The silver market broke down during most of the trading session on Friday, as markets received the jobs numbers out of the United States. The Bureau of Labor Statistics released a gain of 270,000 jobs, and that of course is better than expected. However, the silver market has a lot of crosscurrents going on right now, and that of course makes a huge difference in how this goes. While most central banks around the world are loosening monetary policy, that is going to be a positive driver for precious metals in general. Unfortunately, silver also has an industrial component attached to it and I believe that is one of the main drivers right now.

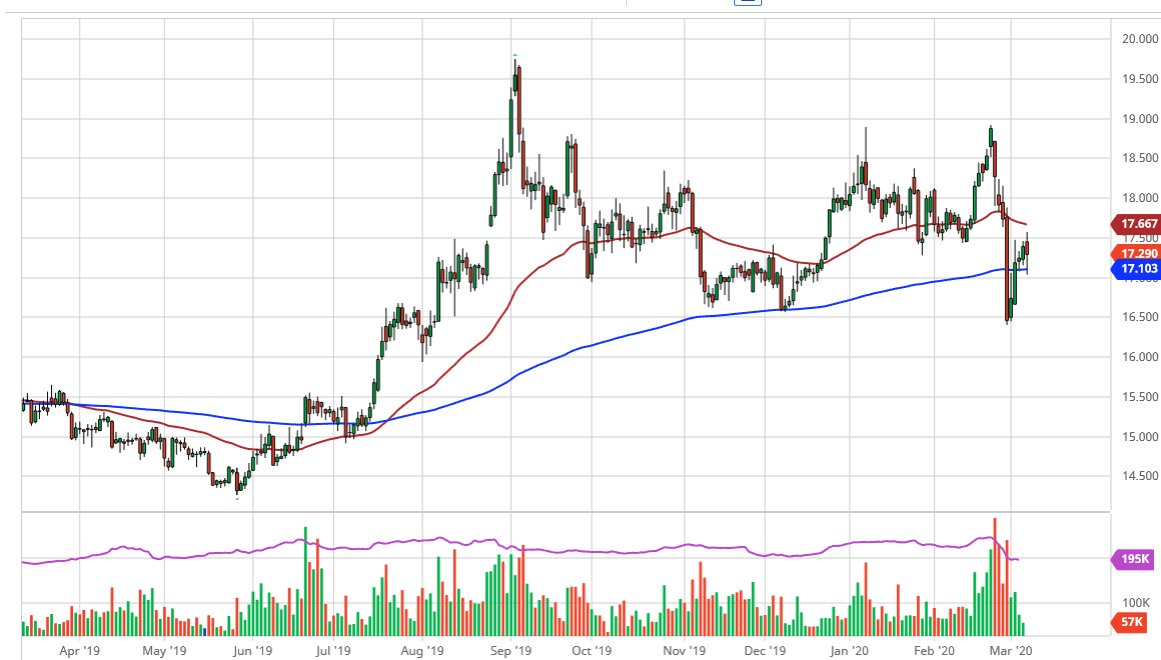

The daily candlestick is somewhat encouraging though, as we have bounced from the 200 day EMA, which of course is a very important longer-term technical signal. Just above, we have the 50 day EMA and they both are running at roughly the same slope. That suggests that this is going to be a relatively grinding market, and that we are going to struggle for momentum. Keep in mind that as stock markets are trying to rally, there is a certain amount of negativity attached to the idea of global growth, and therefore industry. If there is going to be less momentum out there, it makes sense that the demand for silver will drop.

Pairs trading

Most of you will be Forex traders by nature, so the bit that I am about to explain will make perfect sense if you think about it long enough. Pairs trading is possible when it comes to commodities, just as they are when it comes to Forex. One thing that has become abundantly clear as of late is that even though precious metals in general have gotten a bit of a bid, it should be noted that silver has lagged. It is because of this that one of the best trades has been to buy gold and sell silver simultaneously. By matching these trades up, it’s a way of hedging yourself and taken some of the volatility out of the differential.

All of that being said, the market does break down below the $17.00 level, it’s likely that the market goes down to the $16.50 level. Otherwise, if we can get a close above the 50 day EMA, then silver is very likely to go looking towards the $18.00 level and then the $18.50 level.