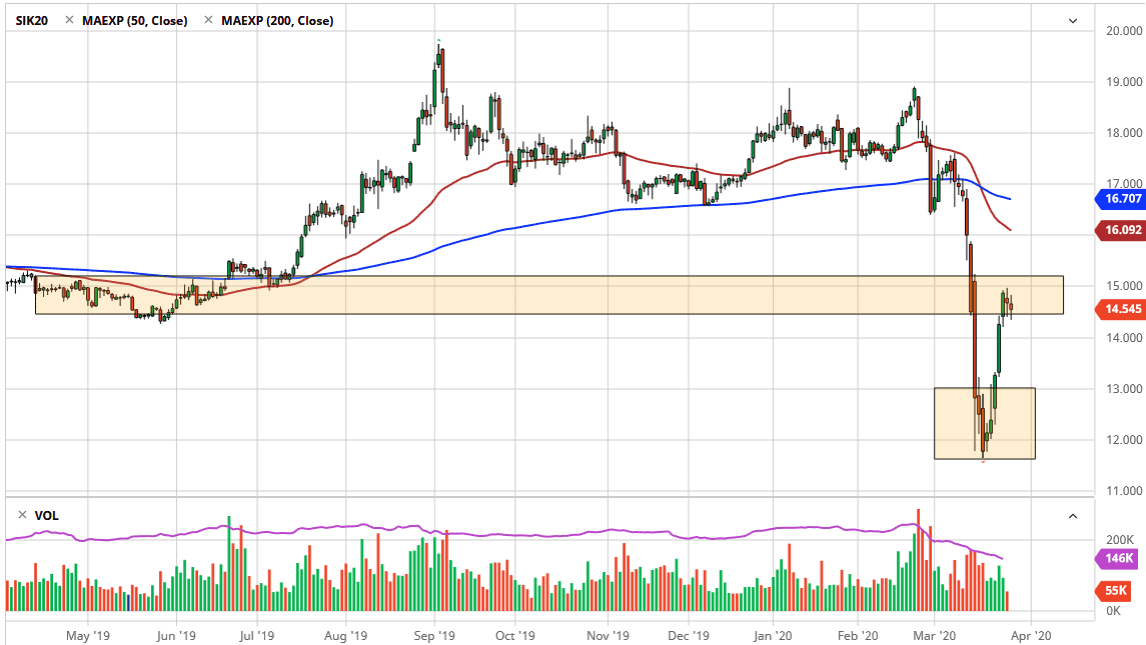

Silver markets went back and forth during the trading session on Friday, as we see the $15 level offer resistance. Quite frankly, that’s not a huge surprise considering that it is a large, round, psychologically significant figure, and it’s an area where we have seen previous support. That previous support should be an opportunity for sellers to come in and take advantage of the market, and that’s what I expect to see next. This area is roughly a 50% retracement of the massive selloff that we just had, so it would make quite a bit of sense that we fall from here.

This isn’t to say that I am extraordinarily bearish on silver, I am not. However, there is an industrial component to this metal, and that of course is going to work against the value of silver, because there simply isn’t much in the way of industrial demand right now. However, there is also the precious metals factor, and that of course is bullish. The US dollar will have its influence as well, rising and falling, causing the direct opposite in this market overall.

To the downside I believe that the $13.00 level should be rather supportive, as it was the scene of the most recent break out. However, I think that pullbacks at this point will be looked at as potential buying opportunities, and therefore we could very well end up forming a “lower high” near that area. Because of this, we essentially have a “two speed trade” setting up here. Short-term, this market looks like it’s probably going to rollover, while longer-term I still believe that there are plenty of buyers underneath willing to take advantage of cheap silver.

The alternate scenario of course is that we don’t pullback at all. If we get a daily close above $15.20, at that point I think the market probably goes looking towards the $16.00 level and then eventually the 50 day EMA, followed by the $16.50 level. With that being the case, one would have to become very bullish when it comes to the market, but at this point I think we are more than likely going to see that pullback in order to get constructive longer term. Short-term, I am a seller more than a buyer, but longer-term I am much more interested in holding onto silver for a multi-year trade as central banks around the world continue to flood markets with liquidity.