Silver markets broke down after initially trying to rally on Thursday as the market has been all over the place. The silver market is highly influenced by industrial demand and quite frankly there isn’t much in the way of industrial demand right now. At this point, the silver markets are going to suffer at the hands of bearish market sentiment. While many of you will look to precious metals for a “risk off” type of trade, that only works if there’s some type of industrial demand at the same time when it comes to silver.

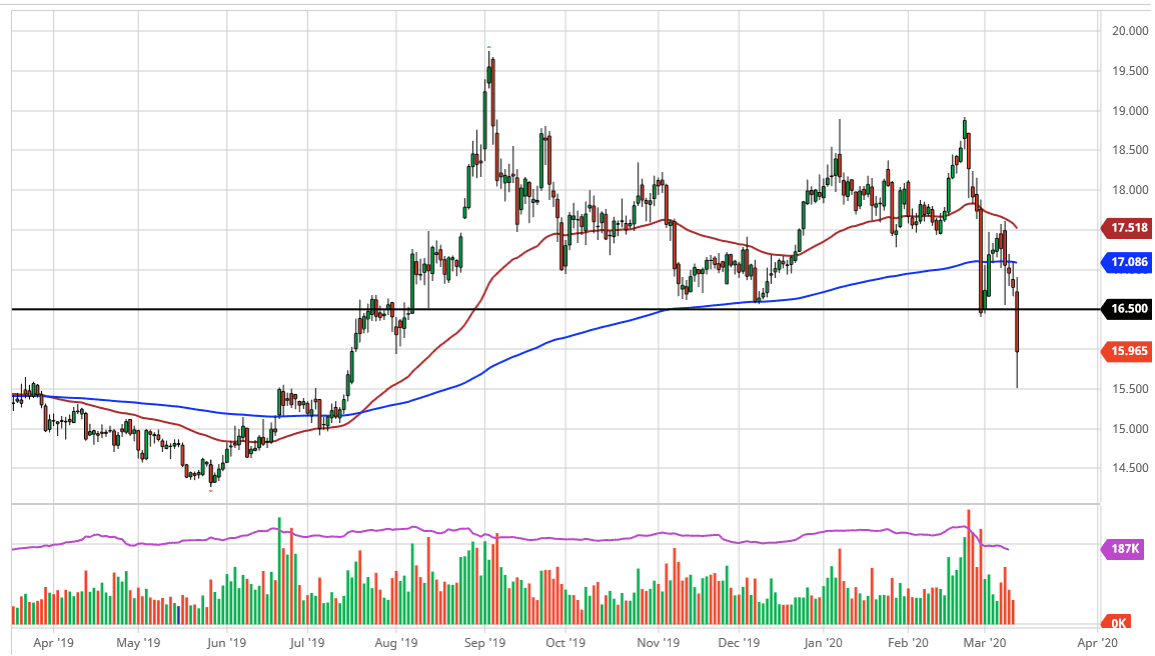

Obviously, this is a market that the sellers got a hold of during the trading session on Thursday, breaking through the psychologically and structurally important $16.50 level. This was an area that if we were to break down below, it signaled bad things. I said that we could go down to the $16.00 level, perhaps even down to the $15.50 level after that. Ultimately, this is a market that broke down rather stringently so I would not be surprised at all to see a little bit of a recovery on Friday, but I don’t know that I would be a buyer of the considering that the markets have seen so much in the way of volatility and of course negativity. If the industrial demand isn’t going to be there, the “safety bid” won’t matter. Furthermore, we are seen quite a bit of US dollar strength, and that is a major headwind for silver as well.

For shorter-term traders, we could see a bounce towards the $16.00 level, perhaps even the $16.50 level. However, I do think that somewhere in that area we would probably find sellers and bearish pressure. Signs of exhaustion will be sold into, so I would not be interested in going into this market heading into the weekend unless of course we spend a serious amount of time above the $16.50 level. I would probably just wait until Monday to buy silver if that does happen due to the fact that who knows what type of headlines will come into play over the weekend. On the other hand, if we were to break down below the $15.50 level, it’s likely that we could go down to the $15.00 level, which of course is a large, round, psychologically significant figure. Because of this, I expect to see even more support at that area.