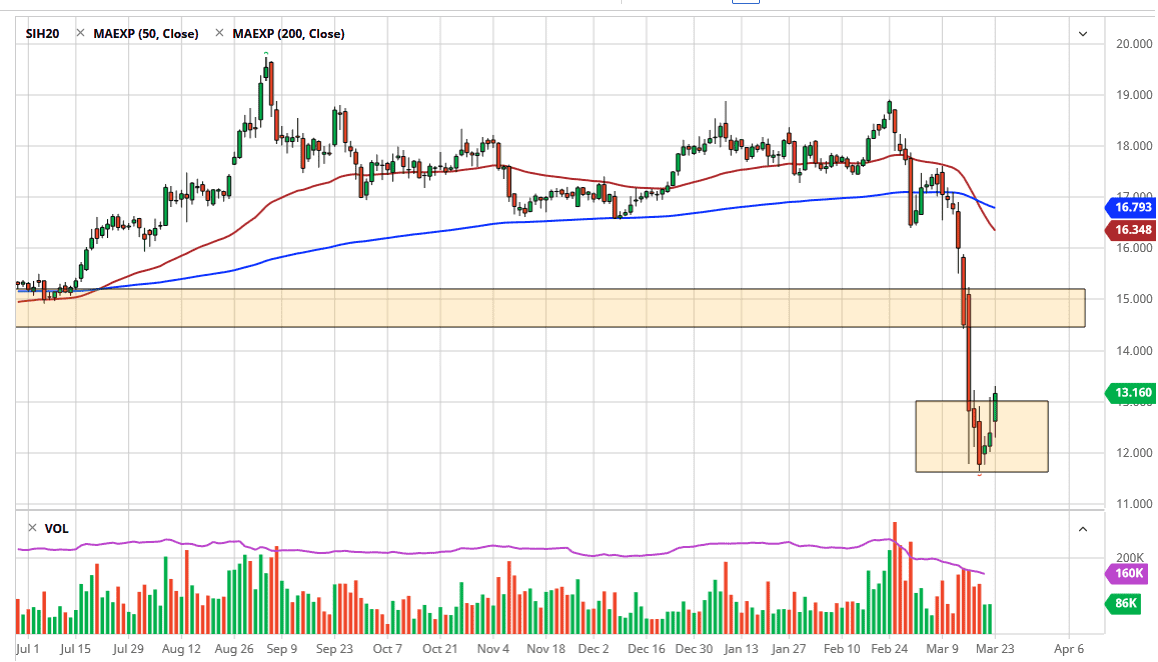

Silver markets initially gapped to kick off the trading session to the upside on Monday, but then turned around to fill that gap. Ultimately though, we found buyers underneath there in turned around to break out towards the upside. The market even broke above the top of the inverted hammer that we had formed on Friday. By breaking the top of this, it shows that markets are trying to do everything they can to squeeze shorts out of their positions. If we break above the candlestick for the Monday session, it’s very likely that silver will go looking towards $14 level next.

Furthermore, when you look beyond there, it’s the $15 level that I think is the real prize. This is an area where there has been selling in the past, so don’t be surprised at all to see this area offer far too much in the way of resistance for the market to continue going higher. I would look for signs of exhaustion in that general vicinity in order to take advantage of exhaustion, and with that being the case it’s very likely that the sellers will come back out in full force at that area. Because of this, the market does look like we could get essentially what would be about a 50% retracement of the massive selloff.

To the downside, I believe that the $12.00 level will be supported, and I had previously suggested that it was perhaps an area that should be a decent buying opportunity. The biggest problem with silver of course is that it has a certain amount of industrial demand built into it, meaning that if the industrial part of the economy continues to flounder, that is one headwind for silver, but at the same time the Federal Reserve has decided to do quantitative easing. The quantitative easing of course lifts precious metals, which of course will lift the value of silver based upon that aspect of the metal. What does this mean? It means that we are more than likely going to see some upward pressure, but almost certainly will see a lot of volatility in this pair as silver is thinner than gold, at least on the whole. However, this also means that if gold starts to take off to the upside, that can provide a bit of a “knock on” effect in this market as well. At this point, I am bullish but just for short-term trades. Longer-term I like silver as well but that comes to an unlevered position such as physical bullion.