candlestick to tell us which direction we go longer term, but obviously this is all about the coronavirus and whether or not there will be some type of treatment or at least a slowing down of the economic devastation.

At this point, we have priced in a significant amount of negativity, so at the first signs of true hope we could rip to the upside. Ultimately, the market will produce a major signal when it stops reacting to bad news, showing that we are starting to see signs of stability. With that being the case, I do like the idea of buying eventually but right now we need to see more “boring days” because that will be the best thing for this market. Stability is what we need right now more than anything else. The volatility in the VIX dropping would be a huge help also.