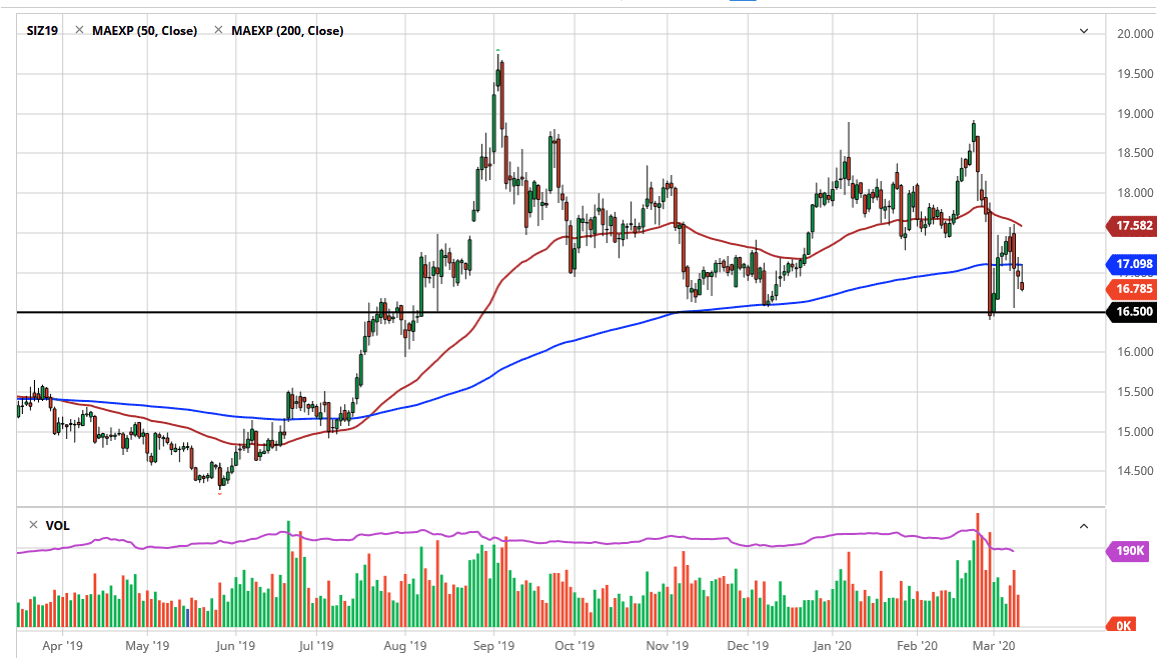

Silver markets initially tried to rally during the trading session on Wednesday, reaching towards the 200 day EMA which currently sits at the $17.09 level before pulling back and showing signs of weakness yet again. By doing so, it has formed a candlestick that looks a bit like a shooting star and therefore shows signs of weakness. At this point, the market is likely to reach towards the next support level, which is seen at the $16.50 level. That’s an area that has served as support several times out, so at this point I think that the market is probably going to be paying attention to it.

If we do break down below the $16.50 level significantly, then I think the market goes looking towards the $16.00 level. That is an area that will attract a lot of attention as well, as it is a large, round, psychologically significant figure. It’s not a huge surprise that we will see the market attracted to this area, but a break down below that signifies that the market finally excepts the idea that there is going to be less demand on the industrial side in this environment. Remember, silver is moving and quite a bit different way then gold, because it’s not so much a safety trade anymore as it is an industrial one.

Recently, we have seen a lot more in the “pairs trade” than previously. In other words, people have been buying gold and shorting silver, allowing the market to make money via that spread. That being said, it isn’t that silver can’t rise, it’s just that the lack of industrial demand is going to hamper that in this environment. If the coronavirus continues to keep people indoors and workers away from work, it’s difficult to imagine a scenario where silver takes off to the upside. All of that being said, if the market were to break above the 200 day EMA, it will probably go looking towards the 50 day EMA which is colored in red, so at this point expect a lot of volatility and needless to say, downward pressure in an environment that simply does not favor industrial battles. Copper is very much the same right now, although silver does have somewhat of a precious metal aspect of it so at least the selling isn’t overly drastic or aggressive. At this point, it’s probably easier to simply sell short-term rallies.