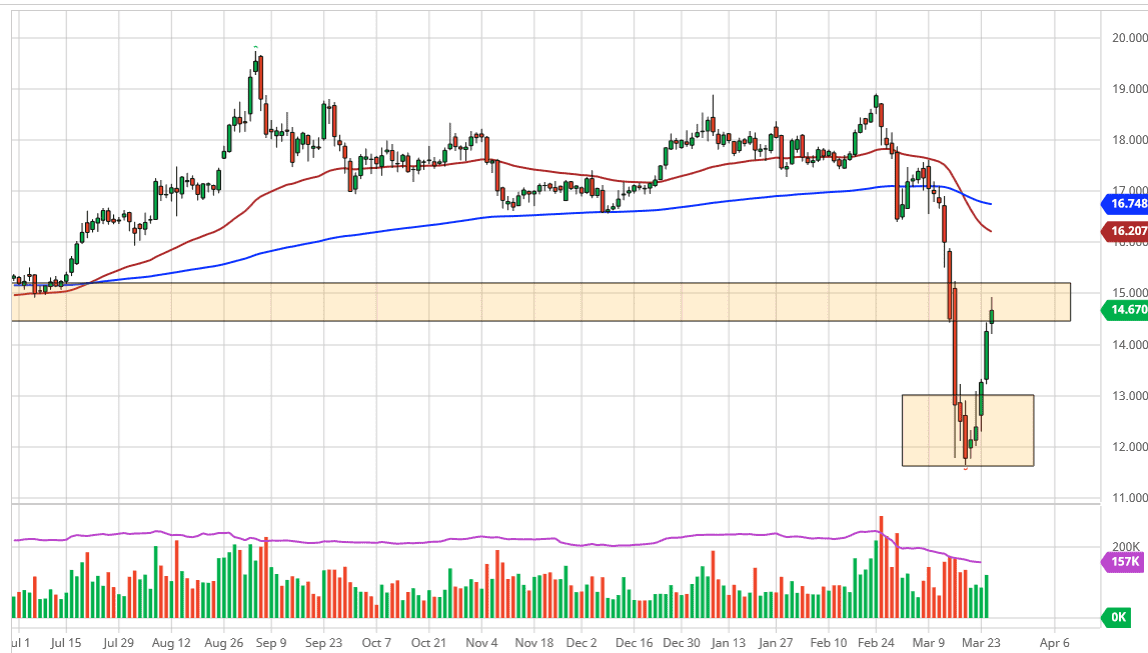

Silver markets did have a bullish trading session during the Wednesday hours, but as you can see the $15.00 level has offered quite a bit of resistance and therefore, we do pull back from that region. Ultimately, this is an area that will determine a lot going forward, because a break above the $15.00 level would be a move towards the $16.00 level just waiting to happen. Keep in mind that although silver is rallying right along with gold, the reality is that the market is also highly sensitive to the industrial demand. It is going to be interesting to see how this plays out, because the stimulus could, at least in theory, drive up the use of silver, but the coronavirus slowdown will continue to keep a lot of resistance on this market.

Looking at this chart, it has been a nice rally, but you can also see that we are only approaching about half of the most recent break down. That means that we will more than likely see sellers jumping in sooner rather than later. This will be especially true if there is a drive into the US dollar overall. At this point, it’s obvious that we have had a nice bounce but quite frankly it’s going to be a while before silver demand picks up markedly. Furthermore, it’s quite common for a bottom to be confirmed by the market reaching back down to retest that area. That’s an area that if it holds, especially just above the $12.00 level, then it’s likely that the longer-term trend will continue. However, if the market were to continue and break above the 50 day EMA it looks as if we will get that retest of the bottom.

I don’t necessarily think that silver is something you should be shorting for a longer-term move, but I do think that it is going to fall further in the short term. The $13.00 level would be a very interesting area to start finding buyers again if you are looking to get long based upon some type of a pullback. Because of this, look for value, or short on the way down, depending on your timeframe. All things being equal, I expect very volatile trading, mainly due to the unclear economic outlook. Ultimately, you will need to be very cautious about your position size, because quite frankly the headlines continue to throw markets around overall.