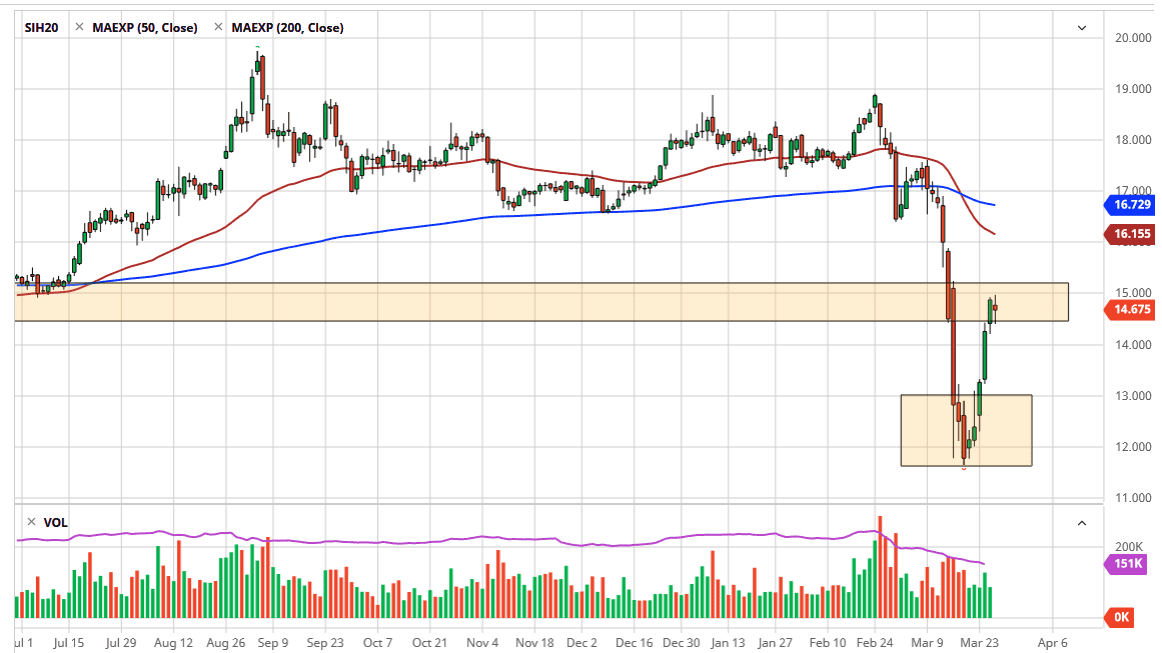

Silver markets went back and forth during the trading session on Thursday, showing signs of strength initially but then giving back the gains. Silver is sitting just below the psychologically important $50.00 level, so it does make sense that there would be a little bit of a barrier here that might cause issues. At this point, I believe that signs of exhaustion or break down below the bottom of the candlestick for the Thursday session is probably a nice sell signal, giving the market the ability to pullback and perhaps try to find the bottom again. Remember, when a market melts down the way this market has, we will typically see some type of massive bounce and then a pullback towards the lows to see if it holds. At this point, that might very well be what we are doing.

To the upside, if we get a daily close above the $15.00 level then we could see the market go looking towards the $16.00 level after that. I think that given enough time the market will find plenty of sellers out there, but clearly the selling of the US dollar has lifted silver in the short term. Ultimately, silver is also an industrial metal, so we need to take a look at that as well. There is a serious lack of industrial demand although the stimulus bill in the United States may help down the road. All of that being said, if you are buying the precious metals in reaction to oversupply of liquidity by central banks, you are better off buying gold instead of silver because it does not have the industrial component to it. As a general rule, if I’m looking to buy precious metals, I tend to buy gold. If I’m looking to short precious metals, I tend to sell silver.

To the downside, I believe that the $13.00 level will probably be an area that the market pulls back to, in order to prove that the recent low was in fact a “bottom” in the market. That being said, the market should continue to see a lot of volatility, so the move could be quite rapid if we get some type of spook headline. If we do turn around a break above the $15.00 level without pulling back, then I think we have a pretty significant $1.00 a move which would probably find even more selling pressure.