This is going to be one of the more difficult weekends for traders, as we will all be waiting around to see what type of headlines crossed the wires over the weekend. Central banks around the world are likely to say or do something, and there could even be some type of coordinated action. The question of course is whether or not that’s actually going to help anything, because quite frankly the loosening of monetary policy could of course lift markets but at the end of the day thank you to do anything about a global slowdown when it comes to the coronavirus shutting down production.

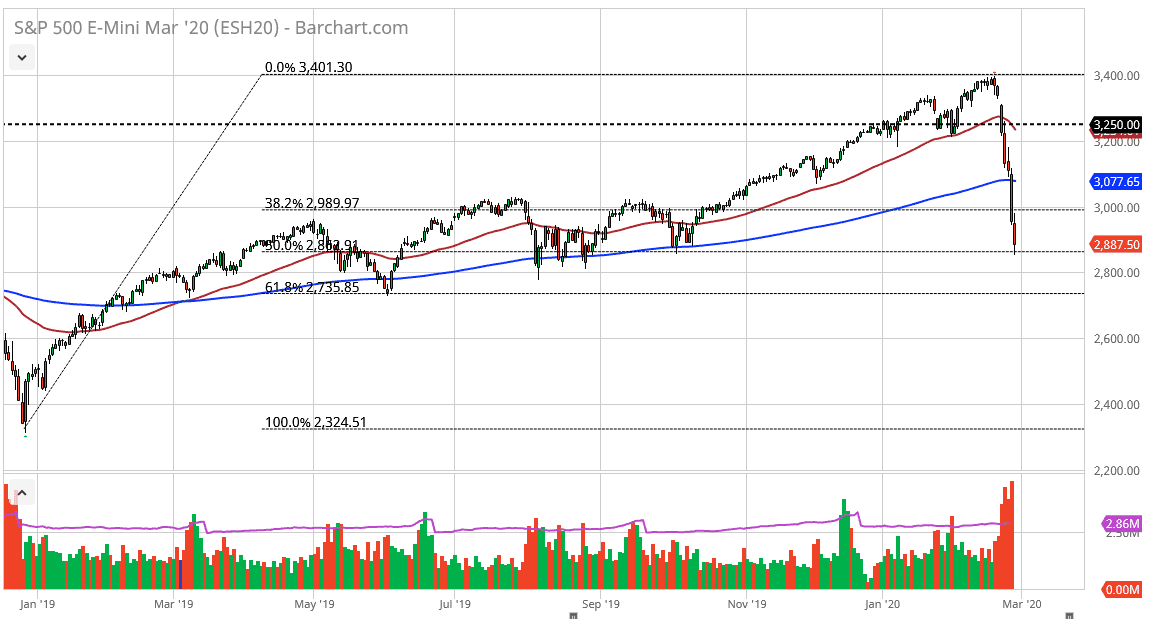

The 2900 level seems to have offered support, and we are a little bit oversold at this point so a bounce would make quite a bit of sense regardless. The 200 day EMA above is at the 3078 handle, and it’s likely that we would see a lot of resistance in that general vicinity. I believe in waiting for a bounce that I can sell into, because quite frankly shorting at this level is very difficult to do. I think at this point what you are more than likely going to see is an attempt to recover, but then we could see exhaustion yet again.

At this point in time, it’s likely that the market will continue to be very noisy, and at this point I do believe that what we are going to see as the market going back and forth over the next headline, and of course speculation. Watch coronavirus cases over the weekend, because if they continue to climb there’s no reason to think that any rally will last for a significant amount of time. At this point, I think it’s probably going to be a situation where looking for opportunities to sell is probably the best way. However, if we break down below the 2800 level, it’s likely that we go much lower, perhaps down to the 2600 level, and then the 2500 level. I have no interest in buying, unless of course something drastically changes but I don’t even think that central bank action is going to change things for the longer term because quite frankly the market getting more liquidity isn’t going to change whether or not economies rise or fall, so quite frankly I would be all over shorting that type of bounce until we get a huge close above the 200 day EMA.