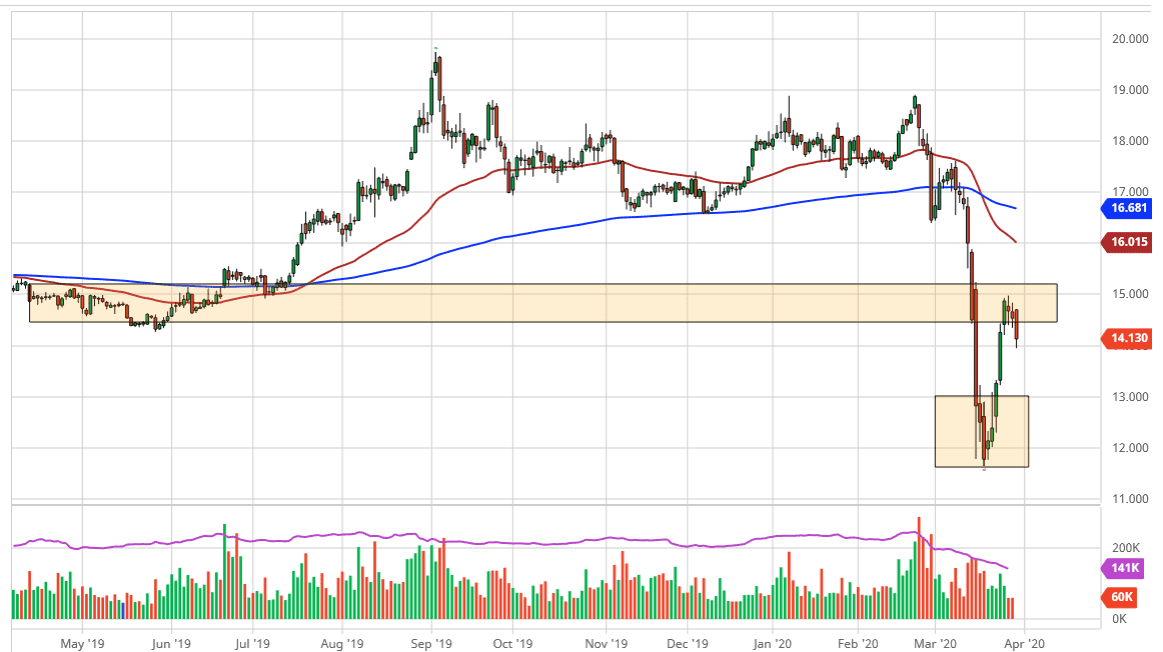

Silver markets fell hard during the trading session on Monday as we have broken down from the $15.00 level. At this point, the market is testing the $14.00 level, and at this point if we can break down below there then I think it opens up the door towards the $13.00 level. At this point, the market is likely to find a bit of support, due to the fact that it was the top of the recent consolidation area. “Market memory” is going to dictate that there should be some support there, and therefore the ability to bounce.

All things being equal, I believe that if the market was to turn around then we could try to build a bit of a bullish flag, and a break above the $15.00 level opens up the door towards the 50 day EMA which is closer to the 16 pointer zero dollars level. At this point, the market is trying to rally but the action on Monday certainly suggests that we are ready to sell off from here. I see a lot of noise between $13.00 level and the $12.00 level. I believe it would be very difficult to break down through that area, but if we did it would be an extraordinarily negative sign for this market. At that point you would be looking at the market heading down towards the $10.00 level.

Looking at the chart, you can see clearly that silver has suffered at the idea of with almost no industrial demand out there, and quite frankly I don’t see that happening in the short term. The volatility of this market will continue due to the fact that there is the component of precious metal in the trade, and of course should be strong, but at the same time the lack of industrial demand is going to be very negative for this market, so having said that it comes down to whatever the market is focusing on. At this point, it certainly looks more negative than positive, so with that being the case it’s likely that the market will continue to see sellers on short-term rallies more often than not. That being the case, I don’t think about buying until we at least get down to the $13.00 level or get that daily close above the $15.00 level above that shows signs of increasing strength in demand.