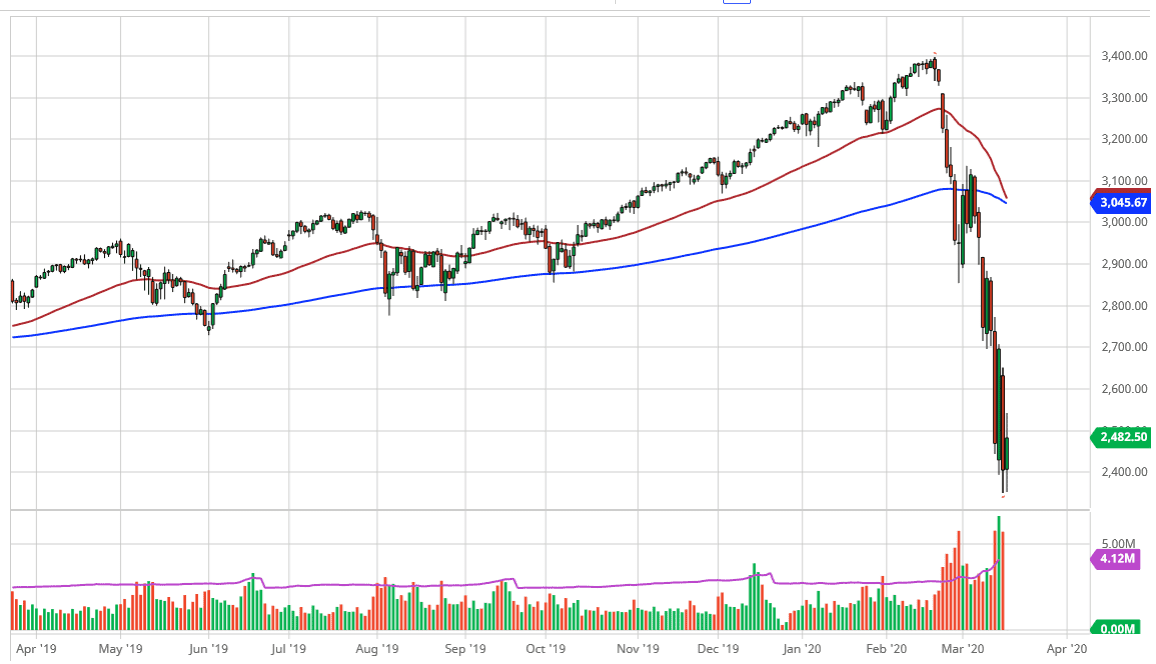

The S&P 500 fell a bit during the trading session initially on Tuesday during Globex trading, but at the end of the day we found buyers below at 2400. We turned around to rally above the 2500 level, but then gave back quite a bit of the gains. This was an extraordinarily volatile market, as stock markets continue to see a lot of confusion and fear. With that being the case, it’s likely that market participants will continue to see a lot of whips all type of trading, but it’s very likely that we are at least getting close to some type of stabilizing force.

Looking at this candlestick for the trading session, it shows a little less than convincing bullish pressure, but the fact that we are starting to slow down our descent is a good sign. With this, we could see longer-term traders start to dip their toe in the water. That being the case though, it’s very likely that the action will be very difficult handle, so small position size is are necessary until the market proves itself. I don’t think that they are ready to do so, therefore it’s going to be something that most short-term traders will simply ignore.

That being said though, if we can break above the 2700 level, I think that the market will turn around for a bigger move to the upside. We need to see several days of stability for shorter-term traders to be a bit more comfortable. I think a lot of shorter-term traders will be fading short-term rallies, but eventually this thing will turn around and explode to the upside. After all, there are a lot of “rip your face off relief rallies” during these bear markets like this.

If we break down below the bottom of the last couple of days, it’s very likely that the S&P 500 goes down to the 2100 level. That is an area that should offer support down to the 2000 handle, which obviously will attract a lot of attention in and of itself. One thing is for sure, this isn’t exactly the most inspiring candlestick, but the fact that the descent is starting to slow down is a good sign. I like the idea of waiting for some type of weekly candlestick in order to go long, but I do recognize that the short-term traders may continue to go back and forth, with a little bit more emphasis on the downside on the short-term charts.