Silver markets fell slightly during the trading session on Thursday as we continue to see a lot of volatility, and of course confusion to say the least. After all, silver serves two different purposes, the initial of course be in a precious metal. However, the other factor that comes into play when it comes to the silver markets, and that of course is industrial demand. Industrial demand is going to be greatly influenced by whatever happens next, and at this point one would have to think that industrial demand will shrink in a scenario where the coronavirus is shutting down mass parts of populations. Furthermore, there is the fact that a lot of people will be avoiding crowds, so therefore it has a lot of an effect on the idea of global growth in general.

In this case, it’s very likely that the silver markets will be a bit of a laggard when it comes to precious metals, because if people are concerned about the global growth, it makes sense that gold might be a bit more of a safety metal with and silver, and quite frankly a lot of people are doing this as a “peers trade”, meaning that their shorting silver while buying gold. Either way, silver does look like it’s on its back foot in this general vicinity. All is not lost though as I see technical confluence just below.

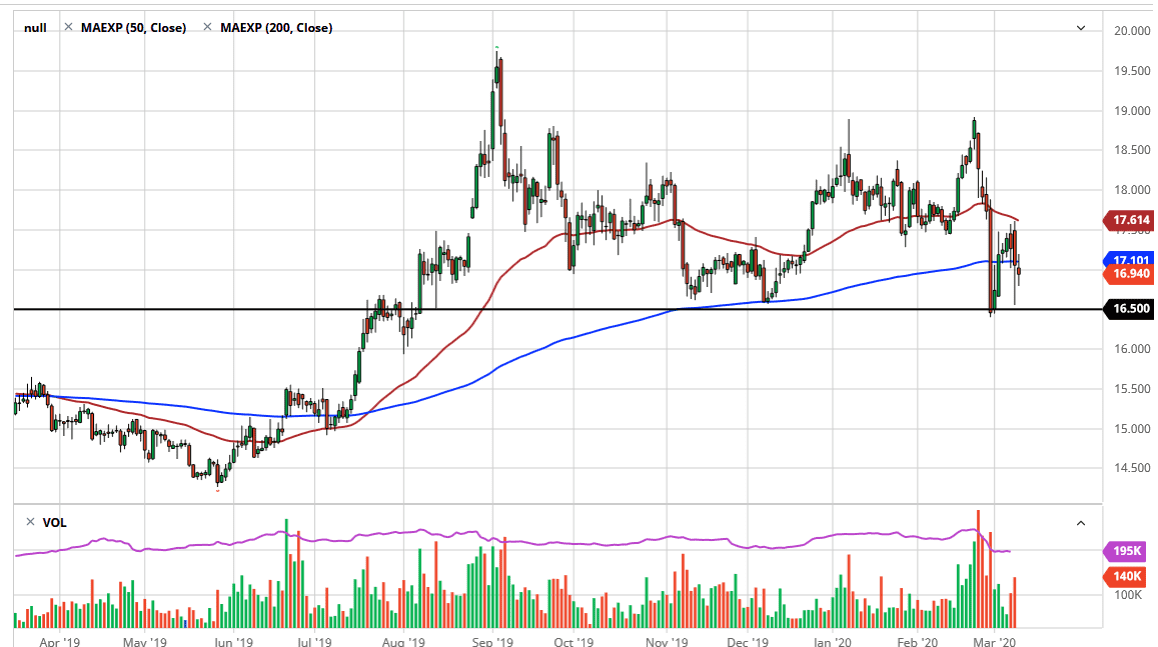

The $16.50 level should offer plenty of support, an area that has been important more than once. Because of this, the market is likely to respect this level, but if we were to break down below the $16.50 level it could open up the door down to the $16.00 level. On shorter-term charts, $16.50 has caused quite a rally, just as the $17.50 level has been significantly resistive. The $17.00 level is the scene of the 200 day EMA and therefore it looks as if it is also “fair value” for the market in general. With that being the case, you can also employ some type of “reversion to the mean” when it comes to trading this market based upon that fact in and of itself. If the market were to break above the $17.50 level, then it would be free to go much higher but, in the meantime, it’s going to be difficult to put too much money into this market as it will certainly go back and forth rather violently at times.