Silver markets fell a bit during the trading session on Wednesday as we continue to worry about the overall demand of industry when it comes to silver, as it is so highly levered to the idea of global growth. Ultimately, this is a commodity that although it is a precious metal, the reality is that it is an industrial one as well, so that seems to be weighing on the minds of traders more than anything else as the global slowdown continues to cause massive amount of concern and of course major factories are starting to close down.

Ultimately, silver will rebound but it looks as if the $12 level is a bit of a magnet. Once we break down below this area though, then we will be looking at the $10 level underneath which is even more supportive from a longer-term standpoint. Ultimately, I like the idea of buying silver for a longer-term move, but if you are using any type of leverage at all the timing becomes much more crucial as you know.

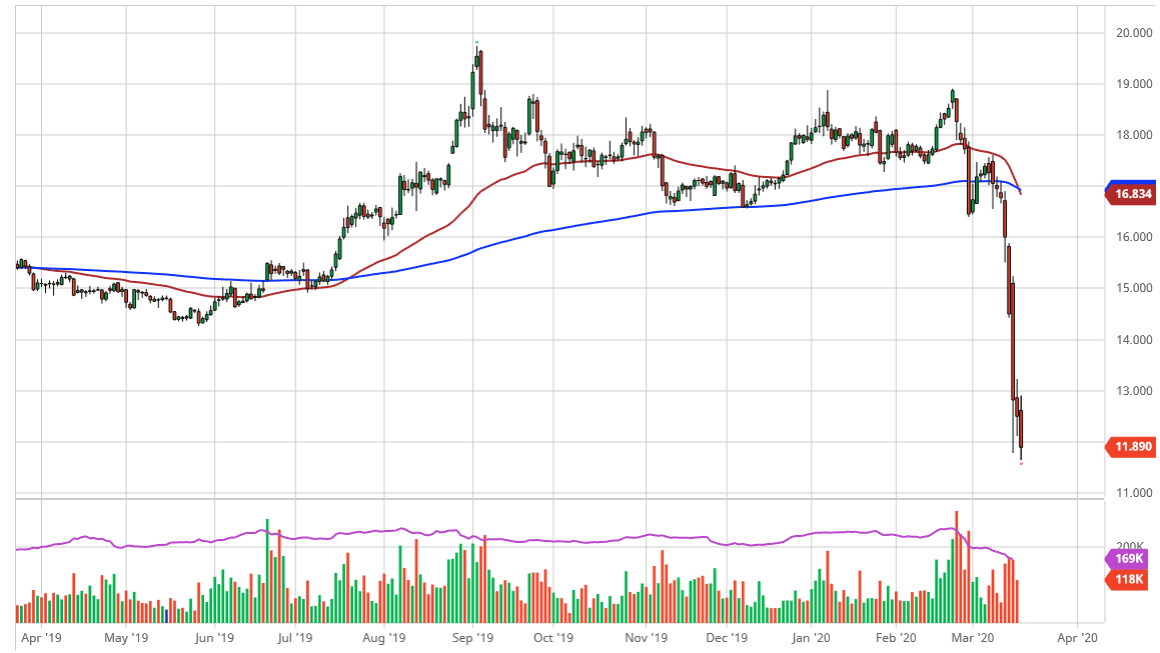

A breakdown below the lows of the trading session for Wednesday does open up the idea of the $10 level being an area that I would be interested in buying, but if we were to turn around and close above the $13 level, then it would be a buying opportunity. Granted, we got the so-called “death cross” happen during the session, when the 50 day EMA crosses below the 200 day EMA, but it’s very likely giving you a sell signal far too late as it typically does. Nonetheless, it does suggest just how bearish this market is, so you need to be very cautious.

That being said, I think that it makes a nice longer-term investment but beyond that it’s going to be difficult to trade without breaking to the upside with some type of significance. If the market was to rollover below the $10 level, that would certainly be rather catastrophic, and could send this market much lower, and into somewhat unknown territory. I don’t think that happens, but it is only a matter of time before people start to question that. Ultimately though, we are approaching a relatively cheap levels, and in a sense the silver market act very much like the oil market, and both should move in concert when things start to go back to some semblance of normalcy.